Tomaso Aste

23 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Relation between Financial Market Structure and the Real Economy: Comparison between Clustering Methods

We quantify the amount of information filtered by different hierarchical clustering methods on correlations between stock returns comparing it with the underlying industrial activity structure. Spec...

HLOB -- Information Persistence and Structure in Limit Order Books

We introduce a novel large-scale deep learning model for Limit Order Book mid-price changes forecasting, and we name it `HLOB'. This architecture (i) exploits the information encoded by an Informati...

Deep Limit Order Book Forecasting

We exploit cutting-edge deep learning methodologies to explore the predictability of high-frequency Limit Order Book mid-price changes for a heterogeneous set of stocks traded on the NASDAQ exchange...

Retail Central Bank Digital Currency: Motivations, Opportunities, and Mistakes

Nations around the world are conducting research into the design of central bank digital currency (CBDC), a new, digital form of money that would be issued by central banks alongside cash and centra...

Topological Portfolio Selection and Optimization

Modern portfolio optimization is centered around creating a low-risk portfolio with extensive asset diversification. Following the seminal work of Markowitz, optimal asset allocation can be computed...

Unraveling the Enigma of Double Descent: An In-depth Analysis through the Lens of Learned Feature Space

Double descent presents a counter-intuitive aspect within the machine learning domain, and researchers have observed its manifestation in various models and tasks. While some theoretical explanation...

Homological Convolutional Neural Networks

Deep learning methods have demonstrated outstanding performances on classification and regression tasks on homogeneous data types (e.g., image, audio, and text data). However, tabular data still pos...

ESG Reputation Risk Matters: An Event Study Based on Social Media Data

We investigate the response of shareholders to Environmental, Social, and Governance-related reputational risk (ESG-risk), focusing exclusively on the impact of social media. Using a dataset of 114 ...

Homological Neural Networks: A Sparse Architecture for Multivariate Complexity

The rapid progress of Artificial Intelligence research came with the development of increasingly complex deep learning models, leading to growing challenges in terms of computational complexity, ene...

FTX's downfall and Binance's consolidation: The fragility of centralised digital finance

This paper investigates the causes of the FTX digital currency exchange's failure in November 2022. We identify the collapse of the Terra-Luna ecosystem as the pivotal event that triggered a signifi...

Topological Feature Selection

In this paper, we introduce a novel unsupervised, graph-based filter feature selection technique which exploits the power of topologically constrained network representations. We model dependency st...

Regime-based Implied Stochastic Volatility Model for Crypto Option Pricing

The increasing adoption of Digital Assets (DAs), such as Bitcoin (BTC), rises the need for accurate option pricing models. Yet, existing methodologies fail to cope with the volatile nature of the em...

Anatomy of a Stablecoin's failure: the Terra-Luna case

We quantitatively describe the main events that led to the Terra project's failure in May 2022. We first review, in a systematic way, news from heterogeneous social media sources; we discuss the fra...

Dependency structures in cryptocurrency market from high to low frequency

We investigate logarithmic price returns cross-correlations at different time horizons for a set of 25 liquid cryptocurrencies traded on the FTX digital currency exchange. We study how the structure...

Sparsification and Filtering for Spatial-temporal GNN in Multivariate Time-series

We propose an end-to-end architecture for multivariate time-series prediction that integrates a spatial-temporal graph neural network with a matrix filtering module. This module generates filtered (...

Dynamic Portfolio Optimization with Inverse Covariance Clustering

Market conditions change continuously. However, in portfolio's investment strategies, it is hard to account for this intrinsic non-stationarity. In this paper, we propose to address this issue by us...

