Summary

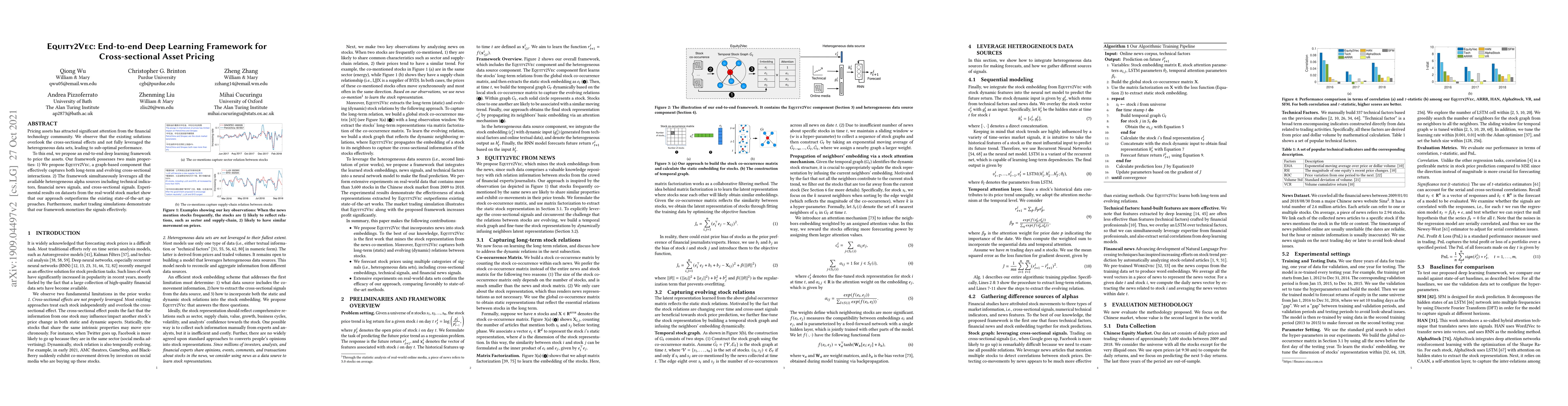

Pricing assets has attracted significant attention from the financial technology community. We observe that the existing solutions overlook the cross-sectional effects and not fully leveraged the heterogeneous data sets, leading to sub-optimal performance. To this end, we propose an end-to-end deep learning framework to price the assets. Our framework possesses two main properties: 1) We propose Equity2Vec, a graph-based component that effectively captures both long-term and evolving cross-sectional interactions. 2) The framework simultaneously leverages all the available heterogeneous alpha sources including technical indicators, financial news signals, and cross-sectional signals. Experimental results on datasets from the real-world stock market show that our approach outperforms the existing state-of-the-art approaches. Furthermore, market trading simulations demonstrate that our framework monetizes the signals effectively.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Inception Networks: A General End-to-End Framework for Multi-asset Quantitative Strategies

Stephen Roberts, Stefan Zohren, Tom Liu

E2EAI: End-to-End Deep Learning Framework for Active Investing

Dahua Lin, Bo Dai, Zikai Wei

| Title | Authors | Year | Actions |

|---|

Comments (0)