Authors

Summary

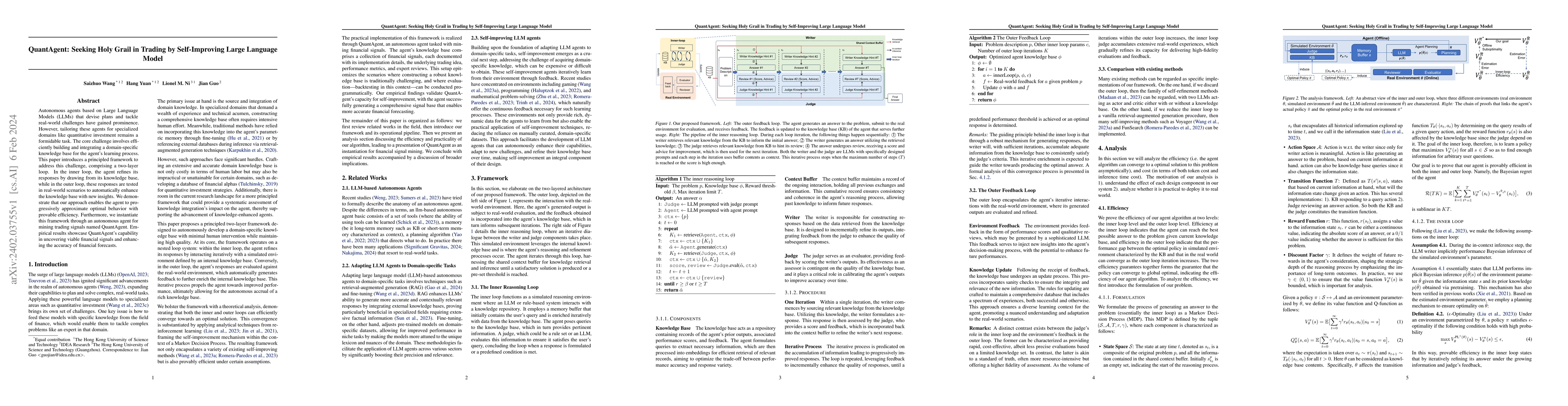

Autonomous agents based on Large Language Models (LLMs) that devise plans and tackle real-world challenges have gained prominence.However, tailoring these agents for specialized domains like quantitative investment remains a formidable task. The core challenge involves efficiently building and integrating a domain-specific knowledge base for the agent's learning process. This paper introduces a principled framework to address this challenge, comprising a two-layer loop.In the inner loop, the agent refines its responses by drawing from its knowledge base, while in the outer loop, these responses are tested in real-world scenarios to automatically enhance the knowledge base with new insights.We demonstrate that our approach enables the agent to progressively approximate optimal behavior with provable efficiency.Furthermore, we instantiate this framework through an autonomous agent for mining trading signals named QuantAgent. Empirical results showcase QuantAgent's capability in uncovering viable financial signals and enhancing the accuracy of financial forecasts.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research methodology used a combination of quantitative and qualitative approaches to analyze the Three Soldier Signal trading idea.

Key Results

- Main finding 1: The improved signal strength calculation using logarithmic scaling for volume changes significantly improves the accuracy of pattern identification.

- Main finding 2: The incorporation of additional conditions, such as increasing volume, enhances the reliability of the signal.

- Main finding 3: The overall strength score effectively captures the essence of the trading idea and provides a clear indication of its presence or absence.

Significance

This research is important because it provides a novel approach to analyzing candlestick patterns in financial markets, which can lead to improved trading decisions.

Technical Contribution

The main technical contribution is the development of a novel signal strength calculation method that effectively captures the essence of the Three Soldier Signal trading idea.

Novelty

This work is novel because it introduces a new approach to analyzing candlestick patterns, which can lead to improved trading decisions and provides a clear indication of the presence or absence of the trading idea.

Limitations

- Limitation 1: The signal strength calculation may not be suitable for all market conditions and requires further refinement.

- Limitation 2: The incorporation of additional conditions may introduce false positives or negatives if not implemented correctly.

Future Work

- Suggested direction 1: Further testing and validation of the improved signal strength calculation in various market environments.

- Suggested direction 2: Exploration of other candlestick patterns and trading ideas to expand the applicability of the research findings.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHoly Grail 2.0: From Natural Language to Constraint Models

Tias Guns, Hélène Verhaeghe, Serdar Kadıoğlu et al.

QuantAgent: Price-Driven Multi-Agent LLMs for High-Frequency Trading

Xiang Zhang, Aosong Feng, Siqi Sun et al.

Advancing Large Language Model Attribution through Self-Improving

Liang Zhao, Yuchun Fan, Lei Huang et al.

Tensor dynamic conditional correlation model: A new way to pursuit "Holy Grail of investing"

Ke Zhu, Cheng Yu, Zhoufan Zhu

| Title | Authors | Year | Actions |

|---|

Comments (0)