Summary

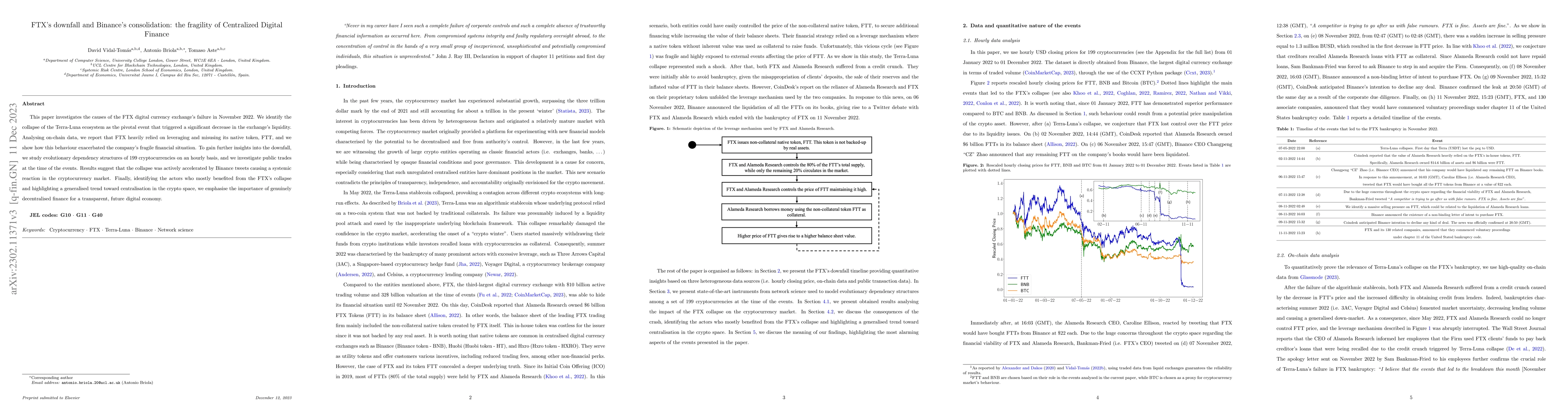

This paper investigates the causes of the FTX digital currency exchange's failure in November 2022. We identify the collapse of the Terra-Luna ecosystem as the pivotal event that triggered a significant decrease in the exchange's liquidity. Analysing on-chain data, we report that FTX heavily relied on leveraging and misusing its native token, FTT, and we show how this behaviour exacerbated the company's fragile financial situation. To gain further insights into the downfall, we study evolutionary dependency structures of 199 cryptocurrencies on an hourly basis, and we investigate public trades at the time of the events. Results suggest that the collapse was actively accelerated by Binance tweets causing a systemic reaction in the cryptocurrency market. Finally, identifying the actors who mostly benefited from the FTX's collapse and highlighting a generalised trend toward centralisation in the crypto space, we emphasise the importance of genuinely decentralised finance for a transparent, future digital economy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDigital finance, Bargaining Power and Gender Wage Gap

Qing Guo, Siyu Chen, Xiangquan Zeng

The rise of digital finance: Financial inclusion or debt trap

Haigang Zhou, Zhichao Yin, Pengpeng Yue et al.

IntraLayer: A Platform of Digital Finance Platforms

Utkarsh Sharma, Arman Abgaryan

| Title | Authors | Year | Actions |

|---|

Comments (0)