Summary

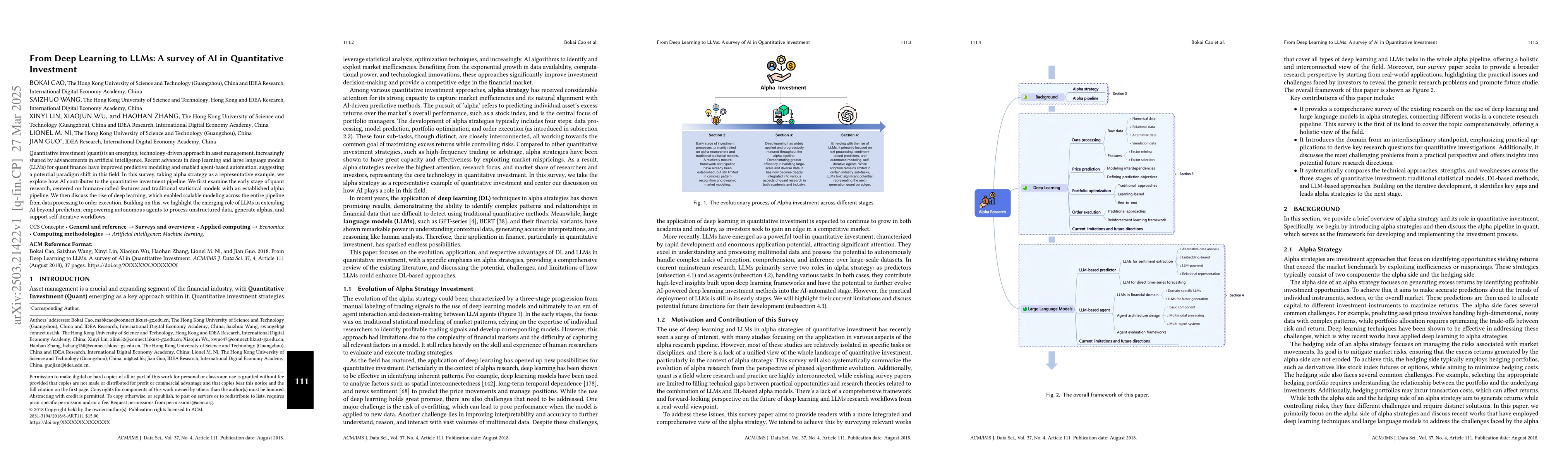

Quantitative investment (quant) is an emerging, technology-driven approach in asset management, increasingy shaped by advancements in artificial intelligence. Recent advances in deep learning and large language models (LLMs) for quant finance have improved predictive modeling and enabled agent-based automation, suggesting a potential paradigm shift in this field. In this survey, taking alpha strategy as a representative example, we explore how AI contributes to the quantitative investment pipeline. We first examine the early stage of quant research, centered on human-crafted features and traditional statistical models with an established alpha pipeline. We then discuss the rise of deep learning, which enabled scalable modeling across the entire pipeline from data processing to order execution. Building on this, we highlight the emerging role of LLMs in extending AI beyond prediction, empowering autonomous agents to process unstructured data, generate alphas, and support self-iterative workflows.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research provides a comprehensive survey of AI, specifically deep learning and large language models (LLMs), in quantitative investment, focusing on alpha strategy as a representative example. It examines the evolution from traditional statistical models to modern AI techniques, highlighting their application across the entire quantitative investment pipeline, from data processing to order execution.

Key Results

- AI advancements, particularly deep learning, have enabled scalable modeling across the entire quantitative investment pipeline.

- Large language models (LLMs) are emerging as tools to extend AI beyond prediction, empowering autonomous agents to process unstructured data, generate alphas, and support self-iterative workflows.

- Deep learning has been applied to enhance existing optimization components and pioneer end-to-end methodologies for direct allocation generation in portfolio optimization.

- Reinforcement learning models have shown better market performance in end-to-end portfolio optimization, eliminating the need for complex model tuning and parameter adjustments.

- Large language models (LLMs) have revolutionized sentiment extraction from financial texts, enabling more nuanced and context-aware textual analysis in financial markets.

Significance

This survey is significant as it provides a holistic view of AI's role in quantitative investment, showcasing its potential to transform the field by improving predictive modeling and enabling agent-based automation, which could lead to a paradigm shift in asset management.

Technical Contribution

The paper's technical contribution lies in its detailed examination of how AI, especially deep learning and LLMs, can be integrated into various stages of the quantitative investment pipeline, from portfolio optimization to order execution.

Novelty

The novelty of this work is its comprehensive survey that bridges the gap between deep learning advancements and their practical application in quantitative investment, highlighting the emerging role of LLMs in extending AI capabilities beyond prediction.

Limitations

- Current research in end-to-end modeling is limited by data availability and task complexity, leading to modest outcomes so far.

- The application of LLMs in financial markets is still less mature compared to other deep learning methods, with certain limitations in specific sub-tasks.

Future Work

- Exploration of automated machine learning (AutoML) to streamline the development and tuning of predictive models for financial markets.

- Development of explainable AI methods to demystify the 'black box' of deep learning models and provide insights into their decision-making processes.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApplication and practice of AI technology in quantitative investment

Jiangshan Wang, Jue Xiao, Shuochen Bi et al.

QuantBench: Benchmarking AI Methods for Quantitative Investment

Yiyan Qi, Jian Guo, Xinyu Wang et al.

Alpha-GPT 2.0: Human-in-the-Loop AI for Quantitative Investment

Jian Guo, Saizhuo Wang, Hang Yuan

No citations found for this paper.

Comments (0)