Summary

We investigate the pricing of financial options under the 2-hypergeometric stochastic volatility model. This is an analytically tractable model that reproduces the volatility smile and skew effects observed in empirical market data. Using a regular perturbation method from asymptotic analysis of partial differential equations, we derive an explicit and easily computable approximate formula for the pricing of barrier options under the 2-hypergeometric stochastic volatility model. The asymptotic convergence of the method is proved under appropriate regularity conditions, and a multi-stage method for improving the quality of the approximation is discussed. Numerical examples are also provided.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

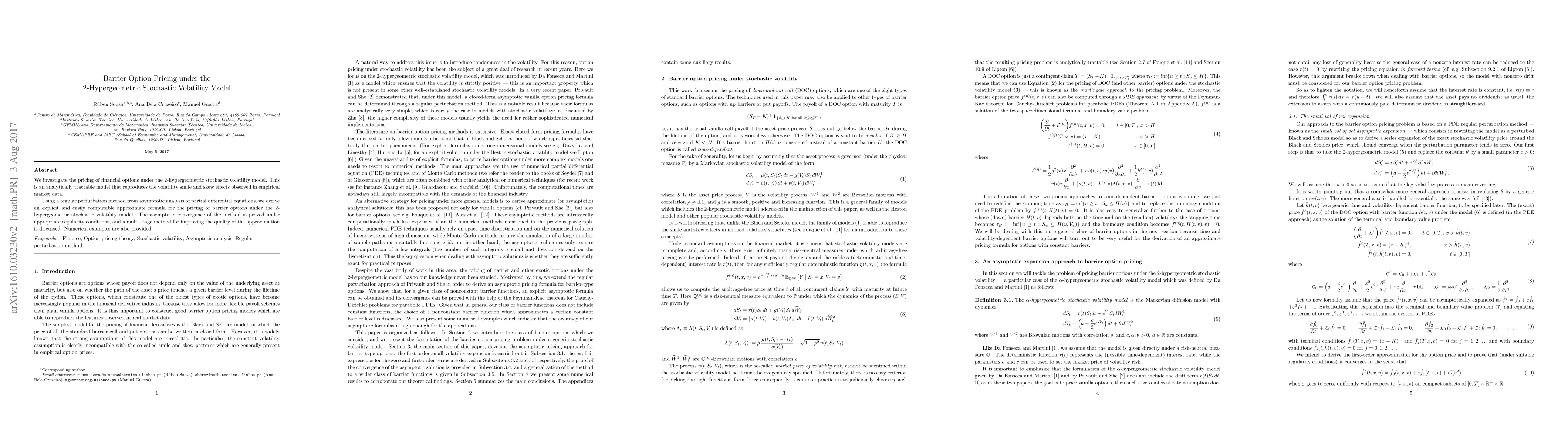

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)