Summary

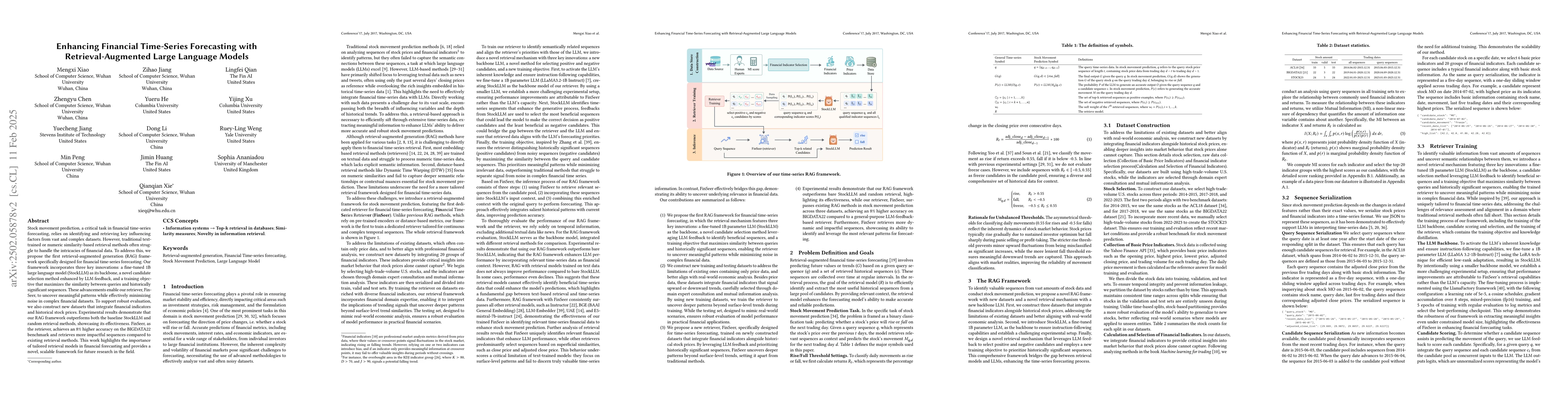

Stock movement prediction, a critical task in financial time-series forecasting, relies on identifying and retrieving key influencing factors from vast and complex datasets. However, traditional text-trained or numeric similarity-based retrieval methods often struggle to handle the intricacies of financial data. To address this, we propose the first retrieval-augmented generation (RAG) framework specifically designed for financial time-series forecasting. Our framework incorporates three key innovations: a fine-tuned 1B large language model (StockLLM) as its backbone, a novel candidate selection method enhanced by LLM feedback, and a training objective that maximizes the similarity between queries and historically significant sequences. These advancements enable our retriever, FinSeer, to uncover meaningful patterns while effectively minimizing noise in complex financial datasets. To support robust evaluation, we also construct new datasets that integrate financial indicators and historical stock prices. Experimental results demonstrate that our RAG framework outperforms both the baseline StockLLM and random retrieval methods, showcasing its effectiveness. FinSeer, as the retriever, achieves an 8% higher accuracy on the BIGDATA22 benchmark and retrieves more impactful sequences compared to existing retrieval methods. This work highlights the importance of tailored retrieval models in financial forecasting and provides a novel, scalable framework for future research in the field.

AI Key Findings

Generated Jun 11, 2025

Methodology

The paper proposes FinSeer, a retrieval-augmented generation (RAG) framework for financial time-series forecasting, integrating a fine-tuned 1B large language model (StockLLM) with a novel candidate selection method and a training objective that maximizes query-historical sequence similarity.

Key Results

- FinSeer outperforms baseline StockLLM-1B-Instruct and random retrieval methods, achieving 8% higher accuracy on the BIGDATA22 benchmark.

- FinSeer retrieves more impactful sequences compared to existing retrieval methods.

- The study demonstrates the critical importance of retrieving truly valuable information in financial forecasting.

- FinSeer's superiority over time-series retrieval is shown by outperforming top-ranked retrievers from the MTEB English leaderboard.

- FinSeer consistently outperforms other retrievers across all datasets, proving its superior ability to learn LLM preferences and enhance time-series forecasting.

Significance

This research highlights the importance of tailored retrieval models in financial forecasting and provides a novel, scalable framework for future research in the field.

Technical Contribution

FinSeer, a novel retriever refined by LLM feedback, effectively identifies historically influential market sequences while filtering out financial noise.

Novelty

The paper presents the first RAG framework specifically designed for financial time-series forecasting, addressing the limitations of traditional text-trained or numeric similarity-based retrieval methods.

Limitations

- The current evaluation focuses specifically on stock movement prediction, with future work needed to validate the generalizability across other domains.

- The study deliberately focuses on unimodal time-series data, and future work should incorporate cross-modal integration for more comprehensive information retrieval.

Future Work

- Systematically validate the generalizability of the framework across various domains, including economic indicators, energy demand forecasting, and epidemiological trend prediction.

- Incorporate cross-modal corpora to enable more comprehensive information retrieval in real-world forecasting scenarios.

Paper Details

PDF Preview

Similar Papers

Found 4 papersRetrieval Augmented Time Series Forecasting

Samet Oymak, Ege Onur Taga, Kutay Tire et al.

Large Language Models for Financial Aid in Financial Time-series Forecasting

Md Khairul Islam, Ayush Karmacharya, Judy Fox et al.

Enhancing Financial Sentiment Analysis via Retrieval Augmented Large Language Models

Xiao-Yang Liu, Hongyang Yang, Boyu Zhang et al.

Retrieval Augmented Time Series Forecasting

Jinsung Yoon, Sercan O Arik, Sungwon Han et al.

No citations found for this paper.

Comments (0)