Yongjae Lee

34 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

LP-3DGS: Learning to Prune 3D Gaussian Splatting

Recently, 3D Gaussian Splatting (3DGS) has become one of the mainstream methodologies for novel view synthesis (NVS) due to its high quality and fast rendering speed. However, as a point-based scene...

SafeguardGS: 3D Gaussian Primitive Pruning While Avoiding Catastrophic Scene Destruction

3D Gaussian Splatting (3DGS) has made a significant stride in novel view synthesis, demonstrating top-notch rendering quality while achieving real-time rendering speed. However, the excessively larg...

Temporal Graph Networks for Graph Anomaly Detection in Financial Networks

This paper explores the utilization of Temporal Graph Networks (TGN) for financial anomaly detection, a pressing need in the era of fintech and digitized financial transactions. We present a compreh...

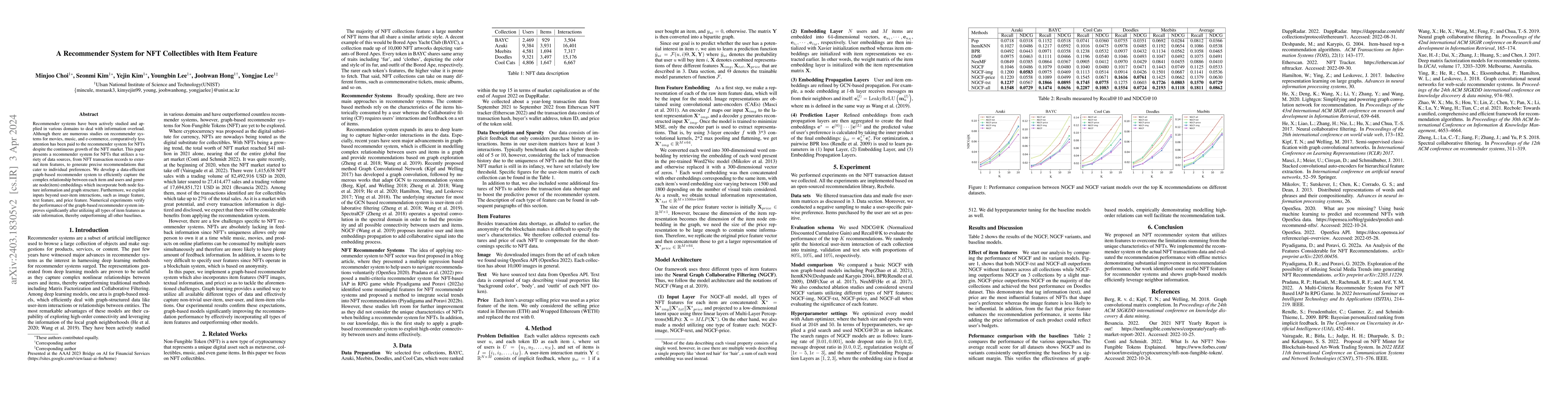

A Recommender System for NFT Collectibles with Item Feature

Recommender systems have been actively studied and applied in various domains to deal with information overload. Although there are numerous studies on recommender systems for movies, music, and e-c...

