Authors

Summary

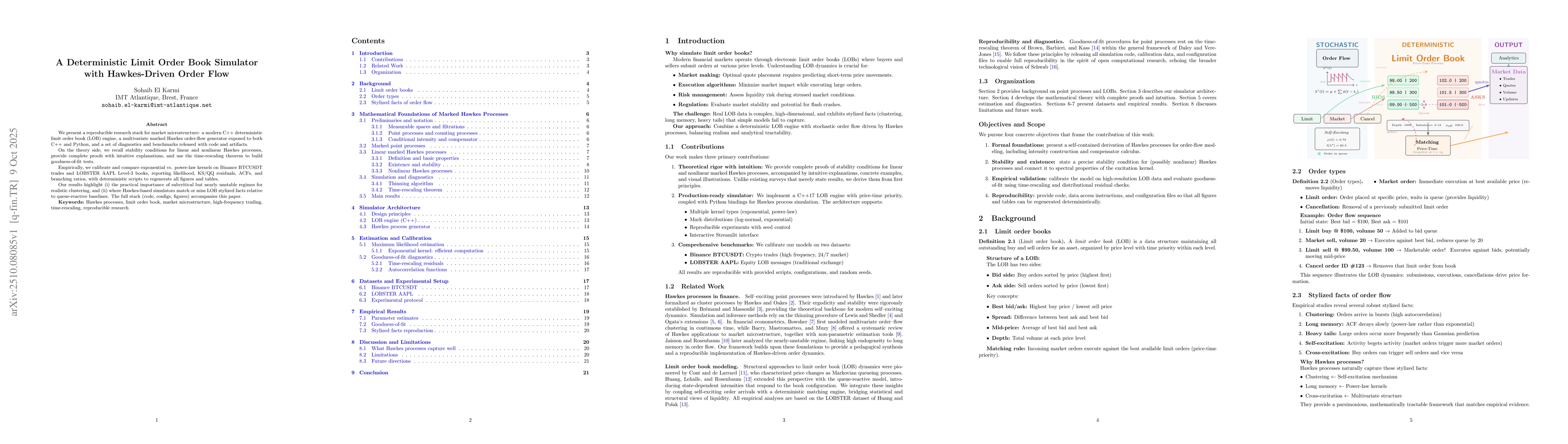

We present a reproducible research framework for market microstructure combining a deterministic C++ limit order book (LOB) simulator with stochastic order flow generated by multivariate marked Hawkes processes. The paper derives full stability and ergodicity proofs for both linear and nonlinear Hawkes models, implements time-rescaling and goodness-of-fit diagnostics, and calibrates exponential and power-law kernels on Binance BTCUSDT and LOBSTER AAPL datasets. Empirical results highlight the nearly-unstable subcritical regime as essential for reproducing realistic clustering in order flow. All code, datasets, and configuration files are publicly available at https://github.com/sohaibelkarmi/High-Frequency-Trading-Simulator

AI Key Findings

Generated Oct 11, 2025

Methodology

The research employs Hawkes processes to model order flow clustering in financial markets, using time-rescaling diagnostics for validation. It combines simulation techniques with real-world data from Binance and LOBSTER datasets to analyze market dynamics.

Key Results

- Hawkes processes effectively capture order flow clustering with early unstable regimes crucial for realistic dynamics

- Time-rescaling diagnostics provide powerful goodness-of-fit tests for point processes

- The queue-reactive model demonstrates competitive performance in simulating order book data

Significance

This research advances financial market modeling by providing a mathematically rigorous framework for understanding order flow dynamics, with potential applications in algorithmic trading and market microstructure analysis.

Technical Contribution

Develops a comprehensive framework combining Hawkes processes with time-rescaling diagnostics for validating and analyzing financial market activity patterns

Novelty

Introduces an early unstable regime analysis for Hawkes processes and applies time-rescaling diagnostics to financial market data, providing new insights into order flow dynamics

Limitations

- Current models lack direct dependence on limit order book states

- Validation relies on specific market data sources which may limit generalizability

Future Work

- Integrate limit order book state dependencies for enhanced realism

- Explore machine learning approaches for parameter estimation

- Validate models across diverse market conditions and asset classes

Paper Details

PDF Preview

Similar Papers

Found 4 papersLimit Order Book Dynamics and Order Size Modelling Using Compound Hawkes Process

Philip Treleaven, Konark Jain, Nick Firoozye et al.

Order Book Queue Hawkes-Markovian Modeling

Shihao Yang, Philip Protter, Qianfan Wu

Comments (0)