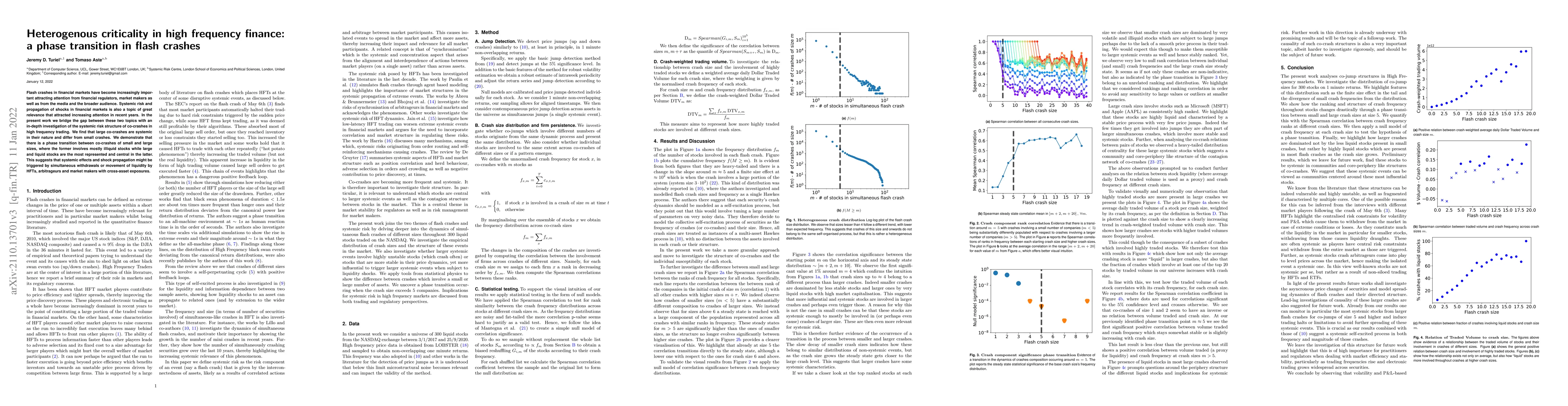

Self-organised criticality in high frequency finance: the case of flash crashes

With the rise of computing and artificial intelligence, advanced modeling and forecasting has been applied to High Frequency markets. A crucial element of solid production modeling though relies on ...

Heterogenous criticality in high frequency finance: a phase transition in flash crashes

Flash crashes in financial markets have become increasingly important attracting attention from financial regulators, market makers as well as from the media and the broader audience. Systemic risk ...

Deep Reinforcement Learning for Active High Frequency Trading

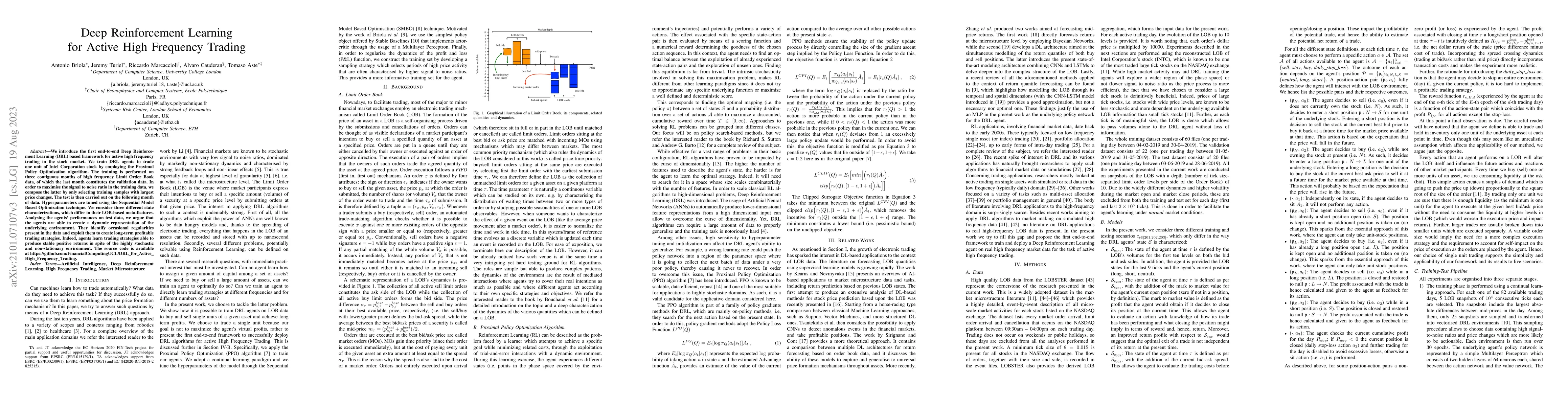

We introduce the first end-to-end Deep Reinforcement Learning (DRL) based framework for active high frequency trading in the stock market. We train DRL agents to trade one unit of Intel Corporation ...