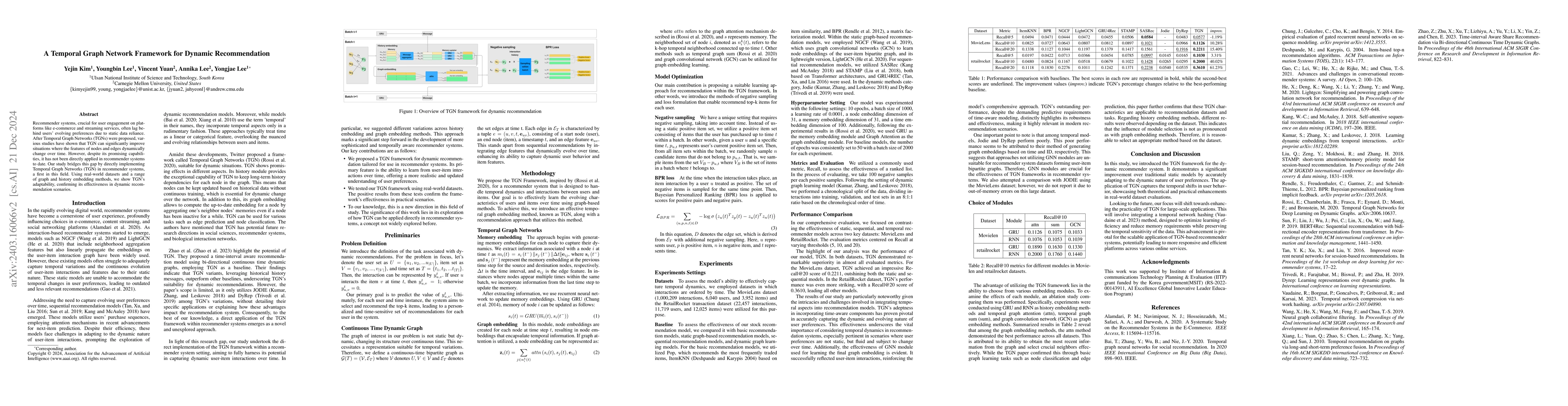

A Temporal Graph Network Framework for Dynamic Recommendation

Recommender systems, crucial for user engagement on platforms like e-commerce and streaming services, often lag behind users' evolving preferences due to static data reliance. After Temporal Graph N...

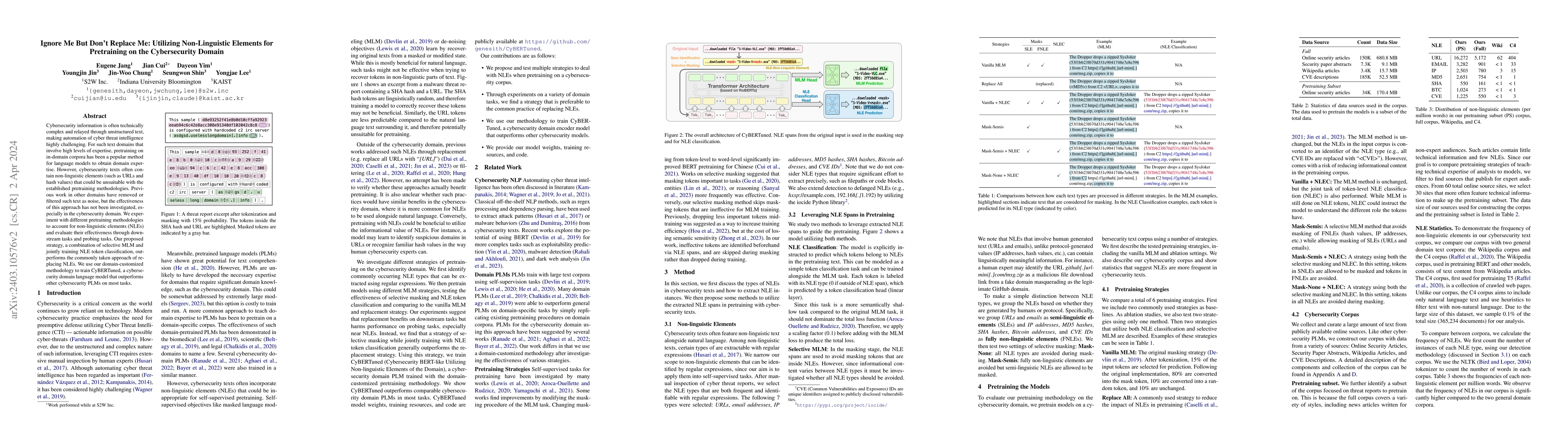

Ignore Me But Don't Replace Me: Utilizing Non-Linguistic Elements for Pretraining on the Cybersecurity Domain

Cybersecurity information is often technically complex and relayed through unstructured text, making automation of cyber threat intelligence highly challenging. For such text domains that involve hi...

