Summary

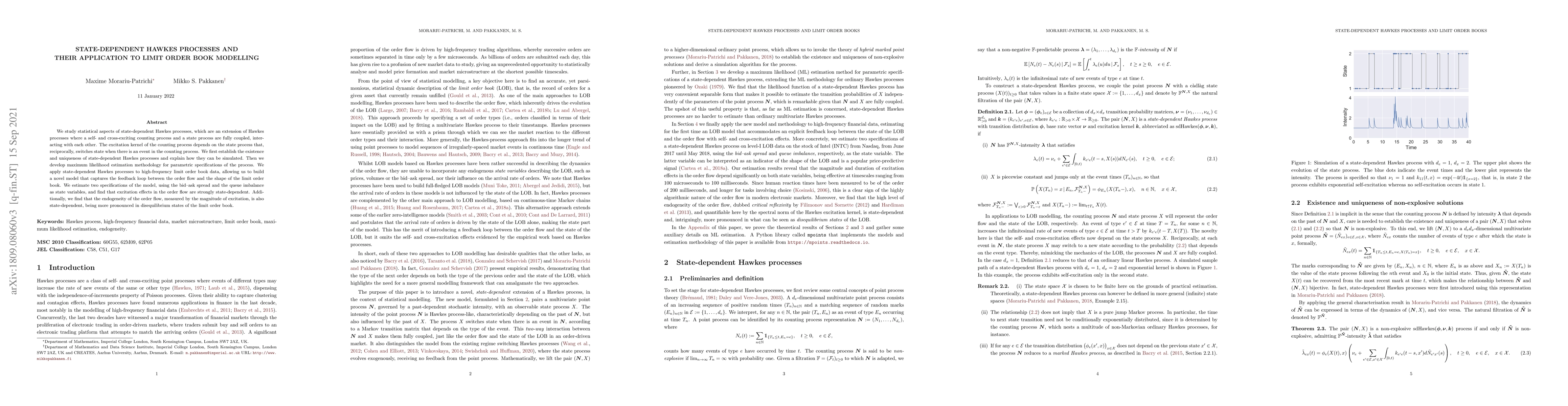

We study statistical aspects of state-dependent Hawkes processes, which are an extension of Hawkes processes where a self- and cross-exciting counting process and a state process are fully coupled, interacting with each other. The excitation kernel of the counting process depends on the state process that, reciprocally, switches state when there is an event in the counting process. We first establish the existence and uniqueness of state-dependent Hawkes processes and explain how they can be simulated. Then we develop maximum likelihood estimation methodology for parametric specifications of the process. We apply state-dependent Hawkes processes to high-frequency limit order book data, allowing us to build a novel model that captures the feedback loop between the order flow and the shape of the limit order book. We estimate two specifications of the model, using the bid-ask spread and the queue imbalance as state variables, and find that excitation effects in the order flow are strongly state-dependent. Additionally, we find that the endogeneity of the order flow, measured by the magnitude of excitation, is also state-dependent, being more pronounced in disequilibrium states of the limit order book.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLimit Order Book Dynamics and Order Size Modelling Using Compound Hawkes Process

Philip Treleaven, Konark Jain, Nick Firoozye et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)