Summary

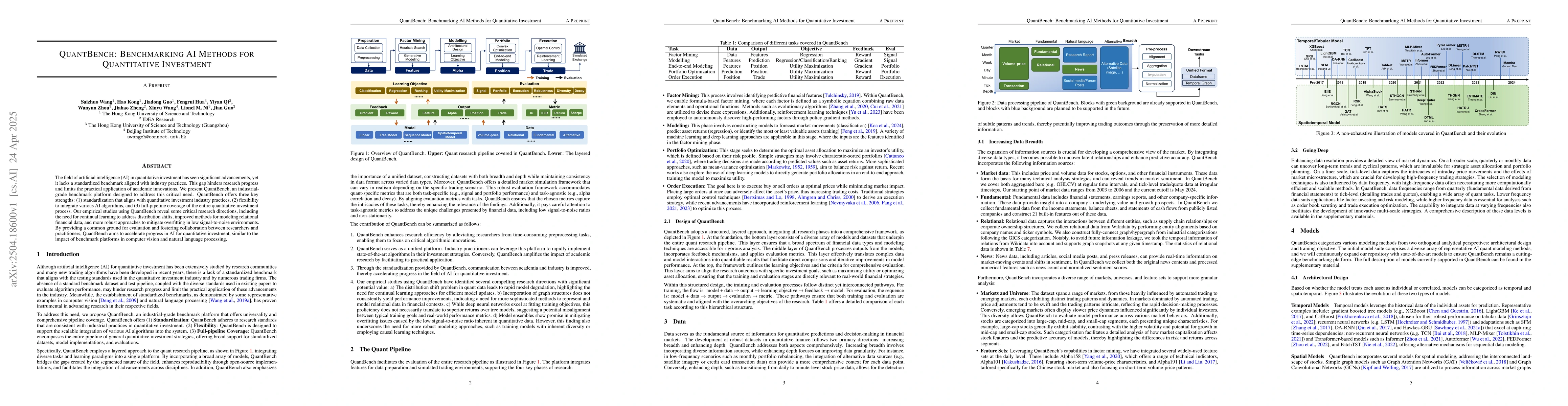

The field of artificial intelligence (AI) in quantitative investment has seen significant advancements, yet it lacks a standardized benchmark aligned with industry practices. This gap hinders research progress and limits the practical application of academic innovations. We present QuantBench, an industrial-grade benchmark platform designed to address this critical need. QuantBench offers three key strengths: (1) standardization that aligns with quantitative investment industry practices, (2) flexibility to integrate various AI algorithms, and (3) full-pipeline coverage of the entire quantitative investment process. Our empirical studies using QuantBench reveal some critical research directions, including the need for continual learning to address distribution shifts, improved methods for modeling relational financial data, and more robust approaches to mitigate overfitting in low signal-to-noise environments. By providing a common ground for evaluation and fostering collaboration between researchers and practitioners, QuantBench aims to accelerate progress in AI for quantitative investment, similar to the impact of benchmark platforms in computer vision and natural language processing.

AI Key Findings

Generated Jun 09, 2025

Methodology

QuantBench, an industrial-grade benchmark platform, was developed to standardize AI methods in quantitative investment, offering flexibility for various AI algorithms and full-pipeline coverage of the investment process.

Key Results

- DNNs generally outperform tree-based models in Information Coefficient (IC), but tree-based models produce better returns and Sharpe ratios.

- Relational Graph Convolutional Networks (RGCN) and Relational Stock Ranking (RSR) networks are effective for modeling complex financial networks with various relationships.

- More frequent model updates help address distribution shifts caused by market evolution, although they come with significant computational costs.

- Retraining on full datasets can improve model stability, especially with fragmented validation set selection methods.

- Ensembling model predictions reduces variance and improves robustness against overfitting in low signal-to-noise environments.

Significance

QuantBench aims to accelerate progress in AI for quantitative investment by providing a common ground for evaluation and fostering collaboration between researchers and practitioners, similar to the impact of benchmark platforms in computer vision and natural language processing.

Technical Contribution

QuantBench provides a comprehensive benchmark platform for AI methods in quantitative investment, addressing the need for standardization aligned with industry practices and offering flexibility for various AI algorithms.

Novelty

QuantBench distinguishes itself by providing a holistic view of the full quantitative research pipeline rather than focusing on specific techniques such as reinforcement learning.

Limitations

- Feature engineering plays a crucial role in improving the signal-to-noise ratio due to inherent noise in financial data.

- The performance of Transformer models designed for time-series data underperformed in stock prediction tasks.

Future Work

- Integrating factor mining with model design could enhance the performance of both tree-based and deep neural network models.

- Future research should focus on designing models that can better integrate temporal and cross-sectional information through unified architectural approaches.

- Investigating more efficient online learning and continual learning techniques to reduce computational burden while allowing for timely model updates.

- Exploring AutoML for automatic optimization of training objectives and end-to-end learning for better incorporation of final goals as training objectives.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAlpha-GPT 2.0: Human-in-the-Loop AI for Quantitative Investment

Jian Guo, Saizhuo Wang, Hang Yuan

Application and practice of AI technology in quantitative investment

Jiangshan Wang, Jue Xiao, Shuochen Bi et al.

Alpha-GPT: Human-AI Interactive Alpha Mining for Quantitative Investment

Jian Guo, Heung-Yeung Shum, Saizhuo Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)