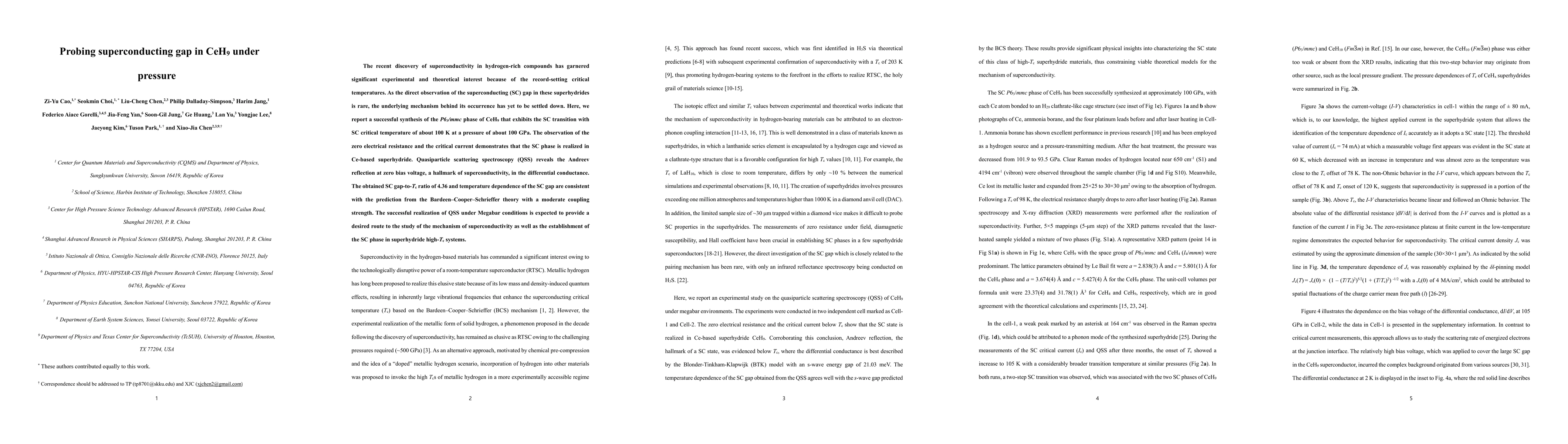

Probing superconducting gap in CeH$_9$ under pressure

The recent discovery of superconductivity in hydrogen-rich compounds has garnered significant experimental and theoretical interest because of the record-setting critical temperatures. As the direct...

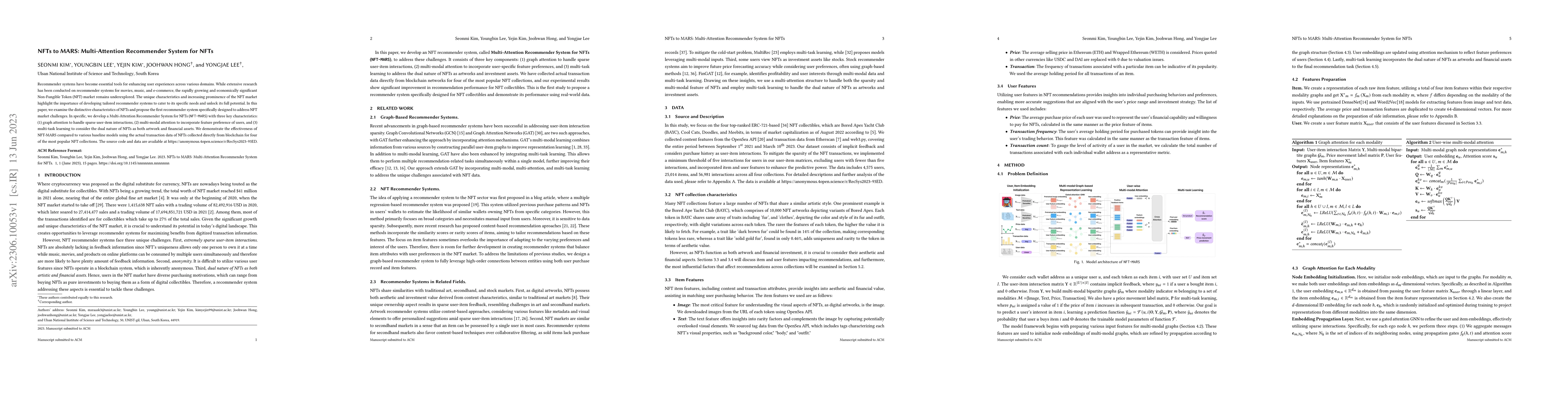

NFTs to MARS: Multi-Attention Recommender System for NFTs

Recommender systems have become essential tools for enhancing user experiences across various domains. While extensive research has been conducted on recommender systems for movies, music, and e-com...

