Authors

Summary

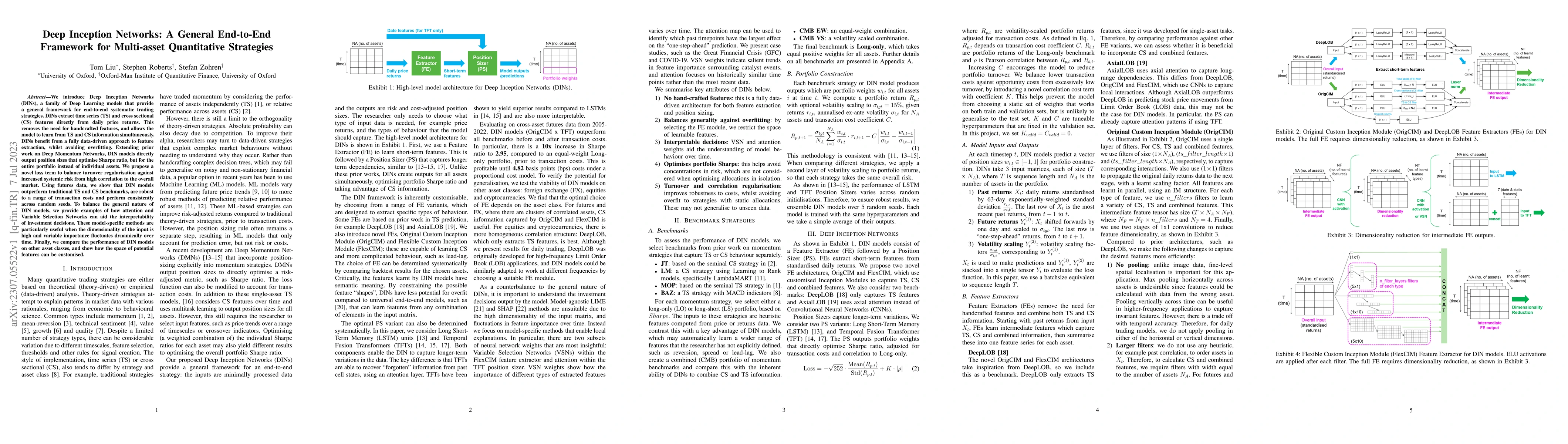

We introduce Deep Inception Networks (DINs), a family of Deep Learning models that provide a general framework for end-to-end systematic trading strategies. DINs extract time series (TS) and cross sectional (CS) features directly from daily price returns. This removes the need for handcrafted features, and allows the model to learn from TS and CS information simultaneously. DINs benefit from a fully data-driven approach to feature extraction, whilst avoiding overfitting. Extending prior work on Deep Momentum Networks, DIN models directly output position sizes that optimise Sharpe ratio, but for the entire portfolio instead of individual assets. We propose a novel loss term to balance turnover regularisation against increased systemic risk from high correlation to the overall market. Using futures data, we show that DIN models outperform traditional TS and CS benchmarks, are robust to a range of transaction costs and perform consistently across random seeds. To balance the general nature of DIN models, we provide examples of how attention and Variable Selection Networks can aid the interpretability of investment decisions. These model-specific methods are particularly useful when the dimensionality of the input is high and variable importance fluctuates dynamically over time. Finally, we compare the performance of DIN models on other asset classes, and show how the space of potential features can be customised.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersE2EAI: End-to-End Deep Learning Framework for Active Investing

Dahua Lin, Bo Dai, Zikai Wei

A General End-to-end Diagnosis Framework for Manufacturing Systems

Ye Yuan, Han Ding, Cheng Cheng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)