Authors

Summary

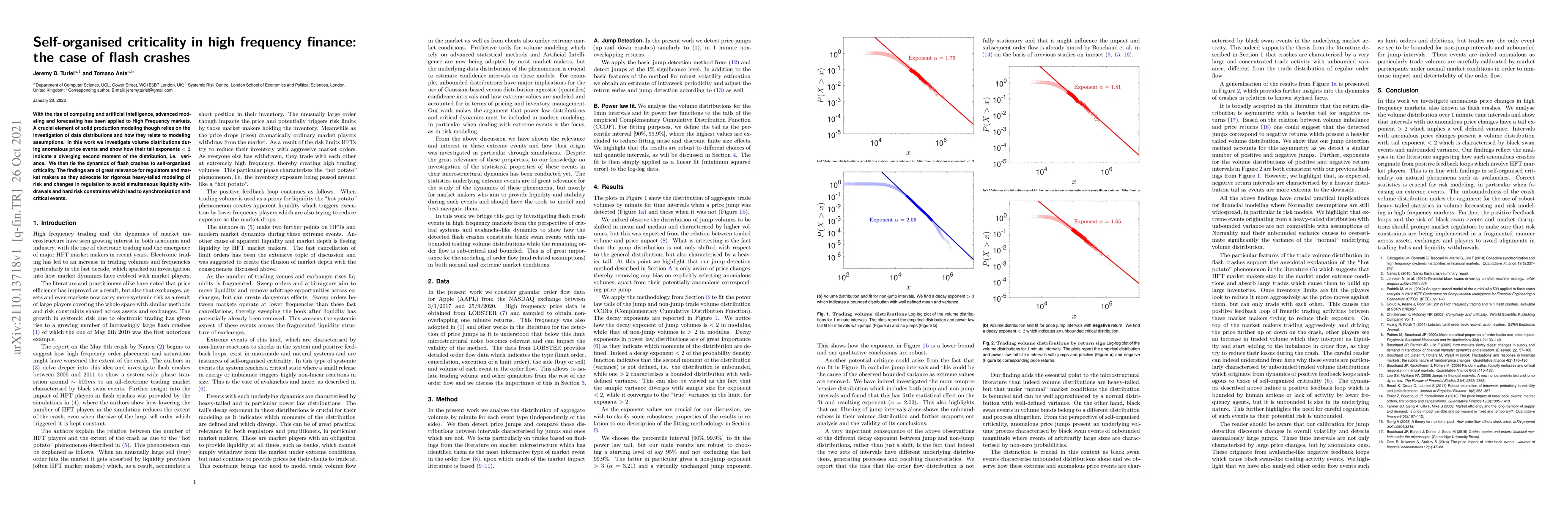

With the rise of computing and artificial intelligence, advanced modeling and forecasting has been applied to High Frequency markets. A crucial element of solid production modeling though relies on the investigation of data distributions and how they relate to modeling assumptions. In this work we investigate volume distributions during anomalous price events and show how their tail exponents < 2 indicate a diverging second moment of the distribution, i.e. variance. We then tie the dynamics of flash crashes to self-organised criticality. The findings are of great relevance for regulators and market makers as they advocate for rigorous heavy-tailed modeling of risk and changes in regulation to avoid simultaneous liquidity withdrawals and hard risk constraints which lead to synchronisation and critical events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHeterogenous criticality in high frequency finance: a phase transition in flash crashes

Tomaso Aste, Jeremy Turiel

Eigenstates in the self-organised criticality

Teng Liu, Maoxin Liu, Xiaosong Chen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)