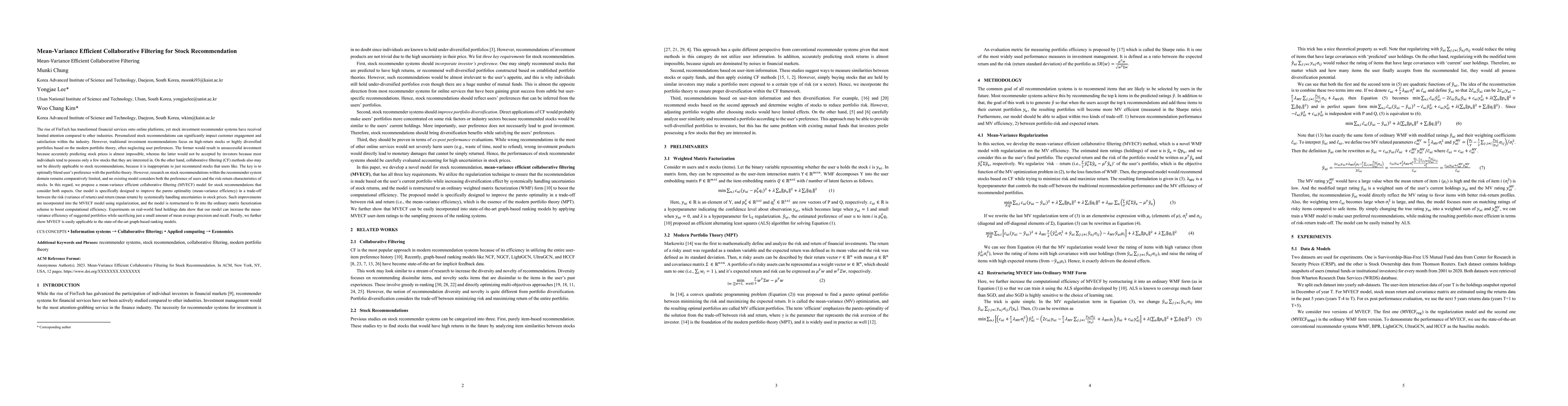

Mean-Variance Efficient Collaborative Filtering for Stock Recommendation

The rise of FinTech has transformed financial services onto online platforms, yet stock investment recommender systems have received limited attention compared to other industries. Personalized stoc...

DarkBERT: A Language Model for the Dark Side of the Internet

Recent research has suggested that there are clear differences in the language used in the Dark Web compared to that of the Surface Web. As studies on the Dark Web commonly require textual analysis ...

MF-NeRF: Memory Efficient NeRF with Mixed-Feature Hash Table

Neural radiance field (NeRF) has shown remarkable performance in generating photo-realistic novel views. Among recent NeRF related research, the approaches that involve the utilization of explicit s...

DRAINCLoG: Detecting Rogue Accounts with Illegally-obtained NFTs using Classifiers Learned on Graphs

As Non-Fungible Tokens (NFTs) continue to grow in popularity, NFT users have become targets of phishing attacks by cybercriminals, called \textit{NFT drainers}. Over the last year, \$100 million wor...

Value Function Gradient Learning for Large-Scale Multistage Stochastic Programming Problems

A stagewise decomposition algorithm called value function gradient learning (VFGL) is proposed for large-scale multistage stochastic convex programs. VFGL finds the parameter values that best fit th...

Shedding New Light on the Language of the Dark Web

The hidden nature and the limited accessibility of the Dark Web, combined with the lack of public datasets in this domain, make it difficult to study its inherent characteristics such as linguistic ...

Temporal Representation Learning for Stock Similarities and Its Applications in Investment Management

In the era of rapid globalization and digitalization, accurate identification of similar stocks has become increasingly challenging due to the non-stationary nature of financial markets and the ambigu...

Anatomy of Machines for Markowitz: Decision-Focused Learning for Mean-Variance Portfolio Optimization

Markowitz laid the foundation of portfolio theory through the mean-variance optimization (MVO) framework. However, the effectiveness of MVO is contingent on the precise estimation of expected returns,...

Can GANs Learn the Stylized Facts of Financial Time Series?

