Summary

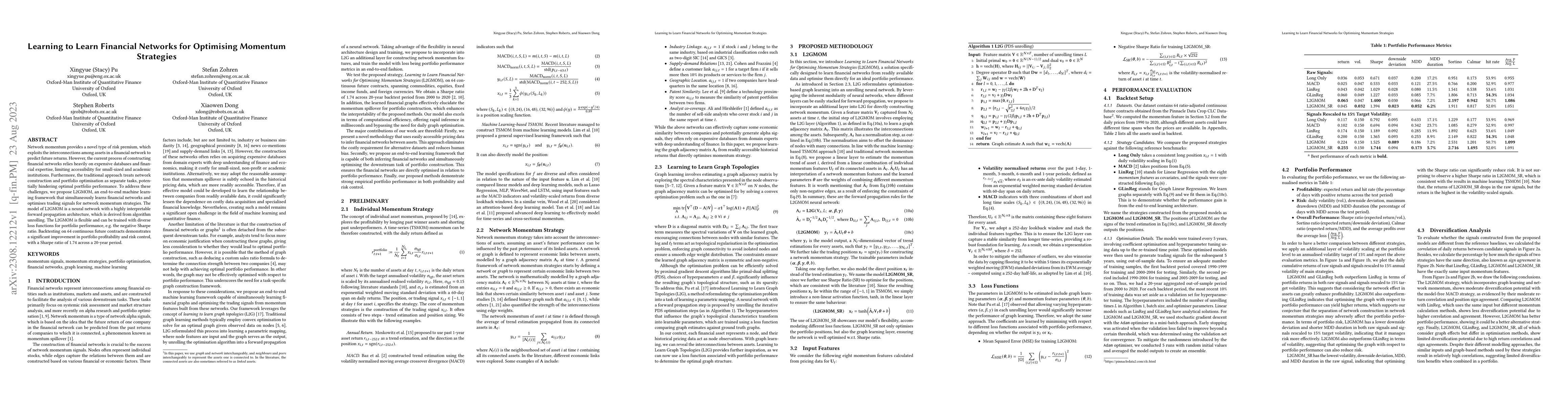

Network momentum provides a novel type of risk premium, which exploits the interconnections among assets in a financial network to predict future returns. However, the current process of constructing financial networks relies heavily on expensive databases and financial expertise, limiting accessibility for small-sized and academic institutions. Furthermore, the traditional approach treats network construction and portfolio optimisation as separate tasks, potentially hindering optimal portfolio performance. To address these challenges, we propose L2GMOM, an end-to-end machine learning framework that simultaneously learns financial networks and optimises trading signals for network momentum strategies. The model of L2GMOM is a neural network with a highly interpretable forward propagation architecture, which is derived from algorithm unrolling. The L2GMOM is flexible and can be trained with diverse loss functions for portfolio performance, e.g. the negative Sharpe ratio. Backtesting on 64 continuous future contracts demonstrates a significant improvement in portfolio profitability and risk control, with a Sharpe ratio of 1.74 across a 20-year period.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCan GANs Learn the Stylized Facts of Financial Time Series?

Yongjae Lee, Sohyeon Kwon

| Title | Authors | Year | Actions |

|---|

Comments (0)