Summary

With the continuous development of artificial intelligence technology, using machine learning technology to predict market trends may no longer be out of reach. In recent years, artificial intelligence has become a research hotspot in the academic circle,and it has been widely used in image recognition, natural language processing and other fields, and also has a huge impact on the field of quantitative investment. As an investment method to obtain stable returns through data analysis, model construction and program trading, quantitative investment is deeply loved by financial institutions and investors. At the same time, as an important application field of quantitative investment, the quantitative investment strategy based on artificial intelligence technology arises at the historic moment.How to apply artificial intelligence to quantitative investment, so as to better achieve profit and risk control, has also become the focus and difficulty of the research. From a global perspective, inflation in the US and the Federal Reserve are the concerns of investors, which to some extent affects the direction of global assets, including the Chinese stock market. This paper studies the application of AI technology, quantitative investment, and AI technology in quantitative investment, aiming to provide investors with auxiliary decision-making, reduce the difficulty of investment analysis, and help them to obtain higher returns.

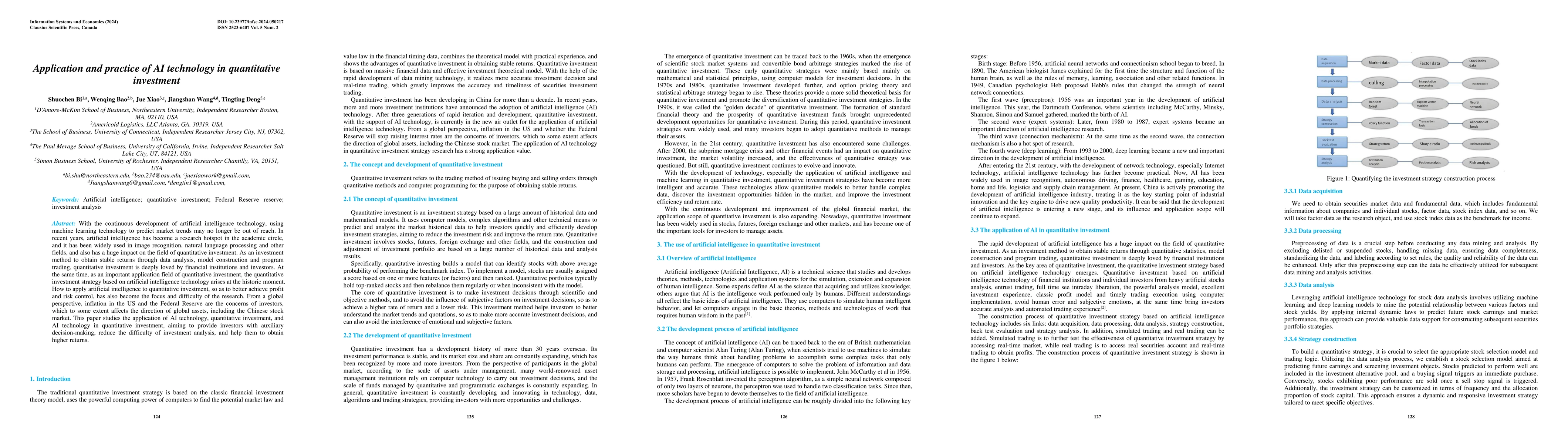

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantBench: Benchmarking AI Methods for Quantitative Investment

Yiyan Qi, Jian Guo, Xinyu Wang et al.

From Deep Learning to LLMs: A survey of AI in Quantitative Investment

Jian Guo, Xiaojun Wu, Saizhuo Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)