In the financial sector, a sophisticated financial time series simulator is essential for evaluating financial products and investment strategies. Traditional back-testing methods have mainly relied o...

Tweezers: A Framework for Security Event Detection via Event Attribution-centric Tweet Embedding

Twitter is recognized as a crucial platform for the dissemination and gathering of Cyber Threat Intelligence (CTI). Its capability to provide real-time, actionable intelligence makes it an indispensab...

Geodesic Flow Kernels for Semi-Supervised Learning on Mixed-Variable Tabular Dataset

Tabular data poses unique challenges due to its heterogeneous nature, combining both continuous and categorical variables. Existing approaches often struggle to effectively capture the underlying stru...

Decision-informed Neural Networks with Large Language Model Integration for Portfolio Optimization

This paper addresses the critical disconnect between prediction and decision quality in portfolio optimization by integrating Large Language Models (LLMs) with decision-focused learning. We demonstrat...

A Cholesky decomposition-based asset selection heuristic for sparse tangent portfolio optimization

In practice, including large number of assets in mean-variance portfolios can lead to higher transaction costs and management fees. To address this, one common approach is to select a smaller subset o...

BitAbuse: A Dataset of Visually Perturbed Texts for Defending Phishing Attacks

Phishing often targets victims through visually perturbed texts to bypass security systems. The noise contained in these texts functions as an adversarial attack, designed to deceive language models a...

Speedy MASt3R

Image matching is a key component of modern 3D vision algorithms, essential for accurate scene reconstruction and localization. MASt3R redefines image matching as a 3D task by leveraging DUSt3R and in...

Integrating LLM-Generated Views into Mean-Variance Optimization Using the Black-Litterman Model

Portfolio optimization faces challenges due to the sensitivity in traditional mean-variance models. The Black-Litterman model mitigates this by integrating investor views, but defining these views rem...

FinDER: Financial Dataset for Question Answering and Evaluating Retrieval-Augmented Generation

In the fast-paced financial domain, accurate and up-to-date information is critical to addressing ever-evolving market conditions. Retrieving this information correctly is essential in financial Quest...

Your AI, Not Your View: The Bias of LLMs in Investment Analysis

In finance, Large Language Models (LLMs) face frequent knowledge conflicts due to discrepancies between pre-trained parametric knowledge and real-time market data. These conflicts become particularly ...

Estimating Covariance for Global Minimum Variance Portfolio: A Decision-Focused Learning Approach

Portfolio optimization constitutes a cornerstone of risk management by quantifying the risk-return trade-off. Since it inherently depends on accurate parameter estimation under conditions of future un...

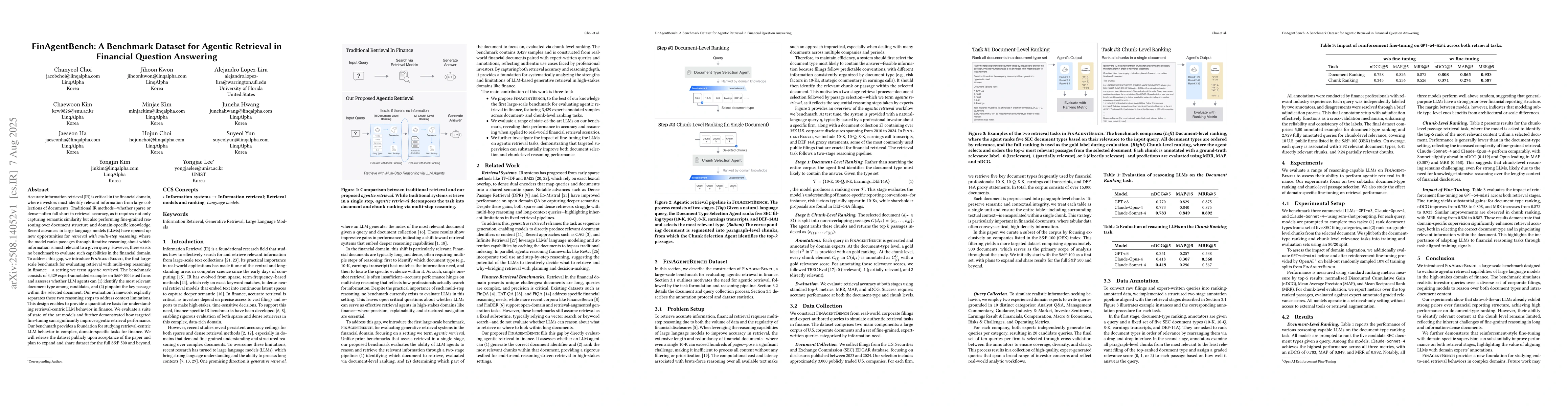

FinAgentBench: A Benchmark Dataset for Agentic Retrieval in Financial Question Answering

