Summary

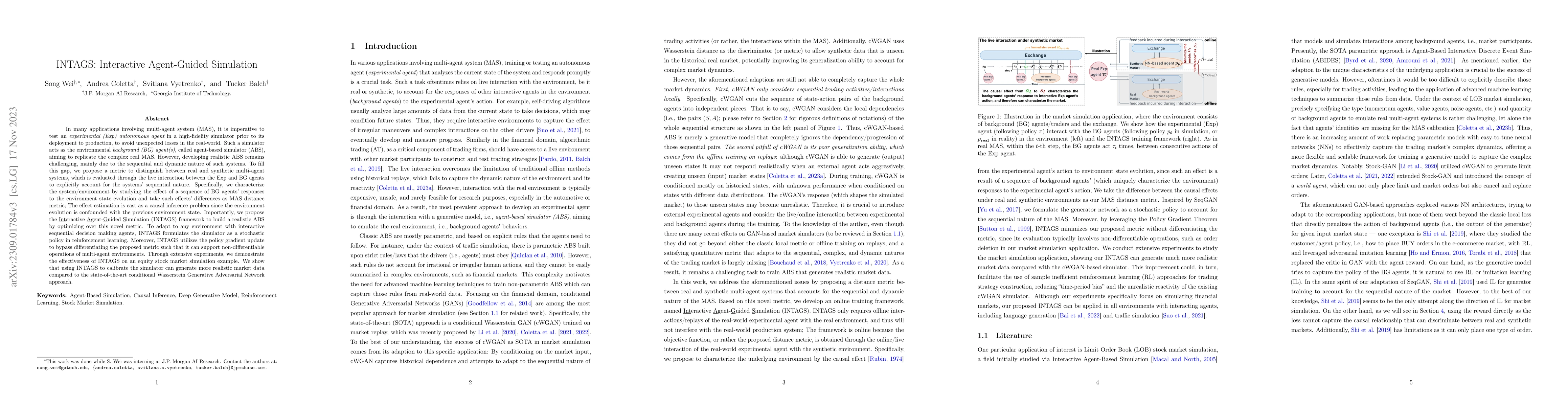

In many applications involving multi-agent system (MAS), it is imperative to test an experimental (Exp) autonomous agent in a high-fidelity simulator prior to its deployment to production, to avoid unexpected losses in the real-world. Such a simulator acts as the environmental background (BG) agent(s), called agent-based simulator (ABS), aiming to replicate the complex real MAS. However, developing realistic ABS remains challenging, mainly due to the sequential and dynamic nature of such systems. To fill this gap, we propose a metric to distinguish between real and synthetic multi-agent systems, which is evaluated through the live interaction between the Exp and BG agents to explicitly account for the systems' sequential nature. Specifically, we characterize the system/environment by studying the effect of a sequence of BG agents' responses to the environment state evolution and take such effects' differences as MAS distance metric; The effect estimation is cast as a causal inference problem since the environment evolution is confounded with the previous environment state. Importantly, we propose the Interactive Agent-Guided Simulation (INTAGS) framework to build a realistic ABS by optimizing over this novel metric. To adapt to any environment with interactive sequential decision making agents, INTAGS formulates the simulator as a stochastic policy in reinforcement learning. Moreover, INTAGS utilizes the policy gradient update to bypass differentiating the proposed metric such that it can support non-differentiable operations of multi-agent environments. Through extensive experiments, we demonstrate the effectiveness of INTAGS on an equity stock market simulation example. We show that using INTAGS to calibrate the simulator can generate more realistic market data compared to the state-of-the-art conditional Wasserstein Generative Adversarial Network approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)