Authors

Summary

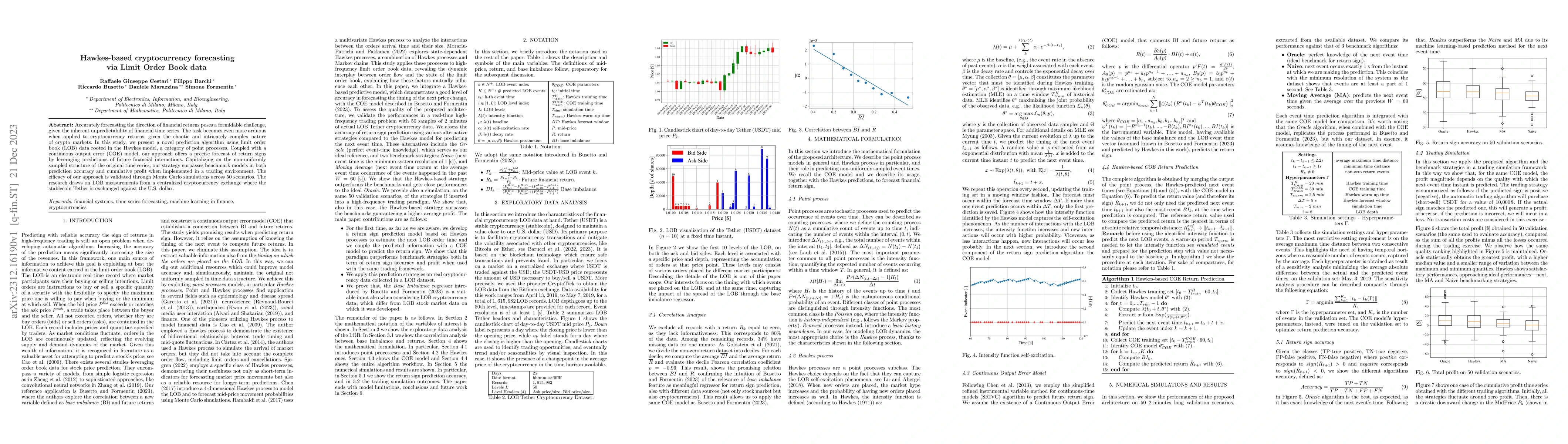

Accurately forecasting the direction of financial returns poses a formidable challenge, given the inherent unpredictability of financial time series. The task becomes even more arduous when applied to cryptocurrency returns, given the chaotic and intricately complex nature of crypto markets. In this study, we present a novel prediction algorithm using limit order book (LOB) data rooted in the Hawkes model, a category of point processes. Coupled with a continuous output error (COE) model, our approach offers a precise forecast of return signs by leveraging predictions of future financial interactions. Capitalizing on the non-uniformly sampled structure of the original time series, our strategy surpasses benchmark models in both prediction accuracy and cumulative profit when implemented in a trading environment. The efficacy of our approach is validated through Monte Carlo simulations across 50 scenarios. The research draws on LOB measurements from a centralized cryptocurrency exchange where the stablecoin Tether is exchanged against the U.S. dollar.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Limit Order Book Forecasting

Antonio Briola, Silvia Bartolucci, Tomaso Aste

Order Book Queue Hawkes-Markovian Modeling

Shihao Yang, Philip Protter, Qianfan Wu

| Title | Authors | Year | Actions |

|---|

Comments (0)