Authors

Summary

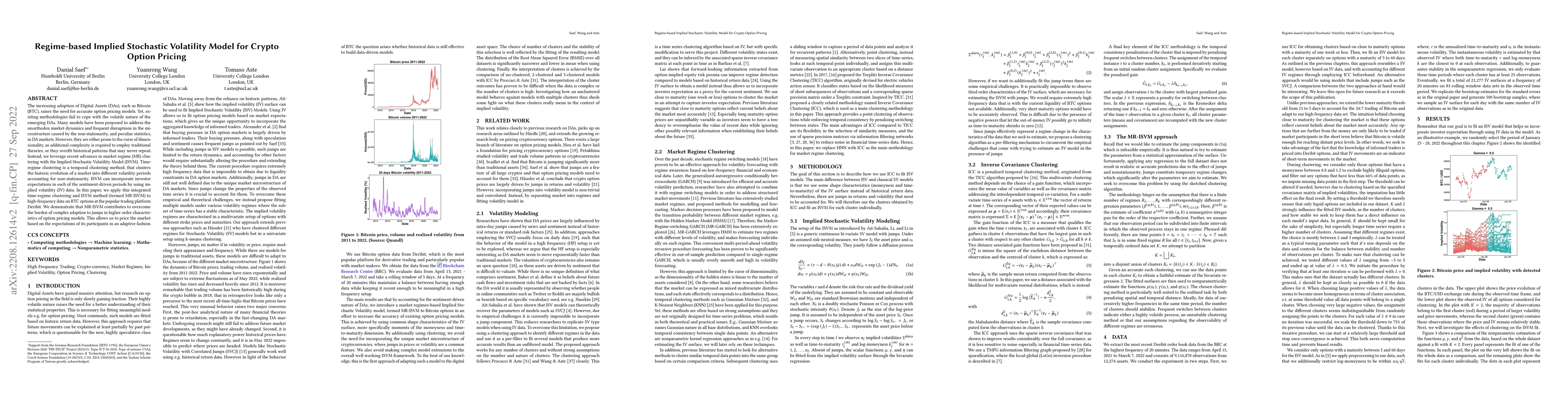

The increasing adoption of Digital Assets (DAs), such as Bitcoin (BTC), rises the need for accurate option pricing models. Yet, existing methodologies fail to cope with the volatile nature of the emerging DAs. Many models have been proposed to address the unorthodox market dynamics and frequent disruptions in the microstructure caused by the non-stationarity, and peculiar statistics, in DA markets. However, they are either prone to the curse of dimensionality, as additional complexity is required to employ traditional theories, or they overfit historical patterns that may never repeat. Instead, we leverage recent advances in market regime (MR) clustering with the Implied Stochastic Volatility Model (ISVM). Time-regime clustering is a temporal clustering method, that clusters the historic evolution of a market into different volatility periods accounting for non-stationarity. ISVM can incorporate investor expectations in each of the sentiment-driven periods by using implied volatility (IV) data. In this paper, we applied this integrated time-regime clustering and ISVM method (termed MR-ISVM) to high-frequency data on BTC options at the popular trading platform Deribit. We demonstrate that MR-ISVM contributes to overcome the burden of complex adaption to jumps in higher order characteristics of option pricing models. This allows us to price the market based on the expectations of its participants in an adaptive fashion.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)