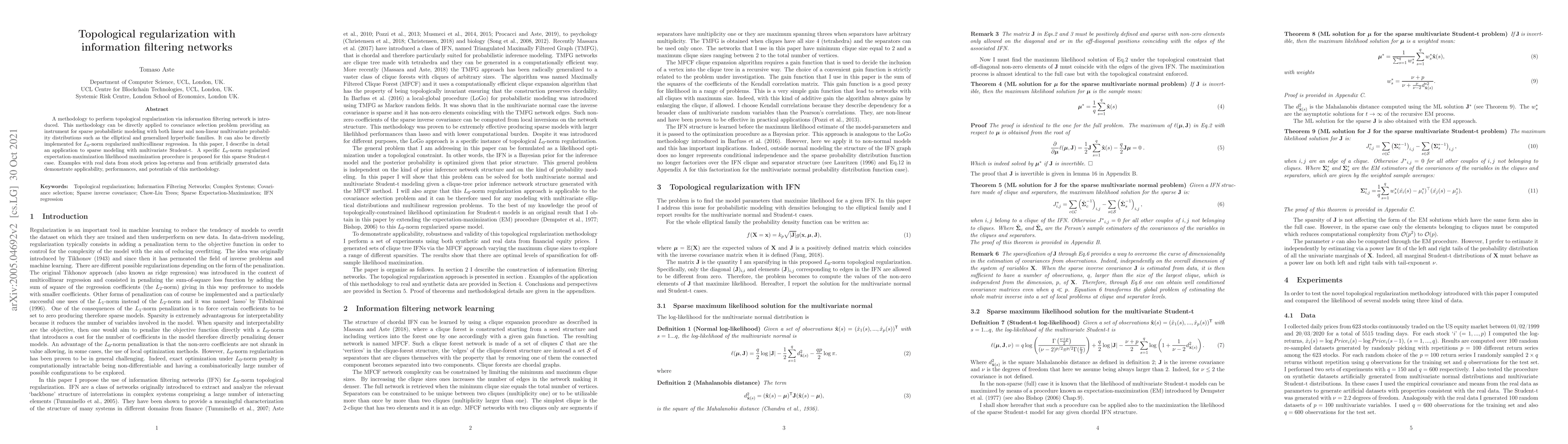

Topological regularization with information filtering networks

A methodology to perform topological regularization via information filtering network is introduced. This methodology can be directly applied to covariance selection problem providing an instrument ...

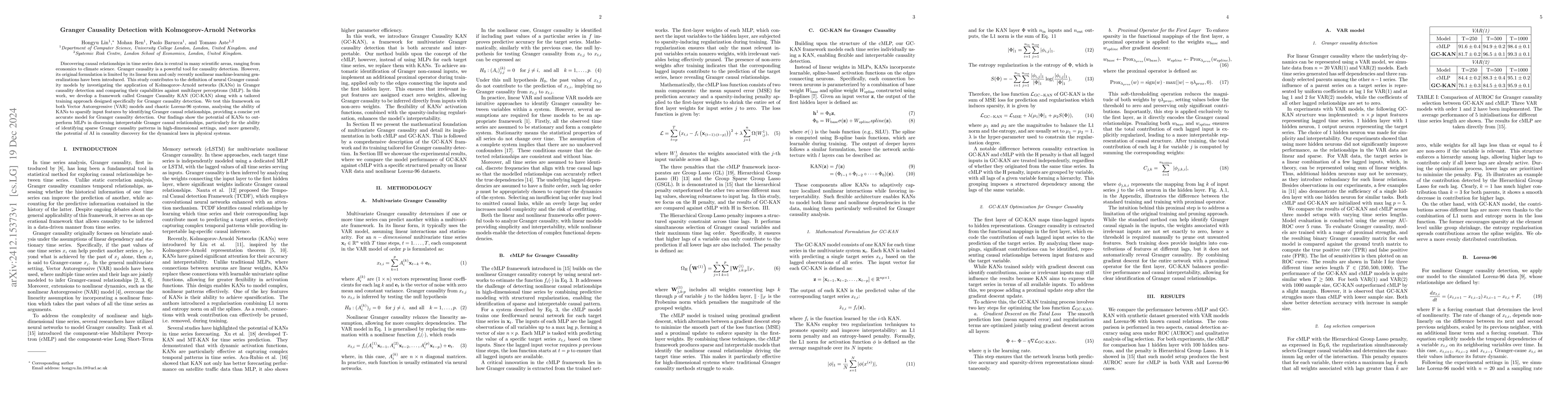

Granger Causality Detection with Kolmogorov-Arnold Networks

Discovering causal relationships in time series data is central in many scientific areas, ranging from economics to climate science. Granger causality is a powerful tool for causality detection. Howev...

