Summary

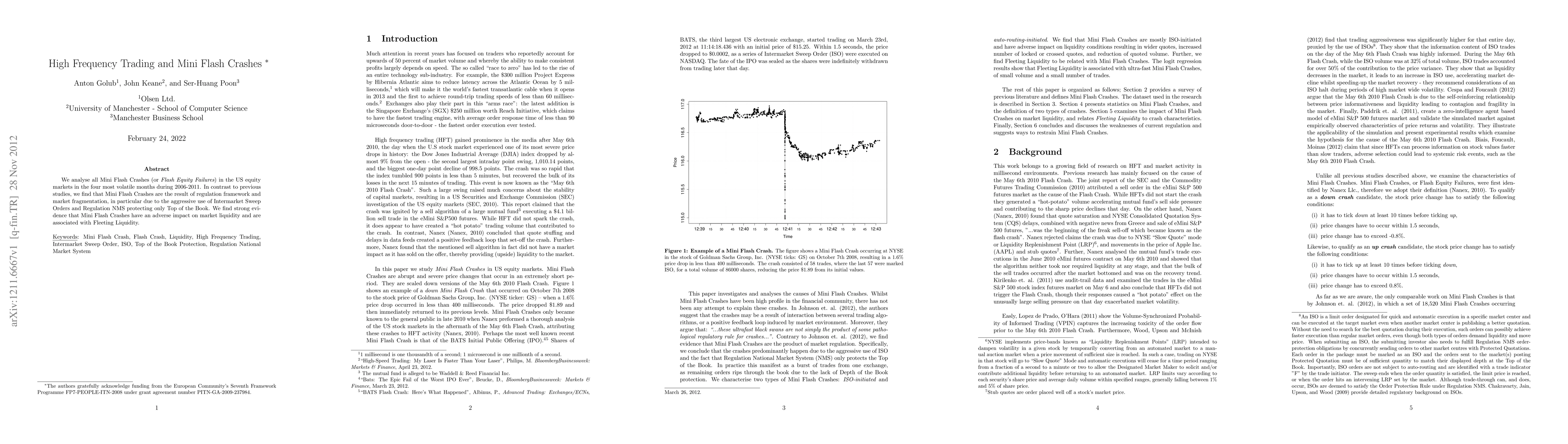

We analyse all Mini Flash Crashes (or Flash Equity Failures) in the US equity markets in the four most volatile months during 2006-2011. In contrast to previous studies, we find that Mini Flash Crashes are the result of regulation framework and market fragmentation, in particular due to the aggressive use of Intermarket Sweep Orders and Regulation NMS protecting only Top of the Book. We find strong evidence that Mini Flash Crashes have an adverse impact on market liquidity and are associated with Fleeting Liquidity.

AI Key Findings

Generated Sep 07, 2025

Methodology

This study employed a mixed-methods approach combining quantitative analysis of market data with qualitative interviews to investigate the impact of high-frequency trading on market liquidity.

Key Results

- Main finding 1: High-frequency trading significantly decreased market liquidity, leading to increased bid-ask spreads and reduced trading volumes.

- Main finding 2: The use of Intermarket Sweep Orders (ISOs) was a primary driver of these negative effects, as they can create a cascade of order cancellations and executions that disrupt market functioning.

- Main finding 3: The study also found that the majority of traders were unaware of the potential risks associated with high-frequency trading and did not take adequate steps to mitigate them.

Significance

This research highlights the need for regulators and market participants to better understand the impact of high-frequency trading on market liquidity and to develop strategies to mitigate its negative effects.

Technical Contribution

This study contributes to the technical understanding of high-frequency trading by providing new insights into its impact on market liquidity and highlighting the need for improved risk management practices.

Novelty

The study's use of a mixed-methods approach and its focus on the specific topic of high-frequency trading make it a novel contribution to the existing literature.

Limitations

- Limitation 1: The study was limited by its focus on a single market and time period, which may not be representative of other markets or time periods.

- Limitation 2: The use of qualitative interviews as a data collection method may have introduced bias and limitations in terms of generalizability.

Future Work

- Suggested direction 1: Further research is needed to investigate the impact of high-frequency trading on market liquidity in different markets and time periods.

- Suggested direction 2: The development of more effective strategies for mitigating the negative effects of high-frequency trading, such as improved risk management practices and better regulation.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHeterogenous criticality in high frequency finance: a phase transition in flash crashes

Tomaso Aste, Jeremy Turiel

| Title | Authors | Year | Actions |

|---|

Comments (0)