Summary

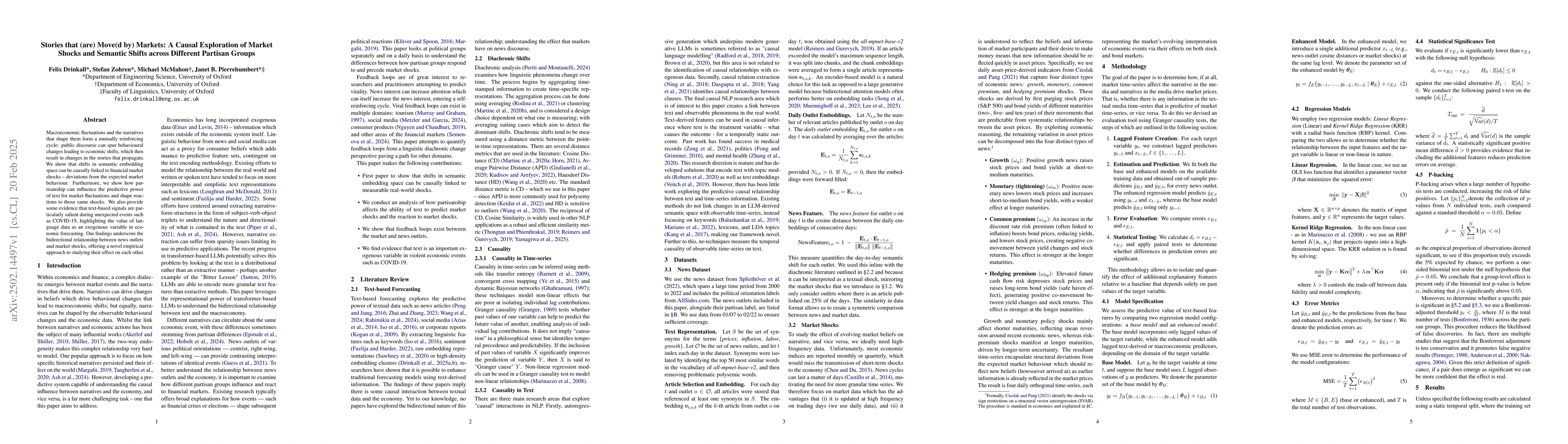

Macroeconomic fluctuations and the narratives that shape them form a mutually reinforcing cycle: public discourse can spur behavioural changes leading to economic shifts, which then result in changes in the stories that propagate. We show that shifts in semantic embedding space can be causally linked to financial market shocks -- deviations from the expected market behaviour. Furthermore, we show how partisanship can influence the predictive power of text for market fluctuations and shape reactions to those same shocks. We also provide some evidence that text-based signals are particularly salient during unexpected events such as COVID-19, highlighting the value of language data as an exogenous variable in economic forecasting. Our findings underscore the bidirectional relationship between news outlets and market shocks, offering a novel empirical approach to studying their effect on each other.

AI Key Findings

Generated Jun 11, 2025

Methodology

The study applies a bidirectional Granger-causality framework to text and economic indicators, linking shifts in semantic embedding space to measurable real-world financial market shocks. It uses a rolling evaluation framework, with each window spanning 365 days, to examine how news outlets react to or precede market shocks during different time periods.

Key Results

- Left-wing and centrist outlets show a stronger and faster response to market changes compared to right-wing outlets.

- Market shocks have a greater influence on changes in text than the other way around, indicating news outlets are more reactive than predictive.

- Different political groups react to and precede different market shocks, with left-wing outlets exhibiting a higher proportion of significant pairs for common risk premium (ωcp) shocks.

- Text-based features serve as essential exogenous variables in unexpected events like COVID-19, highlighting their value in economic forecasting.

- Feedback loops between market shocks and news outlets are identified, particularly involving ωcp shocks.

Significance

This research underscores the bidirectional relationship between news outlets and market shocks, offering a novel empirical approach to study their effect on each other. It highlights the value of semantic representations for understanding and anticipating complex economic phenomena, especially during unexpected events.

Technical Contribution

The paper presents a novel methodology that links shifts in semantic embedding space to measurable real-world financial market shocks using a bidirectional Granger-causality framework on text and economic indicators.

Novelty

This work distinguishes itself by demonstrating the causal link between shifts in semantic embedding space and measurable financial market shocks, while also highlighting the role of partisanship in shaping the predictability of market shocks and the reactivity of news discourse.

Limitations

- The methodology employs multiple regression models but could yield different insights with deep learning architectures or ensemble methods.

- The focus on English-language news articles limits generalizability to other linguistic or cultural contexts.

- The study identifies the presence and strength of causal relationships but does not cover directionality, leaving room for future research.

- Categorization of political orientation and market shocks relies on predefined labels, which may not capture all subtleties in political orientation or economic behavior.

Future Work

- Apply the methodology across international and multilingual contexts to explore cultural influences on media discourse sensitivity to market shocks.

- Adopt richer embedding techniques or domain-adapted language models to capture subtle shifts in discourse, especially during black-swan events like pandemics or geopolitical crises.

- Incorporate more granular lag structures shorter than 1 day for finer temporal insights into the interplay between markets and news discourse.

- Expand the causal framework by integrating unstructured shocks or continuing confounder analysis to create a causal graph capturing interdependencies among multiple shocks and outlets.

- Evaluate the robustness of the approach in real-time forecasting environments to pave the way for practical applications in finance, policymaking, and risk management.

Paper Details

PDF Preview

Similar Papers

Found 5 papersStoring events to retell them (Commentary on Suddendorf and Corballis: 'The evolution of foresight')

FairyLandAI: Personalized Fairy Tales utilizing ChatGPT and DALLE-3

Georgios Makridis, Athanasios Oikonomou, Vasileios Koukos

No citations found for this paper.

Comments (0)