Summary

We consider a trading marketplace that is populated by traders with diverse trading strategies and objectives. The marketplace allows the suppliers to list their goods and facilitates matching between buyers and sellers. In return, such a marketplace typically charges fees for facilitating trade. The goal of this work is to design a dynamic fee schedule for the marketplace that is equitable and profitable to all traders while being profitable to the marketplace at the same time (from charging fees). Since the traders adapt their strategies to the fee schedule, we present a reinforcement learning framework for simultaneously learning a marketplace fee schedule and trading strategies that adapt to this fee schedule using a weighted optimization objective of profits and equitability. We illustrate the use of the proposed approach in detail on a simulated stock exchange with different types of investors, specifically market makers and consumer investors. As we vary the equitability weights across different investor classes, we see that the learnt exchange fee schedule starts favoring the class of investors with the highest weight. We further discuss the observed insights from the simulated stock exchange in light of the general framework of equitable marketplace mechanism design.

AI Key Findings

Generated Sep 07, 2025

Methodology

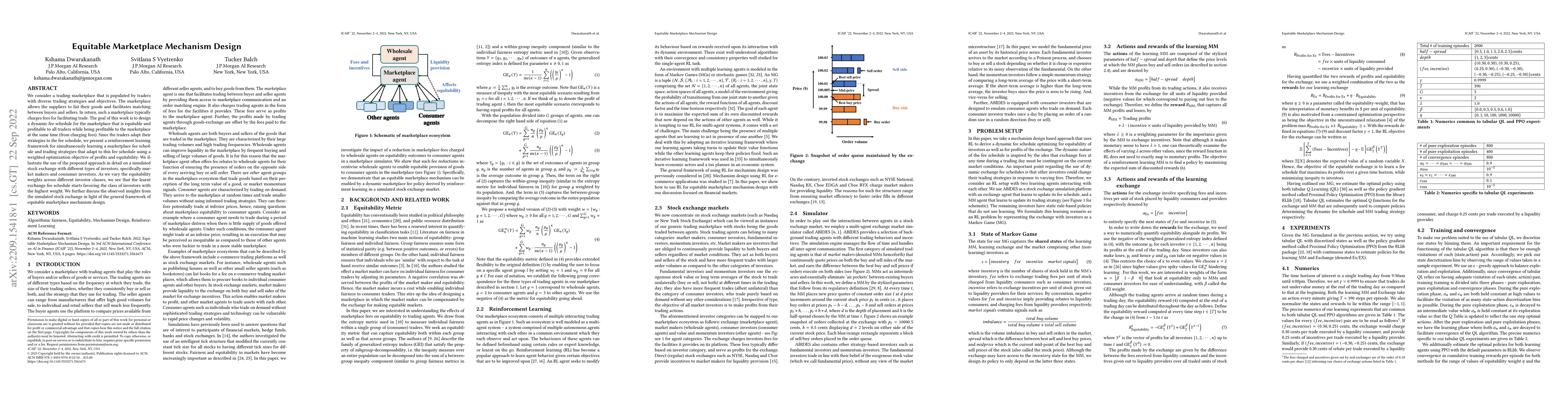

The research uses reinforcement learning (RL) to design a dynamic fee schedule for a marketplace, ensuring equitability and profitability for traders and the marketplace simultaneously. An iterative learning framework is adopted, where learning agents take turns updating their value functions while others keep their policies fixed. The study employs ABIDES, a multi-agent stock exchange simulator, to model interactions between agents.

Key Results

- A dynamic fee schedule is learned that optimizes equitability for investors and profits for the exchange.

- The RL setup involves two learning agents: a market maker (MM) and an exchange agent, with other investors having static rule-based policies.

- The learning scenario is formulated as an RL problem using a Markov Game (MG) framework, capturing shared states of the MM, exchange, and other investors.

- Both tabular Q-Learning (QL) and Proximal Policy Optimization (PPO) methods are used to estimate optimal policies for the learning MM and exchange.

- PPO outperforms QL in achieving higher cumulative training rewards for both learning agents.

Significance

This research is significant as it demonstrates how RL can be used to design equitable marketplace mechanisms, particularly in financial markets. It provides insights into how marketplace fee structures can be optimized to balance equitability and profitability, which can lead to more fair and efficient trading environments.

Technical Contribution

The paper presents a reinforcement learning framework for simultaneously learning a marketplace fee schedule and trading strategies that adapt to this fee schedule, using a weighted optimization objective of profits and equitability.

Novelty

This work differs from existing research by focusing on equitable marketplace mechanism design using RL, specifically in financial markets, and by considering the dynamic nature of fees contingent on market conditions.

Limitations

- The study focuses on a simulated stock exchange environment, and its findings may not directly translate to real-world complexities.

- The model assumes rational behavior of agents, which might not always hold in real-world scenarios.

Future Work

- Explore the application of the proposed approach in more complex and diverse marketplaces.

- Investigate the impact of additional market factors, such as regulatory changes or external shocks, on the learned fee schedules.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)