Andrea Coletta

18 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Simulating the economic impact of rationality through reinforcement learning and agent-based modelling

Agent-based models (ABMs) are simulation models used in economics to overcome some of the limitations of traditional frameworks based on general equilibrium assumptions. However, agents within an AB...

LLM-driven Imitation of Subrational Behavior : Illusion or Reality?

Modeling subrational agents, such as humans or economic households, is inherently challenging due to the difficulty in calibrating reinforcement learning models or collecting data that involves huma...

Synthetic Data Applications in Finance

Synthetic data has made tremendous strides in various commercial settings including finance, healthcare, and virtual reality. We present a broad overview of prototypical applications of synthetic da...

Multi-Modal Financial Time-Series Retrieval Through Latent Space Projections

Financial firms commonly process and store billions of time-series data, generated continuously and at a high frequency. To support efficient data storage and retrieval, specialized time-series data...

INTAGS: Interactive Agent-Guided Simulation

In many applications involving multi-agent system (MAS), it is imperative to test an experimental (Exp) autonomous agent in a high-fidelity simulator prior to its deployment to production, to avoid ...

LOB-Based Deep Learning Models for Stock Price Trend Prediction: A Benchmark Study

The recent advancements in Deep Learning (DL) research have notably influenced the finance sector. We examine the robustness and generalizability of fifteen state-of-the-art DL models focusing on St...

On the Constrained Time-Series Generation Problem

Synthetic time series are often used in practical applications to augment the historical time series dataset for better performance of machine learning algorithms, amplify the occurrence of rare eve...

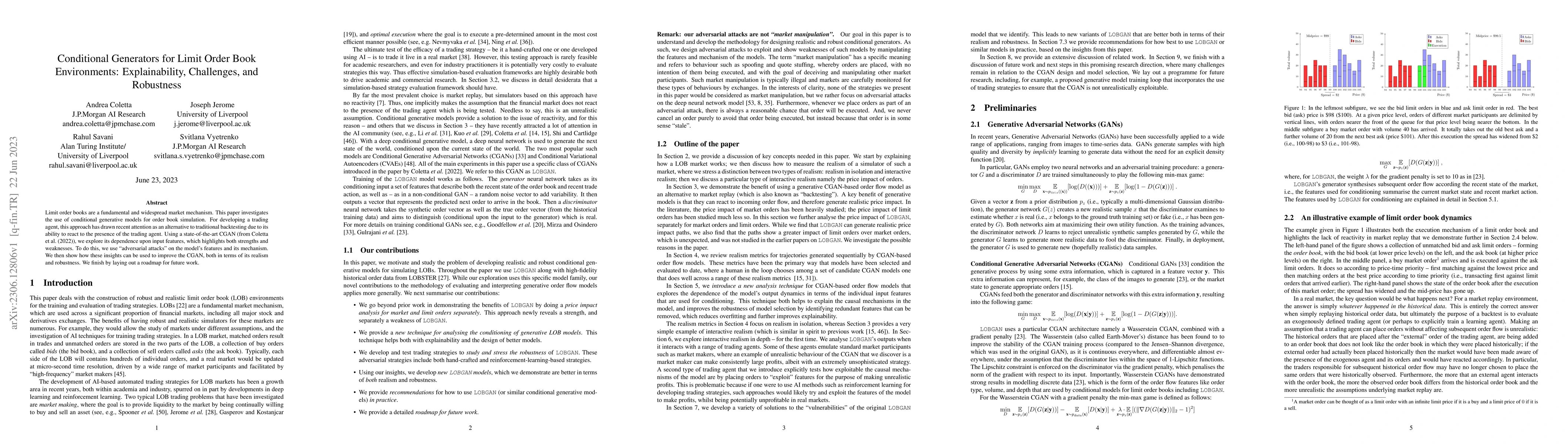

Conditional Generators for Limit Order Book Environments: Explainability, Challenges, and Robustness

Limit order books are a fundamental and widespread market mechanism. This paper investigates the use of conditional generative models for order book simulation. For developing a trading agent, this ...

