Summary

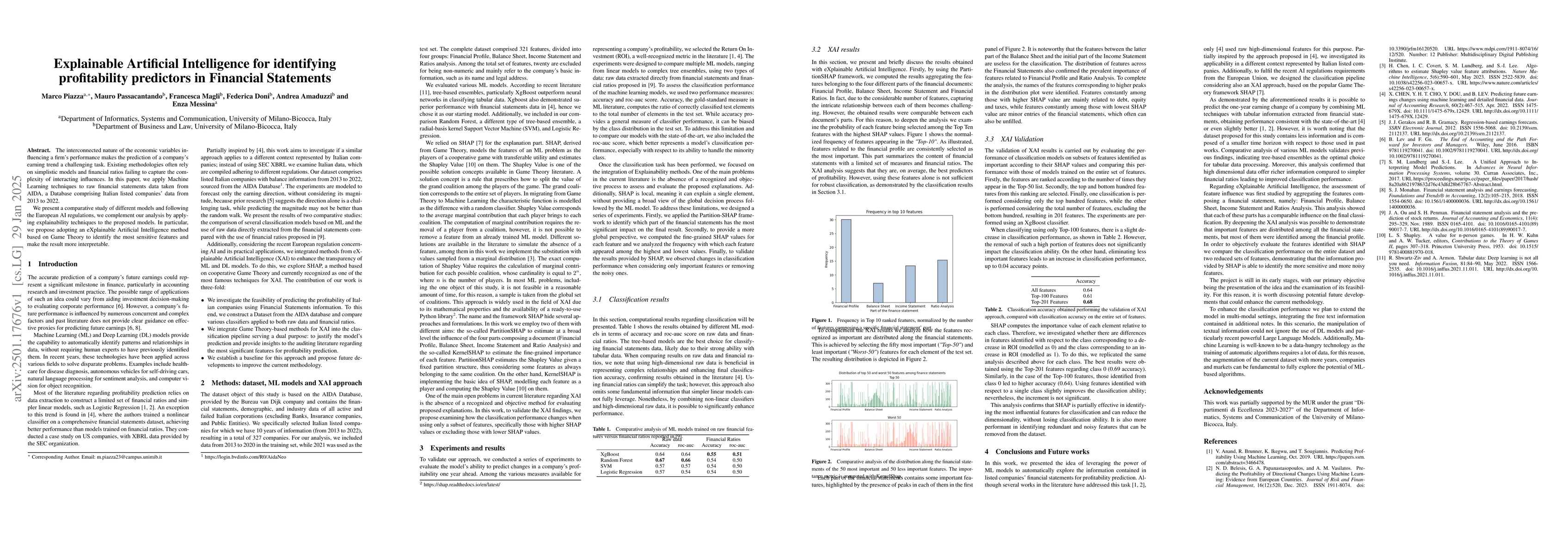

The interconnected nature of the economic variables influencing a firm's performance makes the prediction of a company's earning trend a challenging task. Existing methodologies often rely on simplistic models and financial ratios failing to capture the complexity of interacting influences. In this paper, we apply Machine Learning techniques to raw financial statements data taken from AIDA, a Database comprising Italian listed companies' data from 2013 to 2022. We present a comparative study of different models and following the European AI regulations, we complement our analysis by applying explainability techniques to the proposed models. In particular, we propose adopting an eXplainable Artificial Intelligence method based on Game Theory to identify the most sensitive features and make the result more interpretable.

AI Key Findings

Generated Jun 13, 2025

Methodology

The research applies Machine Learning techniques to raw financial statements data from AIDA, a Database of Italian listed companies' data from 2013 to 2022. It presents a comparative study of different models and uses explainability techniques, specifically an eXplainable Artificial Intelligence method based on Game Theory, to identify the most sensitive features and enhance interpretability.

Key Results

- Application of Machine Learning to raw financial data for profitability prediction.

- Comparative analysis of various models for identifying earning trends.

Significance

This research is important as it tackles the complexity of predicting a company's earning trend by moving beyond simplistic models and financial ratios, thus providing a more nuanced understanding of economic variables influencing firm performance.

Technical Contribution

The paper introduces the use of Game Theory-based explainable AI for identifying sensitive features in financial statement data, enhancing the interpretability of Machine Learning models in financial analysis.

Novelty

The novelty lies in the application of explainable AI, specifically Game Theory, to raw financial statement data for identifying profitability predictors, addressing the shortcomings of traditional simplistic models and ratios.

Limitations

- The study is limited to Italian listed companies' data from 2013 to 2022.

- Generalizability of findings to other markets or time periods might be limited.

Future Work

- Expanding the dataset to include companies from different countries and time periods.

- Investigating the application of similar explainable AI methods to other financial prediction tasks.

Paper Details

PDF Preview

Similar Papers

Found 4 papersA Survey of Explainable Artificial Intelligence (XAI) in Financial Time Series Forecasting

Pierre-Daniel Arsenault, Shengrui Wang, Jean-Marc Patenande

Identifying preflare spectral features using explainable artificial intelligence

Lucia Kleint, Brandon Panos, Jonas Zbinden

No citations found for this paper.

Comments (0)