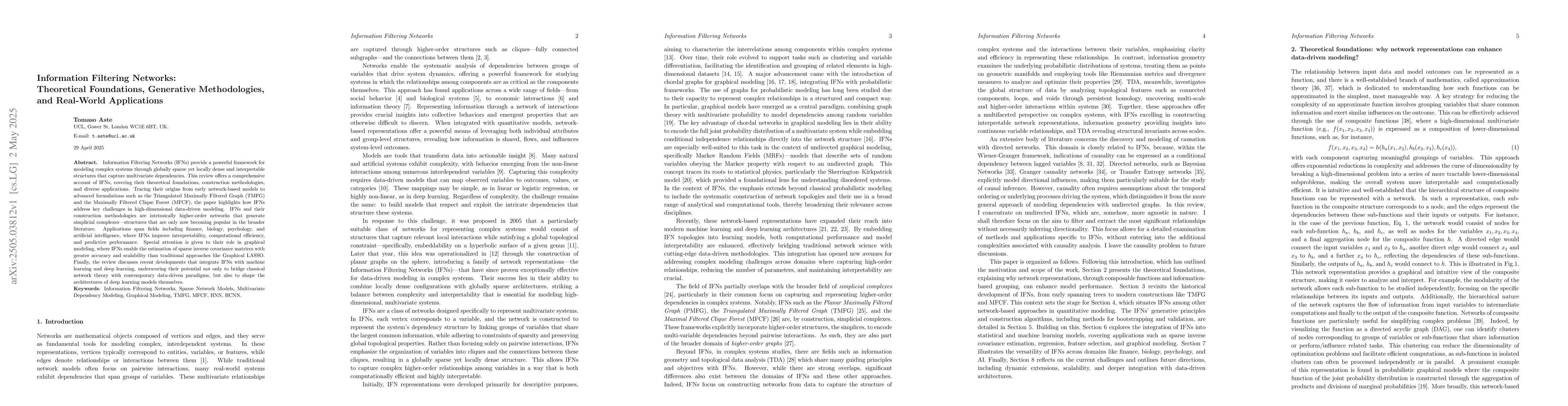

Information Filtering Networks: Theoretical Foundations, Generative Methodologies, and Real-World Applications

Information Filtering Networks (IFNs) provide a powerful framework for modeling complex systems through globally sparse yet locally dense and interpretable structures that capture multivariate depende...

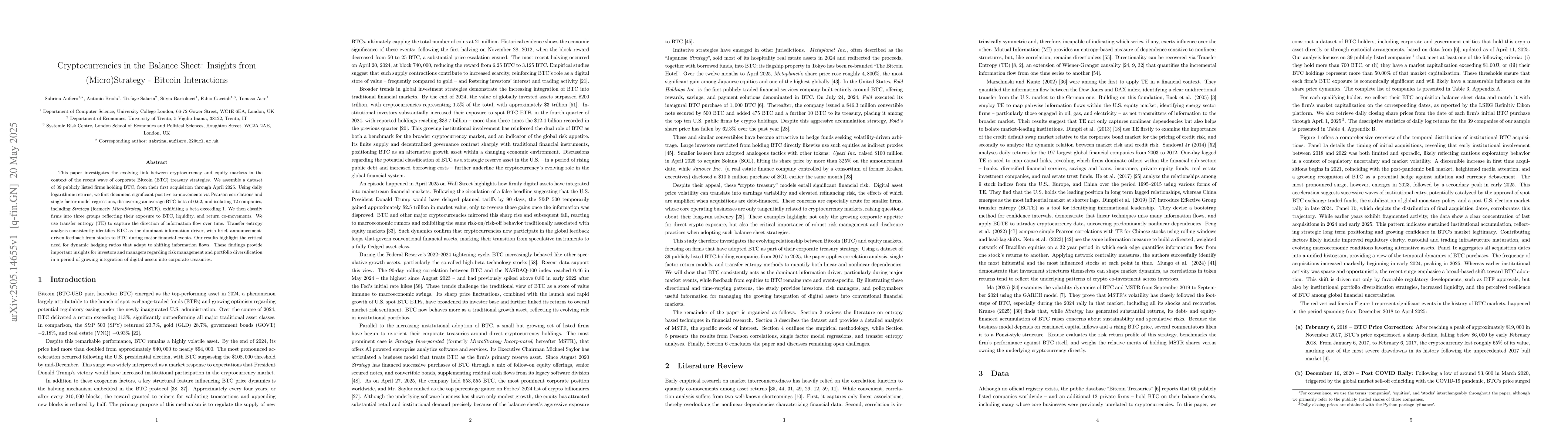

Cryptocurrencies in the Balance Sheet: Insights from (Micro)Strategy -- Bitcoin Interactions

This paper investigates the evolving link between cryptocurrency and equity markets in the context of the recent wave of corporate Bitcoin (BTC) treasury strategies. We assemble a dataset of 39 public...