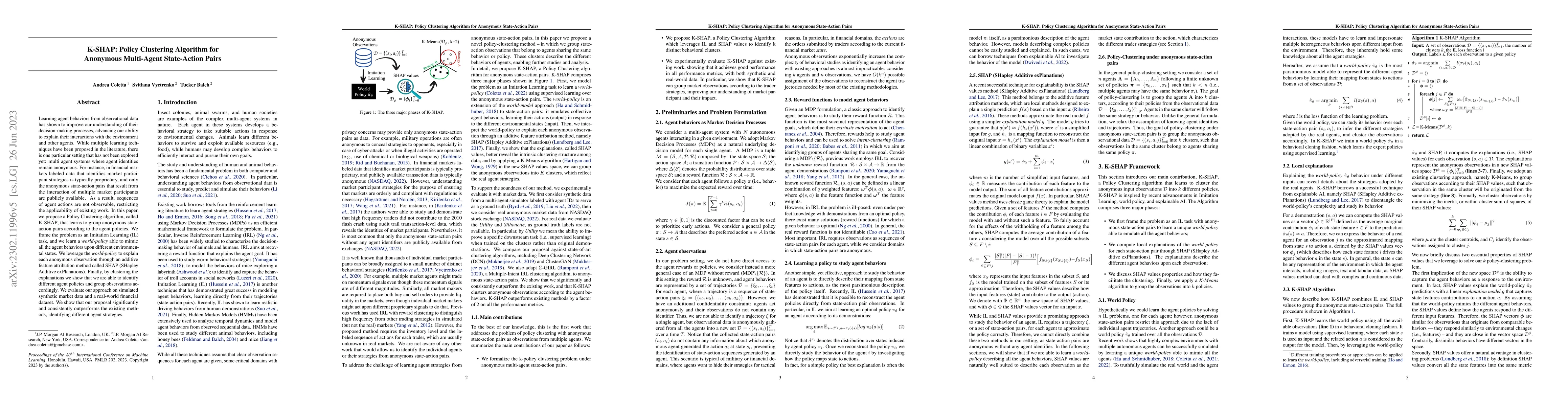

K-SHAP: Policy Clustering Algorithm for Anonymous Multi-Agent State-Action Pairs

Learning agent behaviors from observational data has shown to improve our understanding of their decision-making processes, advancing our ability to explain their interactions with the environment a...

A$^2$-UAV: Application-Aware Content and Network Optimization of Edge-Assisted UAV Systems

To perform advanced surveillance, Unmanned Aerial Vehicles (UAVs) require the execution of edge-assisted computer vision (CV) tasks. In multi-hop UAV networks, the successful transmission of these t...

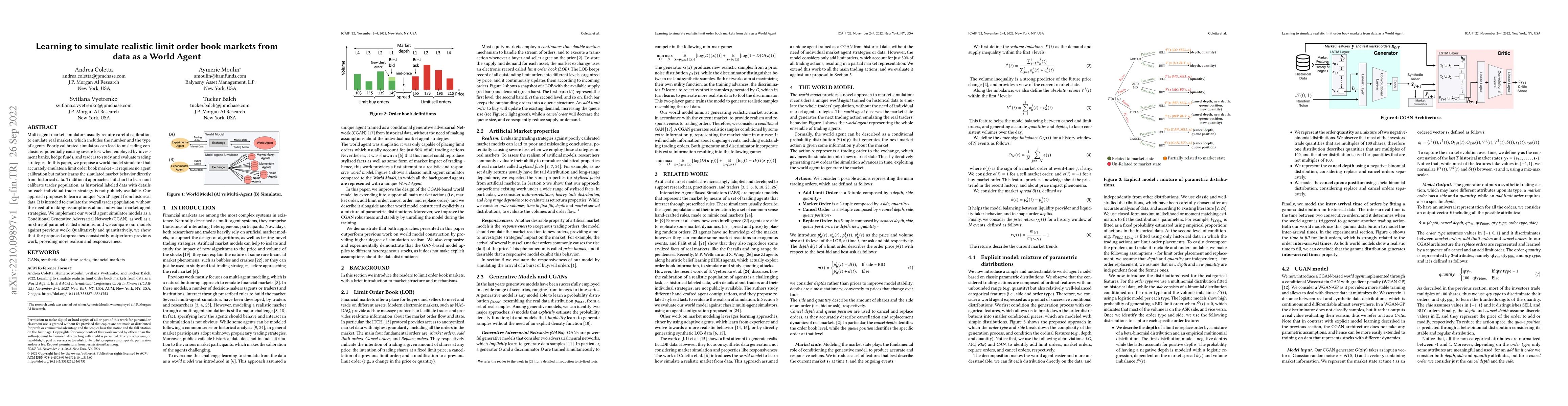

Learning to simulate realistic limit order book markets from data as a World Agent

Multi-agent market simulators usually require careful calibration to emulate real markets, which includes the number and the type of agents. Poorly calibrated simulators can lead to misleading concl...

Towards Realistic Market Simulations: a Generative Adversarial Networks Approach

Simulated environments are increasingly used by trading firms and investment banks to evaluate trading strategies before approaching real markets. Backtesting, a widely used approach, consists of si...

Privacy-Preserving Synthetically Augmented Knowledge Graphs with Semantic Utility

Knowledge Graphs (KGs) have recently gained relevant attention in many application domains, from healthcare to biotechnology, from logistics to finance. Financial organisations, central banks, economi...

Chat Bankman-Fried: an Exploration of LLM Alignment in Finance

Advancements in large language models (LLMs) have renewed concerns about AI alignment - the consistency between human and AI goals and values. As various jurisdictions enact legislation on AI safety, ...

Robust Causal Discovery in Real-World Time Series with Power-Laws

Exploring causal relationships in stochastic time series is a challenging yet crucial task with a vast range of applications, including finance, economics, neuroscience, and climate science. Many algo...

SMART: Relation-Aware Learning of Geometric Representations for Knowledge Graphs

Knowledge graph representation learning approaches provide a mapping between symbolic knowledge in the form of triples in a knowledge graph (KG) and their feature vectors. Knowledge graph embedding (K...

Aligning Knowledge Graphs and Language Models for Factual Accuracy

Large language models like GPT-4, Gemini, and Claude have transformed natural language processing (NLP) tasks such as question answering, dialogue generation, summarization, and so forth; yet their su...

ReFactX: Scalable Reasoning with Reliable Facts via Constrained Generation

Knowledge gaps and hallucinations are persistent challenges for Large Language Models (LLMs), which generate unreliable responses when lacking the necessary information to fulfill user instructions. E...