Summary

This study focuses on the impact of digital finance on households. While digital finance has brought financial inclusion, it has also increased the risk of households falling into a debt trap. We provide evidence that supports this notion and explain the channel through which digital finance increases the likelihood of financial distress. Our results show that the widespread use of digital finance increases credit market participation. The broadened access to credit markets increases household consumption by changing the marginal propensity to consume. However, the easier access to credit markets also increases the risk of households falling into a debt trap.

AI Key Findings

Generated Sep 03, 2025

Methodology

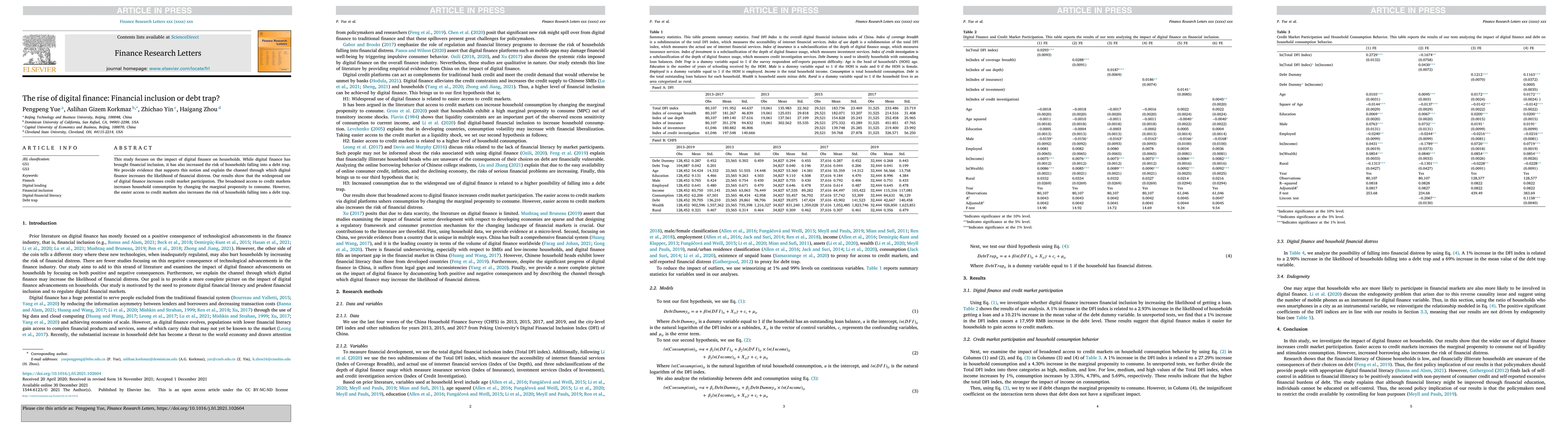

The study uses econometric analysis, including fixed-effects models and two-stage least squares (2SLS) to investigate the impact of digital finance on households, focusing on credit market participation, household consumption behavior, and the risk of falling into a debt trap.

Key Results

- Digital finance increases credit market participation, making it easier for households to access credit markets.

- Broadened access to credit markets increases household consumption, particularly for higher levels of digital finance inclusion.

- Increased borrowing due to digital finance also raises the risk of financial distress, despite improved financial literacy.

Significance

This research is important as it highlights the dual nature of digital finance – while it promotes financial inclusion by expanding access to credit, it also increases the likelihood of households falling into a debt trap.

Technical Contribution

The paper employs advanced econometric techniques, including 2SLS, to address potential endogeneity concerns and provides robustness tests using smartphone ownership as an instrumental variable.

Novelty

This study uniquely combines the analysis of financial inclusion and the risk of debt traps in the context of digital finance, offering insights into the trade-offs associated with the expansion of digital financial services.

Limitations

- The study is limited to China, so findings may not be generalizable to other countries.

- Self-reported data on financial distress might be subject to bias.

Future Work

- Investigate the impact of digital finance on financial distress in other countries.

- Explore the effectiveness of financial literacy programs in mitigating the risk of over-indebtedness.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApplying AHP and FUZZY AHP Management Methods to Assess the Level of Financial and Digital Inclusion

Camelia Oprean-Stan, Sebastian Emanuel Stan, Bogdan Marza et al.

A Framework for Digital Currencies for Financial Inclusion in Latin America and the Caribbean

Gabriel Bizama, Alexander Wu, Bernardo Paniagua et al.

Digital finance, Bargaining Power and Gender Wage Gap

Qing Guo, Siyu Chen, Xiangquan Zeng

Debt-Financed Collateral and Stability Risks in the DeFi Ecosystem

Leandros Tassiulas, Georgios Palaiokrassas, Michael Darlin

| Title | Authors | Year | Actions |

|---|

Comments (0)