Authors

Summary

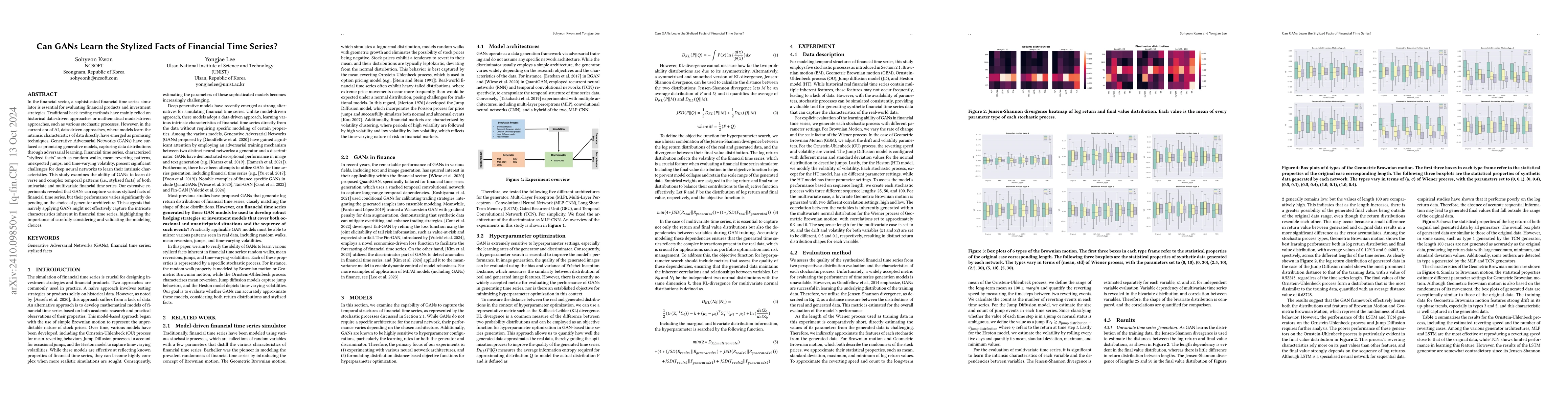

In the financial sector, a sophisticated financial time series simulator is essential for evaluating financial products and investment strategies. Traditional back-testing methods have mainly relied on historical data-driven approaches or mathematical model-driven approaches, such as various stochastic processes. However, in the current era of AI, data-driven approaches, where models learn the intrinsic characteristics of data directly, have emerged as promising techniques. Generative Adversarial Networks (GANs) have surfaced as promising generative models, capturing data distributions through adversarial learning. Financial time series, characterized 'stylized facts' such as random walks, mean-reverting patterns, unexpected jumps, and time-varying volatility, present significant challenges for deep neural networks to learn their intrinsic characteristics. This study examines the ability of GANs to learn diverse and complex temporal patterns (i.e., stylized facts) of both univariate and multivariate financial time series. Our extensive experiments revealed that GANs can capture various stylized facts of financial time series, but their performance varies significantly depending on the choice of generator architecture. This suggests that naively applying GANs might not effectively capture the intricate characteristics inherent in financial time series, highlighting the importance of carefully considering and validating the modeling choices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSimulating financial time series using attention

Ali Hirsa, Weilong Fu, Jörg Osterrieder

No citations found for this paper.

Comments (0)