Summary

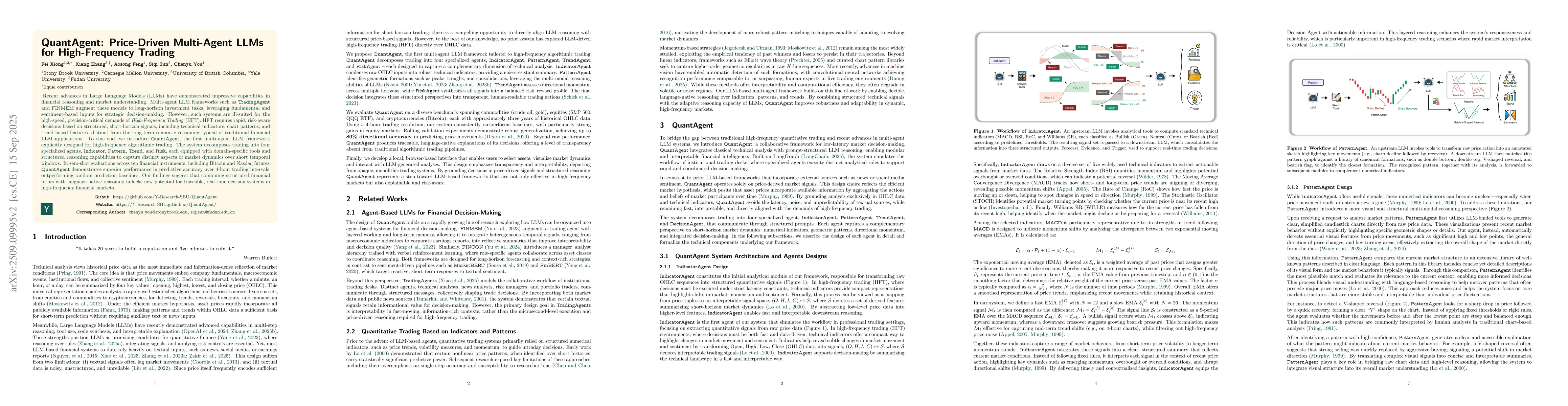

Recent advances in Large Language Models (LLMs) have demonstrated impressive capabilities in financial reasoning and market understanding. Multi-agent LLM frameworks such as TradingAgent and FINMEM augment these models to long-horizon investment tasks, leveraging fundamental and sentiment-based inputs for strategic decision-making. However, such systems are ill-suited for the high-speed, precision-critical demands of High-Frequency Trading (HFT). HFT requires rapid, risk-aware decisions based on structured, short-horizon signals, including technical indicators, chart patterns, and trend-based features, distinct from the long-term semantic reasoning typical of traditional financial LLM applications. To this end, we introduce QuantAgent, the first multi-agent LLM framework explicitly designed for high-frequency algorithmic trading. The system decomposes trading into four specialized agents, Indicator, Pattern, Trend, and Risk, each equipped with domain-specific tools and structured reasoning capabilities to capture distinct aspects of market dynamics over short temporal windows. In zero-shot evaluations across ten financial instruments, including Bitcoin and Nasdaq futures, QuantAgent demonstrates superior performance in both predictive accuracy and cumulative return over 4-hour trading intervals, outperforming random prediction baselines. Our findings suggest that combining structured financial priors with language-native reasoning unlocks new potential for traceable, real-time decision systems in high-frequency financial markets.

AI Key Findings

Generated Oct 12, 2025

Methodology

The research employs a multi-agent system integrating technical indicators, pattern recognition, and trend analysis to evaluate market behavior. It uses historical OHLC data from various financial assets to train and validate the system's predictive capabilities.

Key Results

- QuantAgent demonstrates consistent short-term directional predictions across multiple asset classes.

- The system successfully identifies common technical patterns like Double Bottom with high reliability.

- Trend analysis modules show moderate to strong trend strength indicators across different timeframes.

Significance

This research provides a comprehensive framework for automated trading decisions using multi-agent systems, offering potential improvements in market prediction accuracy and risk management strategies.

Technical Contribution

The development of a modular multi-agent architecture that combines technical analysis with pattern recognition and trend analysis for comprehensive market insights.

Novelty

The integration of multiple technical analysis modules within a single framework, enabling coordinated decision-making across different market analysis perspectives.

Limitations

- The system's performance is dependent on the quality and completeness of historical data.

- It may struggle with extreme market conditions or sudden news events that disrupt established patterns.

Future Work

- Integration with real-time news sentiment analysis for enhanced market prediction.

- Expansion to include more complex trading strategies and risk management frameworks.

- Testing with higher-frequency data to improve short-term prediction accuracy.

Paper Details

PDF Preview

Similar Papers

Found 4 papersQuantAgent: Seeking Holy Grail in Trading by Self-Improving Large Language Model

Jian Guo, Saizhuo Wang, Hang Yuan et al.

Comments (0)