Authors

Summary

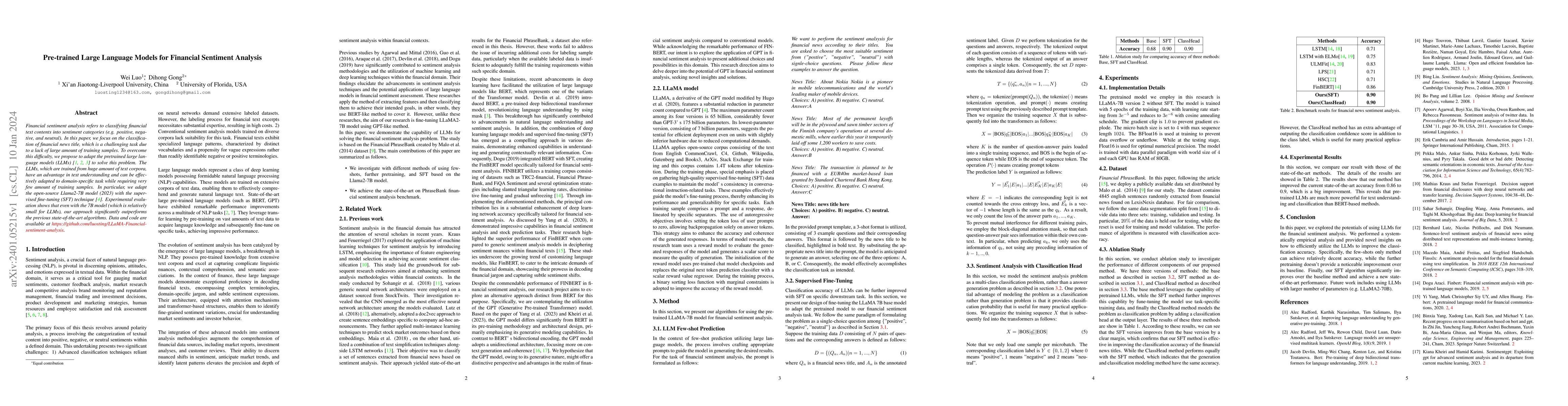

Financial sentiment analysis refers to classifying financial text contents into sentiment categories (e.g. positive, negative, and neutral). In this paper, we focus on the classification of financial news title, which is a challenging task due to a lack of large amount of training samples. To overcome this difficulty, we propose to adapt the pretrained large language models (LLMs) [1, 2, 3] to solve this problem. The LLMs, which are trained from huge amount of text corpora,have an advantage in text understanding and can be effectively adapted to domain-specific task while requiring very few amount of training samples. In particular, we adapt the open-source Llama2-7B model (2023) with the supervised fine-tuning (SFT) technique [4]. Experimental evaluation shows that even with the 7B model (which is relatively small for LLMs), our approach significantly outperforms the previous state-of-the-art algorithms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Financial Sentiment Analysis via Retrieval Augmented Large Language Models

Xiao-Yang Liu, Hongyang Yang, Boyu Zhang et al.

Sentiment Analysis of Spanish Political Party Tweets Using Pre-trained Language Models

Hao Chen, Xinyi Cai, Chuqiao Song et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)