Summary

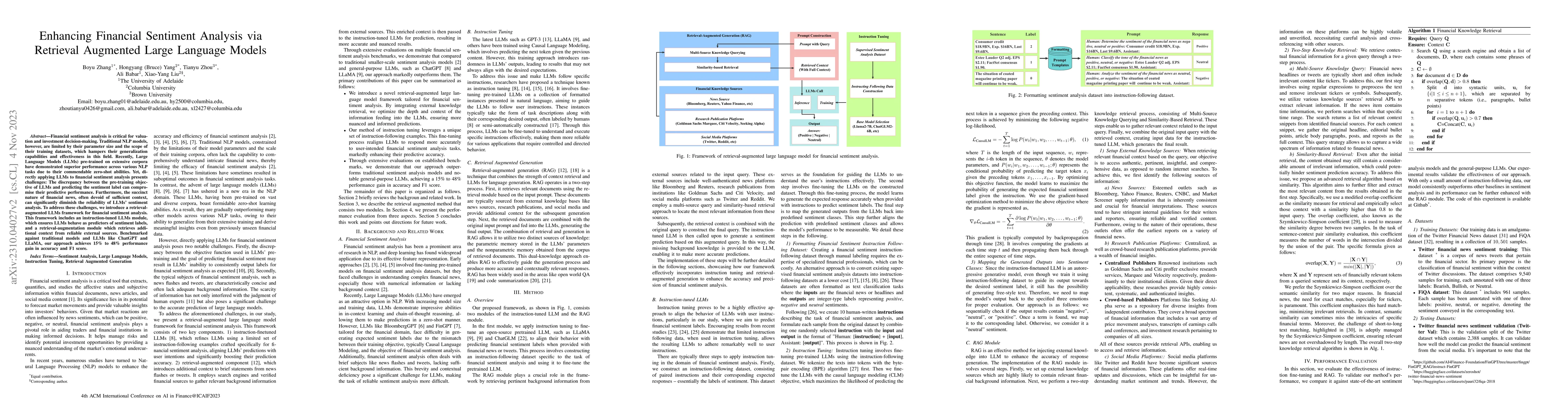

Financial sentiment analysis is critical for valuation and investment decision-making. Traditional NLP models, however, are limited by their parameter size and the scope of their training datasets, which hampers their generalization capabilities and effectiveness in this field. Recently, Large Language Models (LLMs) pre-trained on extensive corpora have demonstrated superior performance across various NLP tasks due to their commendable zero-shot abilities. Yet, directly applying LLMs to financial sentiment analysis presents challenges: The discrepancy between the pre-training objective of LLMs and predicting the sentiment label can compromise their predictive performance. Furthermore, the succinct nature of financial news, often devoid of sufficient context, can significantly diminish the reliability of LLMs' sentiment analysis. To address these challenges, we introduce a retrieval-augmented LLMs framework for financial sentiment analysis. This framework includes an instruction-tuned LLMs module, which ensures LLMs behave as predictors of sentiment labels, and a retrieval-augmentation module which retrieves additional context from reliable external sources. Benchmarked against traditional models and LLMs like ChatGPT and LLaMA, our approach achieves 15\% to 48\% performance gain in accuracy and F1 score.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Financial Time-Series Forecasting with Retrieval-Augmented Large Language Models

Zhengyu Chen, Jimin Huang, Sophia Ananiadou et al.

Enhancing TinyBERT for Financial Sentiment Analysis Using GPT-Augmented FinBERT Distillation

Graison Jos Thomas

Chinese Fine-Grained Financial Sentiment Analysis with Large Language Models

Wang Xu, Yanru Wu, Yinyu Lan et al.

Enhancing Retrieval-Augmented Large Language Models with Iterative Retrieval-Generation Synergy

Yelong Shen, Weizhu Chen, Minlie Huang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)