Summary

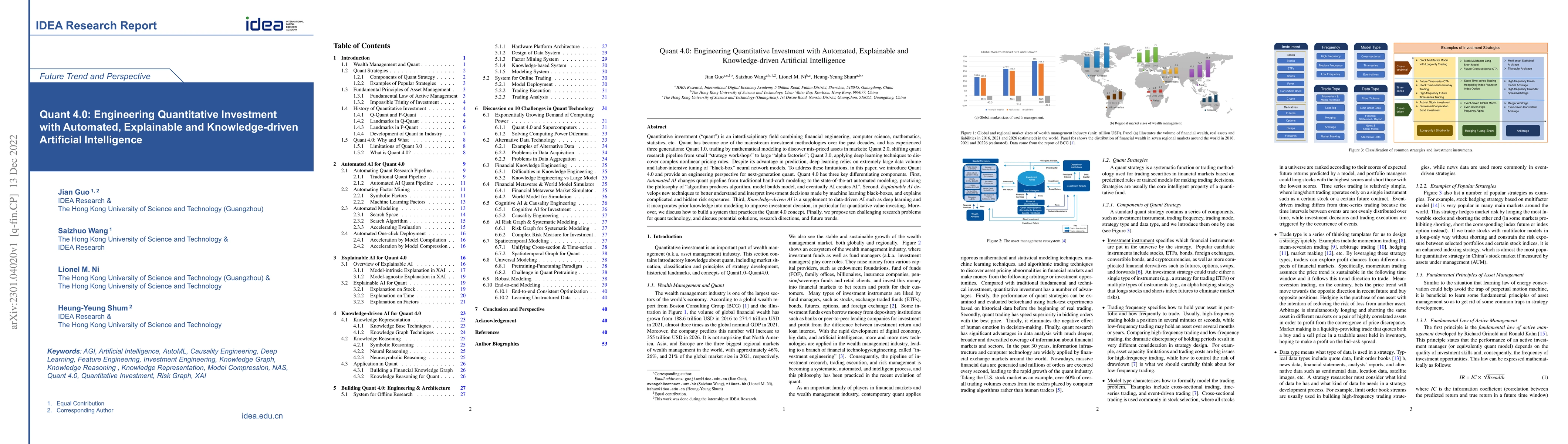

Quantitative investment (``quant'') is an interdisciplinary field combining financial engineering, computer science, mathematics, statistics, etc. Quant has become one of the mainstream investment methodologies over the past decades, and has experienced three generations: Quant 1.0, trading by mathematical modeling to discover mis-priced assets in markets; Quant 2.0, shifting quant research pipeline from small ``strategy workshops'' to large ``alpha factories''; Quant 3.0, applying deep learning techniques to discover complex nonlinear pricing rules. Despite its advantage in prediction, deep learning relies on extremely large data volume and labor-intensive tuning of ``black-box'' neural network models. To address these limitations, in this paper, we introduce Quant 4.0 and provide an engineering perspective for next-generation quant. Quant 4.0 has three key differentiating components. First, automated AI changes quant pipeline from traditional hand-craft modeling to the state-of-the-art automated modeling, practicing the philosophy of ``algorithm produces algorithm, model builds model, and eventually AI creates AI''. Second, explainable AI develops new techniques to better understand and interpret investment decisions made by machine learning black-boxes, and explains complicated and hidden risk exposures. Third, knowledge-driven AI is a supplement to data-driven AI such as deep learning and it incorporates prior knowledge into modeling to improve investment decision, in particular for quantitative value investing. Moreover, we discuss how to build a system that practices the Quant 4.0 concept. Finally, we propose ten challenging research problems for quant technology, and discuss potential solutions, research directions, and future trends.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)