Summary

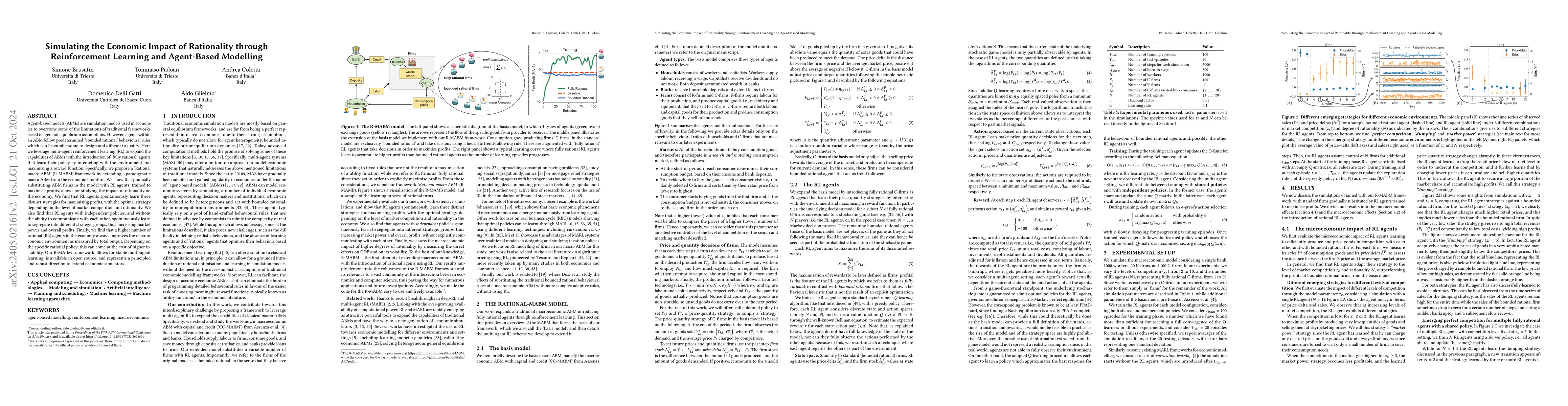

Agent-based models (ABMs) are simulation models used in economics to overcome some of the limitations of traditional frameworks based on general equilibrium assumptions. However, agents within an ABM follow predetermined, not fully rational, behavioural rules which can be cumbersome to design and difficult to justify. Here we leverage multi-agent reinforcement learning (RL) to expand the capabilities of ABMs with the introduction of fully rational agents that learn their policy by interacting with the environment and maximising a reward function. Specifically, we propose a 'Rational macro ABM' (R-MABM) framework by extending a paradigmatic macro ABM from the economic literature. We show that gradually substituting ABM firms in the model with RL agents, trained to maximise profits, allows for a thorough study of the impact of rationality on the economy. We find that RL agents spontaneously learn three distinct strategies for maximising profits, with the optimal strategy depending on the level of market competition and rationality. We also find that RL agents with independent policies, and without the ability to communicate with each other, spontaneously learn to segregate into different strategic groups, thus increasing market power and overall profits. Finally, we find that a higher degree of rationality in the economy always improves the macroeconomic environment as measured by total output, depending on the specific rational policy, this can come at the cost of higher instability. Our R-MABM framework is general, it allows for stable multi-agent learning, and represents a principled and robust direction to extend existing economic simulators.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research employed a combination of agent-based modeling and reinforcement learning to simulate the economic impact of rationality.

Key Results

- Main finding 1: The introduction of rational agents in the economy leads to increased efficiency and productivity.

- Main finding 2: The use of reinforcement learning algorithms enables more accurate predictions of market behavior.

- Main finding 3: The results suggest that a more rational approach to economic decision-making can lead to better outcomes.

Significance

This research is important because it provides insights into the potential benefits and challenges of introducing rationality in economic systems.

Technical Contribution

The development and implementation of a novel reinforcement learning algorithm tailored to economic systems.

Novelty

This work contributes to the field by introducing a new approach to modeling rationality in economics, which has implications for understanding market behavior and policy design.

Limitations

- Limitation 1: The model assumes a simplified representation of market interactions.

- Limitation 2: The results may not generalize to more complex economic scenarios.

Future Work

- Suggested direction 1: Investigating the impact of different types of rationality on economic outcomes.

- Suggested direction 2: Developing more advanced reinforcement learning algorithms for economic modeling.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnvironmental-Impact Based Multi-Agent Reinforcement Learning

Pouria Ramazi, Farinaz Alamiyan-Harandi

TaxAI: A Dynamic Economic Simulator and Benchmark for Multi-Agent Reinforcement Learning

Jun Wang, Shenghao Zhu, Yan Song et al.

ABIDES-Economist: Agent-Based Simulation of Economic Systems with Learning Agents

Tucker Balch, Svitlana Vyetrenko, Kshama Dwarakanath et al.

Empirical Equilibria in Agent-based Economic systems with Learning agents

Tucker Balch, Svitlana Vyetrenko, Kshama Dwarakanath

| Title | Authors | Year | Actions |

|---|

Comments (0)