Saizhuo Wang

14 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

DSPO: An End-to-End Framework for Direct Sorted Portfolio Construction

In quantitative investment, constructing characteristic-sorted portfolios is a crucial strategy for asset allocation. Traditional methods transform raw stock data of varying frequencies into predict...

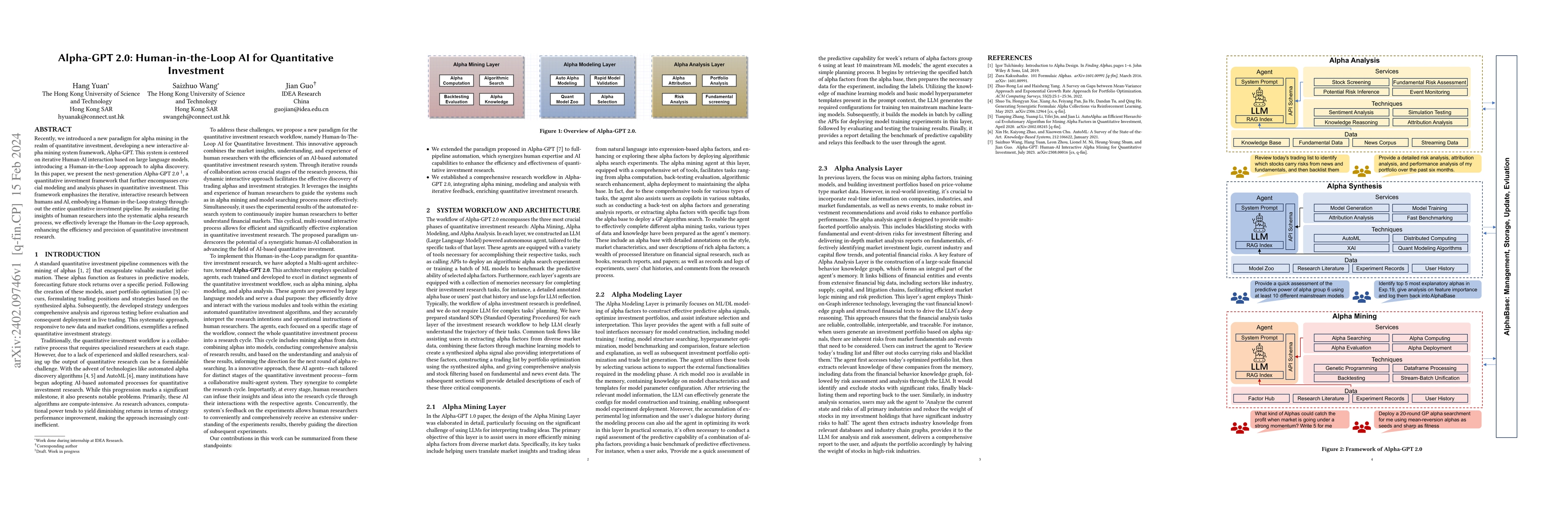

Alpha-GPT 2.0: Human-in-the-Loop AI for Quantitative Investment

Recently, we introduced a new paradigm for alpha mining in the realm of quantitative investment, developing a new interactive alpha mining system framework, Alpha-GPT. This system is centered on ite...