Accurate information retrieval (IR) is critical in the financial domain, where investors must identify relevant information from large collections of documents. Traditional IR methods-whether sparse o...

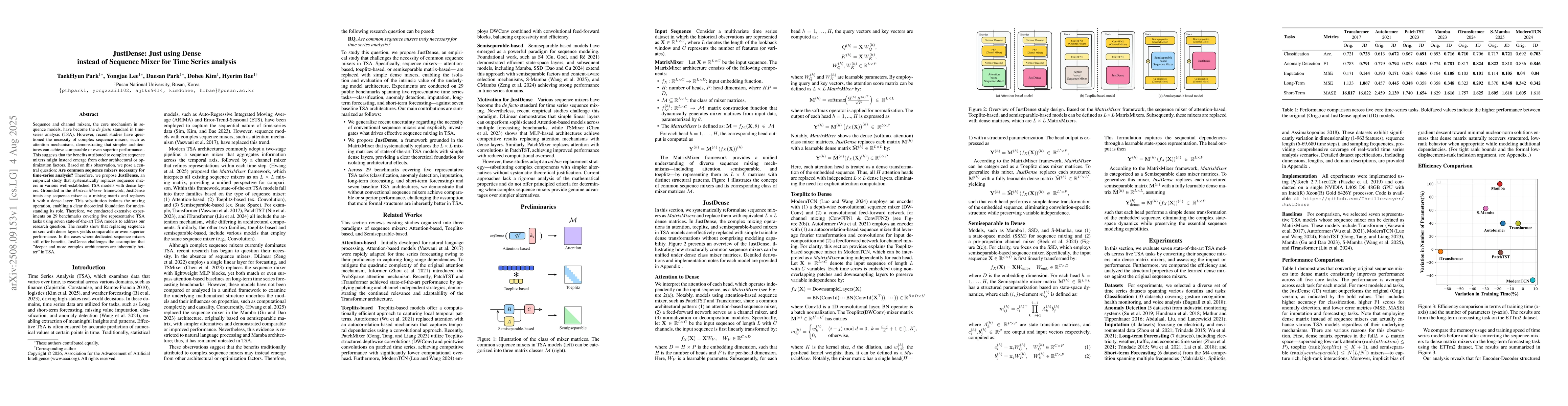

JustDense: Just using Dense instead of Sequence Mixer for Time Series analysis

Sequence and channel mixers, the core mechanism in sequence models, have become the de facto standard in time series analysis (TSA). However, recent studies have questioned the necessity of complex se...

