Summary

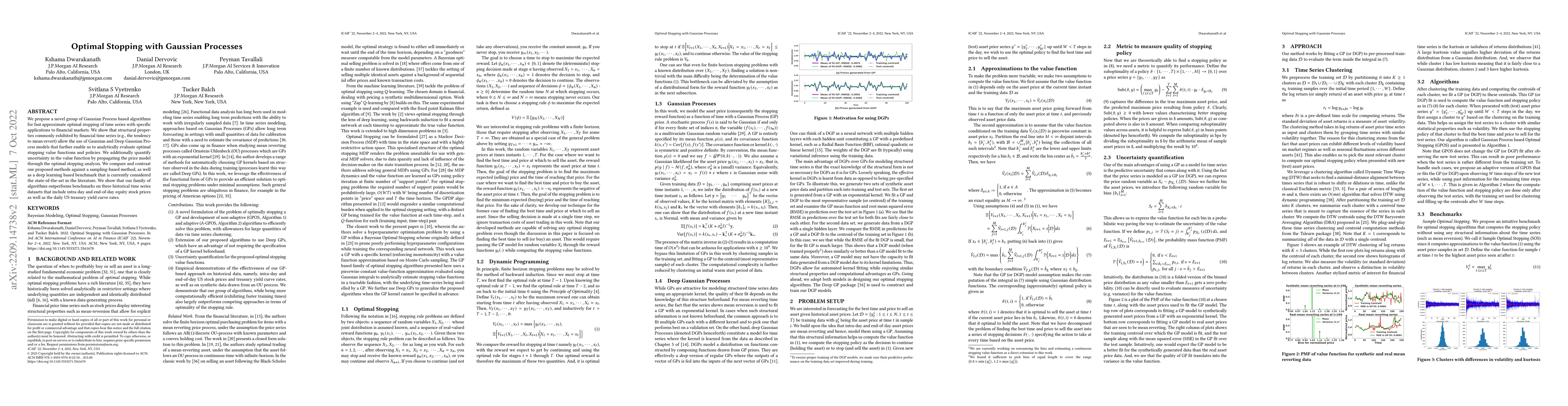

We propose a novel group of Gaussian Process based algorithms for fast approximate optimal stopping of time series with specific applications to financial markets. We show that structural properties commonly exhibited by financial time series (e.g., the tendency to mean-revert) allow the use of Gaussian and Deep Gaussian Process models that further enable us to analytically evaluate optimal stopping value functions and policies. We additionally quantify uncertainty in the value function by propagating the price model through the optimal stopping analysis. We compare and contrast our proposed methods against a sampling-based method, as well as a deep learning based benchmark that is currently considered the state-of-the-art in the literature. We show that our family of algorithms outperforms benchmarks on three historical time series datasets that include intra-day and end-of-day equity stock prices as well as the daily US treasury yield curve rates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Stopping of Branching Diffusion Processes

Antonio Ocello, Idris Kharroubi

| Title | Authors | Year | Actions |

|---|

Comments (0)