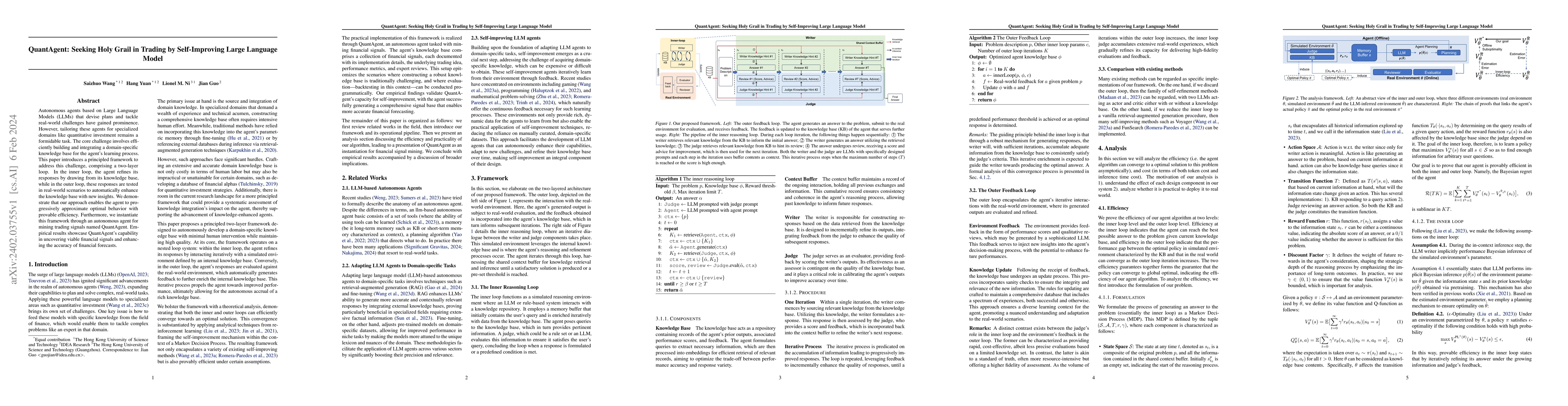

QuantAgent: Seeking Holy Grail in Trading by Self-Improving Large Language Model

Autonomous agents based on Large Language Models (LLMs) that devise plans and tackle real-world challenges have gained prominence.However, tailoring these agents for specialized domains like quantit...

A Principled Framework for Knowledge-enhanced Large Language Model

Large Language Models (LLMs) are versatile, yet they often falter in tasks requiring deep and reliable reasoning due to issues like hallucinations, limiting their applicability in critical scenarios...

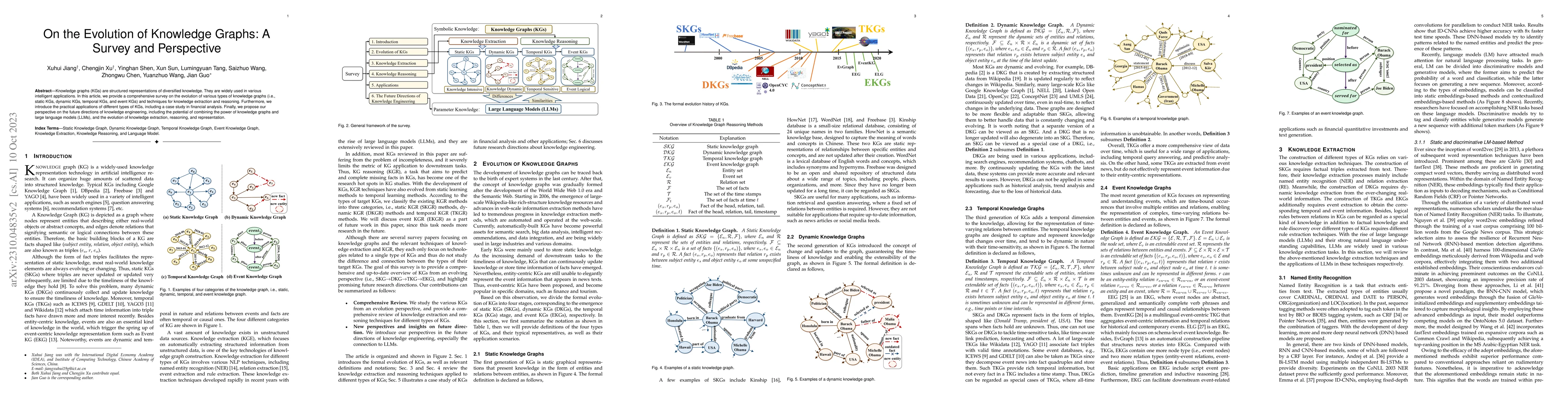

On the Evolution of Knowledge Graphs: A Survey and Perspective

Knowledge graphs (KGs) are structured representations of diversified knowledge. They are widely used in various intelligent applications. In this article, we provide a comprehensive survey on the ev...

