Summary

Limit order books are a fundamental and widespread market mechanism. This paper investigates the use of conditional generative models for order book simulation. For developing a trading agent, this approach has drawn recent attention as an alternative to traditional backtesting due to its ability to react to the presence of the trading agent. Using a state-of-the-art CGAN (from Coletta et al. (2022)), we explore its dependence upon input features, which highlights both strengths and weaknesses. To do this, we use "adversarial attacks" on the model's features and its mechanism. We then show how these insights can be used to improve the CGAN, both in terms of its realism and robustness. We finish by laying out a roadmap for future work.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

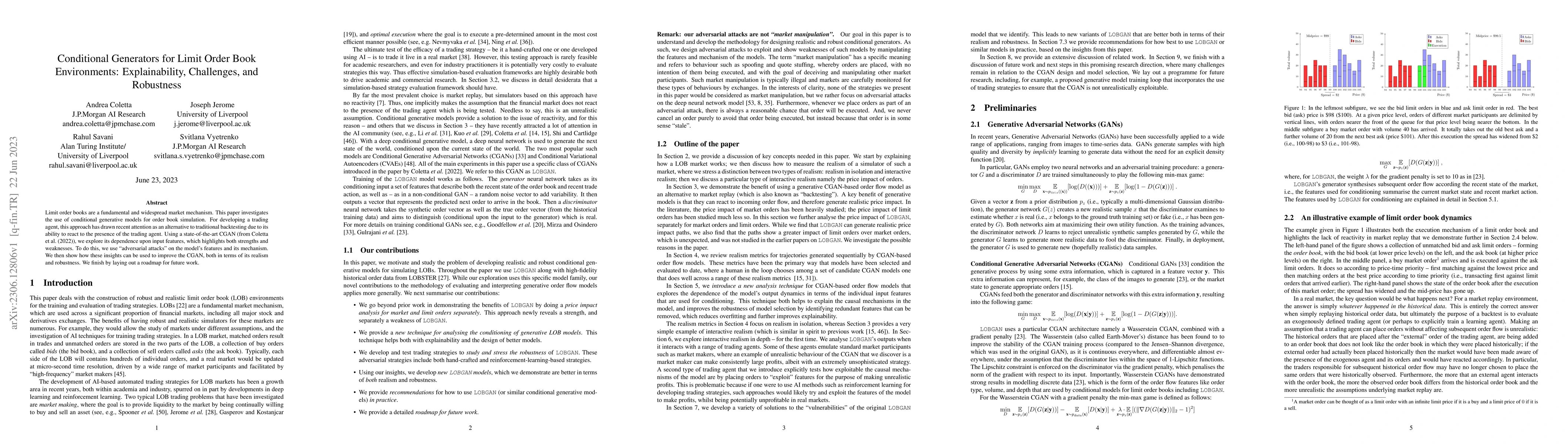

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModel-based gym environments for limit order book trading

Rahul Savani, Martin Herdegen, Leandro Sanchez-Betancourt et al.

Deep Limit Order Book Forecasting

Antonio Briola, Silvia Bartolucci, Tomaso Aste

| Title | Authors | Year | Actions |

|---|

Comments (0)