Authors

Summary

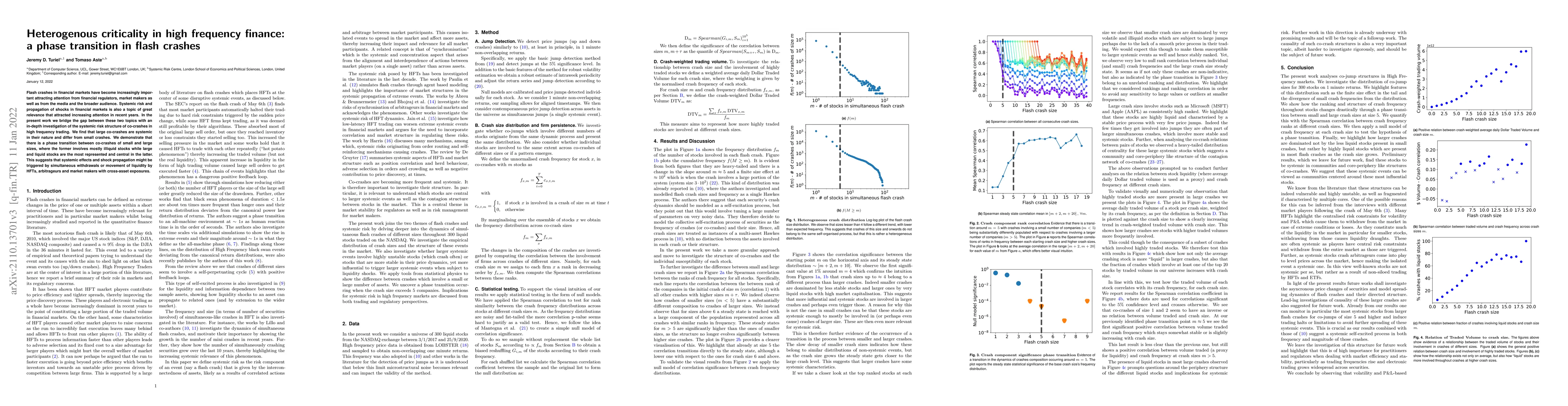

Flash crashes in financial markets have become increasingly important attracting attention from financial regulators, market makers as well as from the media and the broader audience. Systemic risk and propagation of shocks in financial markets is also a topic of great relevance that attracted increasing attention in recent years. In the present work we bridge the gap between these two topics with an in-depth investigation of the systemic risk structure of co-crashes in high frequency trading. We find that large co-crashes are systemic in their nature and differ from small crashes. We demonstrate that there is a phase transition between co-crashes of small and large sizes, where the former involves mostly illiquid stocks while large and liquid stocks are the most represented and central in the latter. This suggests that systemic effects and shock propagation might be triggered by simultaneous withdrawals or movement of liquidity by HFTs, arbitrageurs and market makers with cross-asset exposures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)