Summary

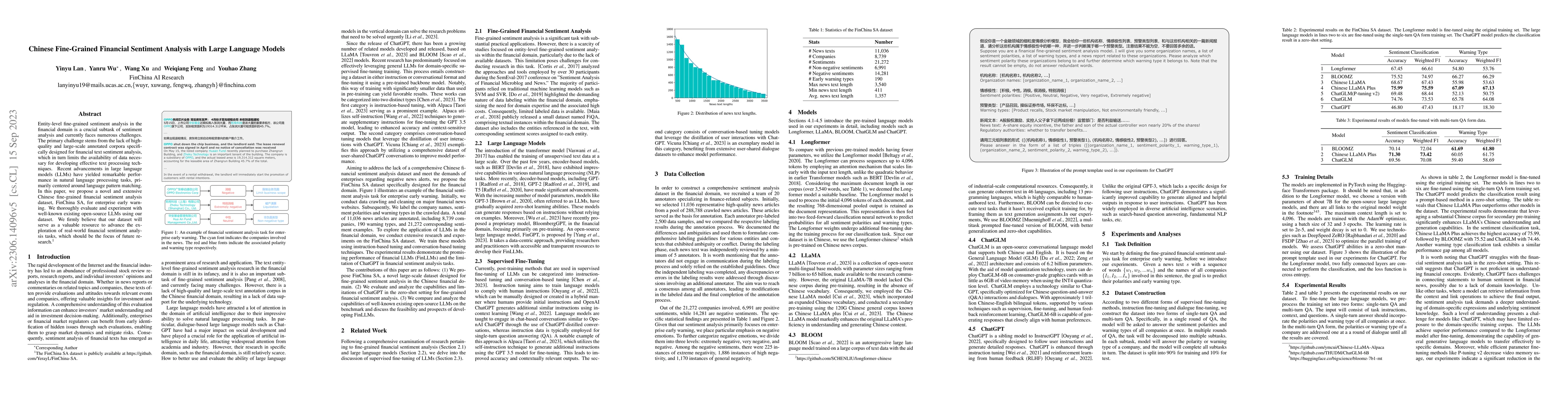

Entity-level fine-grained sentiment analysis in the financial domain is a crucial subtask of sentiment analysis and currently faces numerous challenges. The primary challenge stems from the lack of high-quality and large-scale annotated corpora specifically designed for financial text sentiment analysis, which in turn limits the availability of data necessary for developing effective text processing techniques. Recent advancements in large language models (LLMs) have yielded remarkable performance in natural language processing tasks, primarily centered around language pattern matching. In this paper, we propose a novel and extensive Chinese fine-grained financial sentiment analysis dataset, FinChina SA, for enterprise early warning. We thoroughly evaluate and experiment with well-known existing open-source LLMs using our dataset. We firmly believe that our dataset will serve as a valuable resource to advance the exploration of real-world financial sentiment analysis tasks, which should be the focus of future research. The FinChina SA dataset is publicly available at https://github.com/YerayL/FinChina-SA

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDistilling Fine-grained Sentiment Understanding from Large Language Models

Jianzhu Bao, Yice Zhang, Shiwei Chen et al.

Pre-trained Large Language Models for Financial Sentiment Analysis

Wei Luo, Dihong Gong

Enhancing Financial Sentiment Analysis via Retrieval Augmented Large Language Models

Xiao-Yang Liu, Hongyang Yang, Boyu Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)