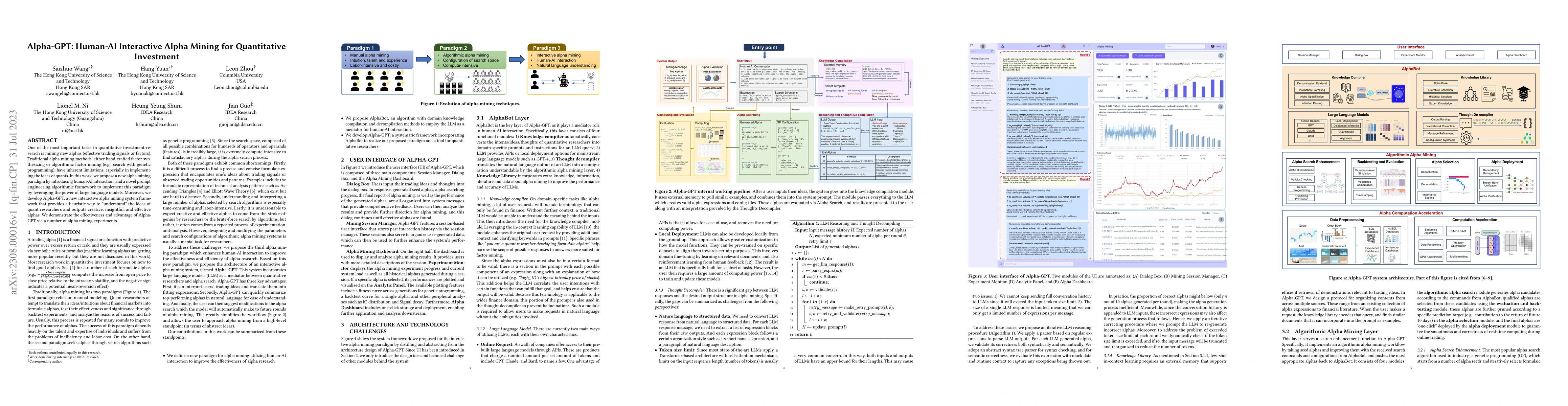

Alpha-GPT: Human-AI Interactive Alpha Mining for Quantitative Investment

One of the most important tasks in quantitative investment research is mining new alphas (effective trading signals or factors). Traditional alpha mining methods, either hand-crafted factor synthesi...

Think-on-Graph: Deep and Responsible Reasoning of Large Language Model on Knowledge Graph

Although large language models (LLMs) have achieved significant success in various tasks, they often struggle with hallucination problems, especially in scenarios requiring deep and responsible reas...

Quant 4.0: Engineering Quantitative Investment with Automated, Explainable and Knowledge-driven Artificial Intelligence

Quantitative investment (``quant'') is an interdisciplinary field combining financial engineering, computer science, mathematics, statistics, etc. Quant has become one of the mainstream investment m...

Transfer Attacks Revisited: A Large-Scale Empirical Study in Real Computer Vision Settings

One intriguing property of adversarial attacks is their "transferability" -- an adversarial example crafted with respect to one deep neural network (DNN) model is often found effective against other...

Golden Touchstone: A Comprehensive Bilingual Benchmark for Evaluating Financial Large Language Models

As large language models become increasingly prevalent in the financial sector, there is a pressing need for a standardized method to comprehensively assess their performance. However, existing financ...

Guided Learning: Lubricating End-to-End Modeling for Multi-stage Decision-making

Multi-stage decision-making is crucial in various real-world artificial intelligence applications, including recommendation systems, autonomous driving, and quantitative investment systems. In quantit...

QuantBench: Benchmarking AI Methods for Quantitative Investment

The field of artificial intelligence (AI) in quantitative investment has seen significant advancements, yet it lacks a standardized benchmark aligned with industry practices. This gap hinders research...

From Deep Learning to LLMs: A survey of AI in Quantitative Investment

Quantitative investment (quant) is an emerging, technology-driven approach in asset management, increasingy shaped by advancements in artificial intelligence. Recent advances in deep learning and larg...

Unleashing Expert Opinion from Social Media for Stock Prediction

While stock prediction task traditionally relies on volume-price and fundamental data to predict the return ratio or price movement trend, sentiment factors derived from social media platforms such as...