Summary

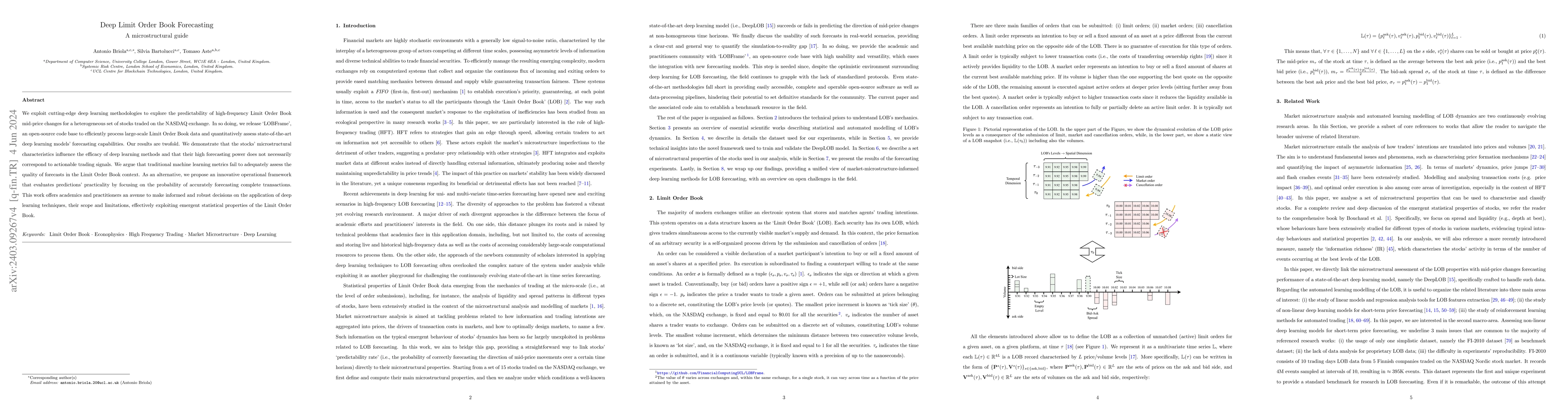

We exploit cutting-edge deep learning methodologies to explore the predictability of high-frequency Limit Order Book mid-price changes for a heterogeneous set of stocks traded on the NASDAQ exchange. In so doing, we release `LOBFrame', an open-source code base to efficiently process large-scale Limit Order Book data and quantitatively assess state-of-the-art deep learning models' forecasting capabilities. Our results are twofold. We demonstrate that the stocks' microstructural characteristics influence the efficacy of deep learning methods and that their high forecasting power does not necessarily correspond to actionable trading signals. We argue that traditional machine learning metrics fail to adequately assess the quality of forecasts in the Limit Order Book context. As an alternative, we propose an innovative operational framework that evaluates predictions' practicality by focusing on the probability of accurately forecasting complete transactions. This work offers academics and practitioners an avenue to make informed and robust decisions on the application of deep learning techniques, their scope and limitations, effectively exploiting emergent statistical properties of the Limit Order Book.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep limit order book forecasting: a microstructural guide.

Briola, Antonio, Bartolucci, Silvia, Aste, Tomaso

Attention-Based Reading, Highlighting, and Forecasting of the Limit Order Book

Kiseop Lee, Jiwon Jung

Hawkes-based cryptocurrency forecasting via Limit Order Book data

Simone Formentin, Riccardo Busetto, Raffaele Giuseppe Cestari et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)