Summary

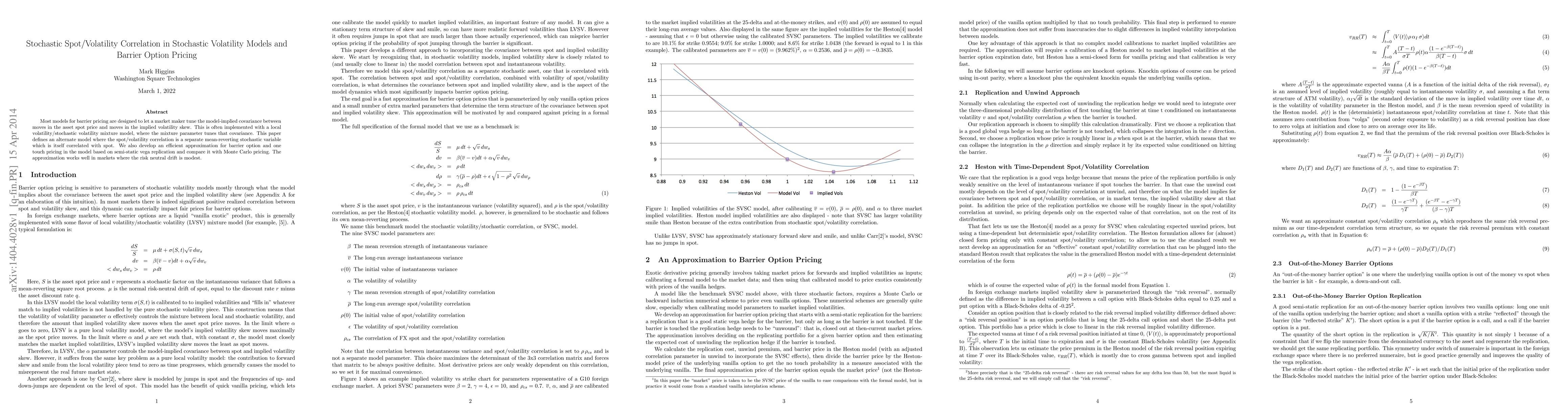

Most models for barrier pricing are designed to let a market maker tune the model-implied covariance between moves in the asset spot price and moves in the implied volatility skew. This is often implemented with a local volatility/stochastic volatility mixture model, where the mixture parameter tunes that covariance. This paper defines an alternate model where the spot/volatility correlation is a separate mean-reverting stochastic variable which is itself correlated with spot. We also develop an efficient approximation for barrier option and one touch pricing in the model based on semi-static vega replication and compare it with Monte Carlo pricing. The approximation works well in markets where the risk neutral drift is modest.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)