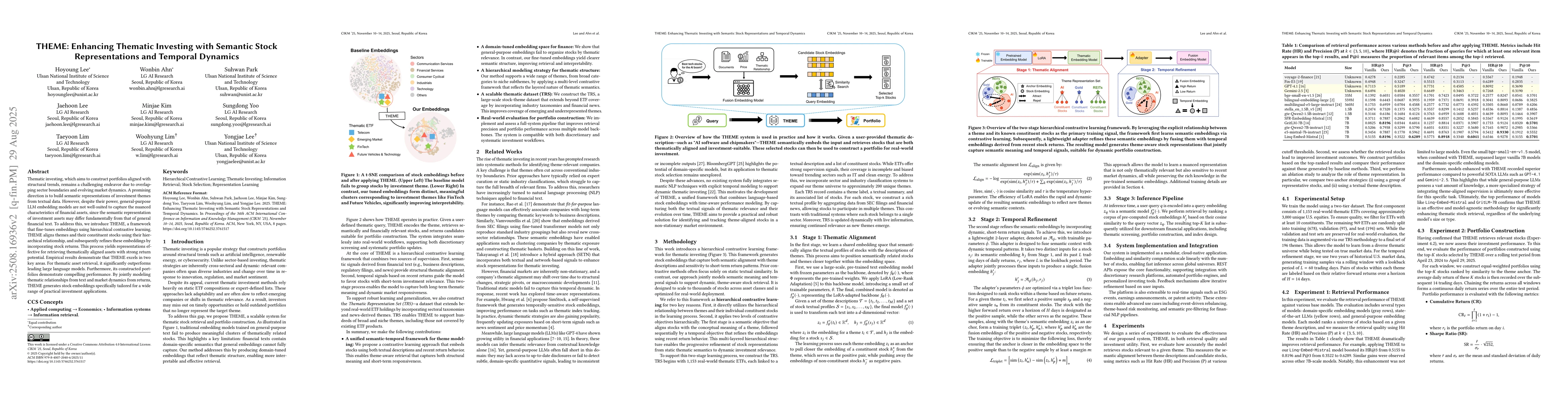

THEME: Enhancing Thematic Investing with Semantic Stock Representations and Temporal Dynamics

Thematic investing, which aims to construct portfolios aligned with structural trends, remains a challenging endeavor due to overlapping sector boundaries and evolving market dynamics. A promising dir...

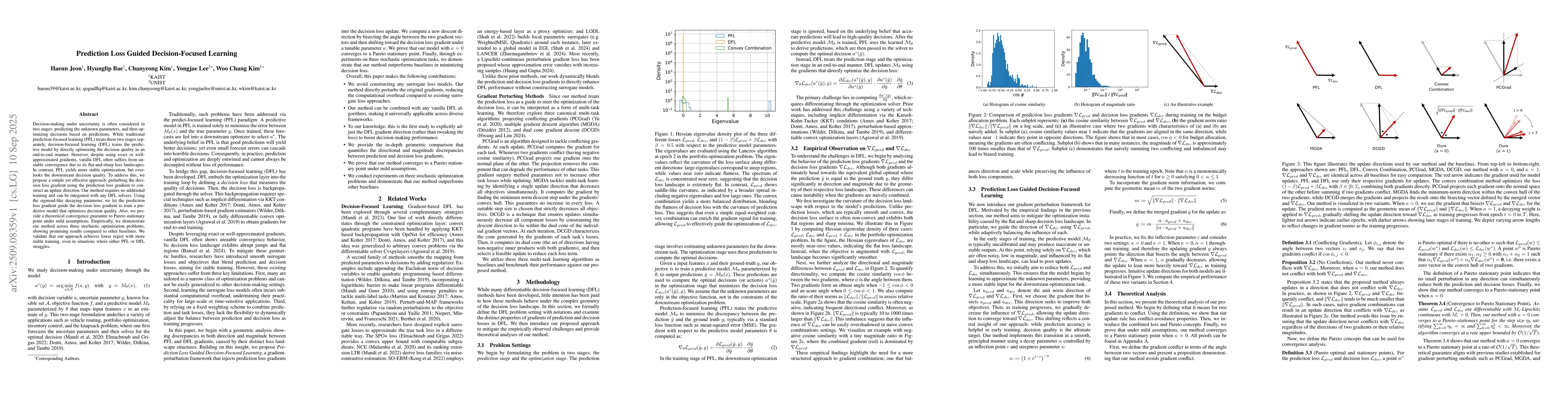

Prediction Loss Guided Decision-Focused Learning

Decision-making under uncertainty is often considered in two stages: predicting the unknown parameters, and then optimizing decisions based on predictions. While traditional prediction-focused learnin...

GeLoc3r: Enhancing Relative Camera Pose Regression with Geometric Consistency Regularization

Prior ReLoc3R achieves breakthrough performance with fast 25ms inference and state-of-the-art regression accuracy, yet our analysis reveals subtle geometric inconsistencies in its internal representat...

GuruAgents: Emulating Wise Investors with Prompt-Guided LLM Agents

This study demonstrates that GuruAgents, prompt-guided AI agents, can systematically operationalize the strategies of legendary investment gurus. We develop five distinct GuruAgents, each designed to ...

Reasoning-Aware GRPO using Process Mining

Reinforcement learning (RL)-based post-training has been crucial for enabling multi-step reasoning in large reasoning models (LRMs), yet current reward schemes are typically outcome-centric. We propos...