Authors

Summary

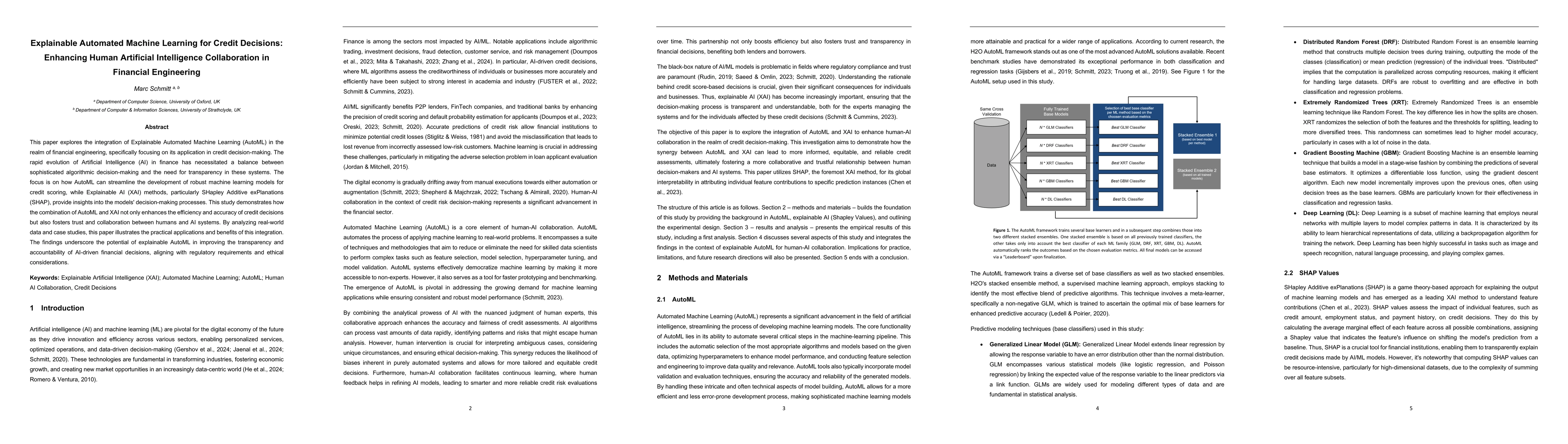

This paper explores the integration of Explainable Automated Machine Learning (AutoML) in the realm of financial engineering, specifically focusing on its application in credit decision-making. The rapid evolution of Artificial Intelligence (AI) in finance has necessitated a balance between sophisticated algorithmic decision-making and the need for transparency in these systems. The focus is on how AutoML can streamline the development of robust machine learning models for credit scoring, while Explainable AI (XAI) methods, particularly SHapley Additive exPlanations (SHAP), provide insights into the models' decision-making processes. This study demonstrates how the combination of AutoML and XAI not only enhances the efficiency and accuracy of credit decisions but also fosters trust and collaboration between humans and AI systems. The findings underscore the potential of explainable AutoML in improving the transparency and accountability of AI-driven financial decisions, aligning with regulatory requirements and ethical considerations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalyzing Machine Learning Models for Credit Scoring with Explainable AI and Optimizing Investment Decisions

Swati Tyagi

Explainable Artificial Intelligence for identifying profitability predictors in Financial Statements

Andrea Amaduzzi, Enza Messina, Mauro Passacantando et al.

Quant 4.0: Engineering Quantitative Investment with Automated, Explainable and Knowledge-driven Artificial Intelligence

Jian Guo, Heung-Yeung Shum, Saizhuo Wang et al.

No citations found for this paper.

Comments (0)