Summary

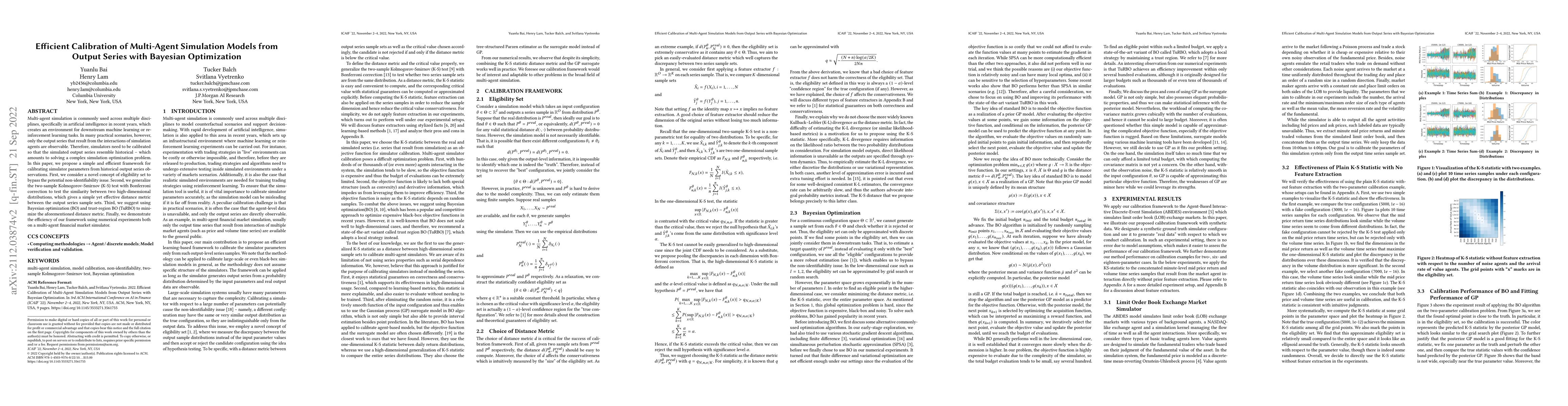

Multi-agent simulation is commonly used across multiple disciplines, specifically in artificial intelligence in recent years, which creates an environment for downstream machine learning or reinforcement learning tasks. In many practical scenarios, however, only the output series that result from the interactions of simulation agents are observable. Therefore, simulators need to be calibrated so that the simulated output series resemble historical -- which amounts to solving a complex simulation optimization problem. In this paper, we propose a simple and efficient framework for calibrating simulator parameters from historical output series observations. First, we consider a novel concept of eligibility set to bypass the potential non-identifiability issue. Second, we generalize the two-sample Kolmogorov-Smirnov (K-S) test with Bonferroni correction to test the similarity between two high-dimensional distributions, which gives a simple yet effective distance metric between the output series sample sets. Third, we suggest using Bayesian optimization (BO) and trust-region BO (TuRBO) to minimize the aforementioned distance metric. Finally, we demonstrate the efficiency of our framework using numerical experiments both on a multi-agent financial market simulator.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersParallel Bayesian Optimization of Agent-based Transportation Simulation

Kiran Chhatre, Rashid Waraich, Sidney Feygin et al.

Cooperative Multi-Agent Trajectory Generation with Modular Bayesian Optimization

Sertac Karaman, Gilhyun Ryou, Ezra Tal

| Title | Authors | Year | Actions |

|---|

Comments (0)