Summary

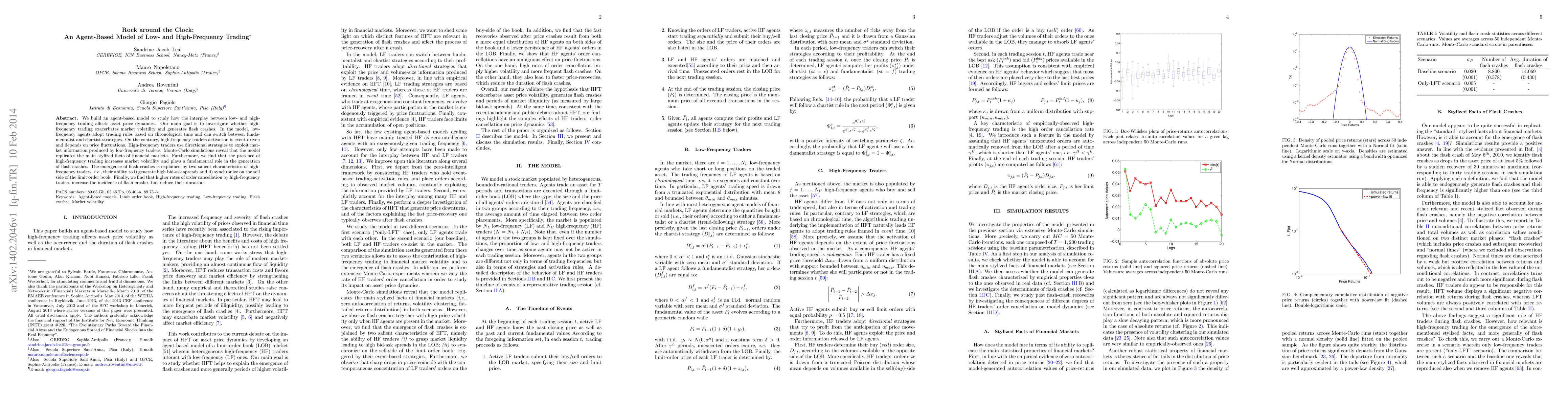

We build an agent-based model to study how the interplay between low- and high-frequency trading affects asset price dynamics. Our main goal is to investigate whether high-frequency trading exacerbates market volatility and generates flash crashes. In the model, low-frequency agents adopt trading rules based on chronological time and can switch between fundamentalist and chartist strategies. On the contrary, high-frequency traders activation is event-driven and depends on price fluctuations. High-frequency traders use directional strategies to exploit market information produced by low-frequency traders. Monte-Carlo simulations reveal that the model replicates the main stylized facts of financial markets. Furthermore, we find that the presence of high-frequency trading increases market volatility and plays a fundamental role in the generation of flash crashes. The emergence of flash crashes is explained by two salient characteristics of high-frequency traders, i.e. their ability to i) generate high bid-ask spreads and ii) synchronize on the sell side of the limit order book. Finally, we find that higher rates of order cancellation by high-frequency traders increase the incidence of flash crashes but reduce their duration.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantAgent: Price-Driven Multi-Agent LLMs for High-Frequency Trading

Xiang Zhang, Aosong Feng, Siqi Sun et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)