Summary

In practice, including large number of assets in mean-variance portfolios can lead to higher transaction costs and management fees. To address this, one common approach is to select a smaller subset of assets from the larger pool, constructing more efficient portfolios. As a solution, we propose a new asset selection heuristic which generates a pre-defined list of asset candidates using a surrogate formulation and re-optimizes the cardinality-constrained tangent portfolio with these selected assets. This method enables faster optimization and effectively constructs portfolios with fewer assets, as demonstrated by numerical analyses on historical stock returns. Finally, we discuss a quantitative metric that can provide a initial assessment of the performance of the proposed heuristic based on asset covariance.

AI Key Findings

Generated Jun 11, 2025

Methodology

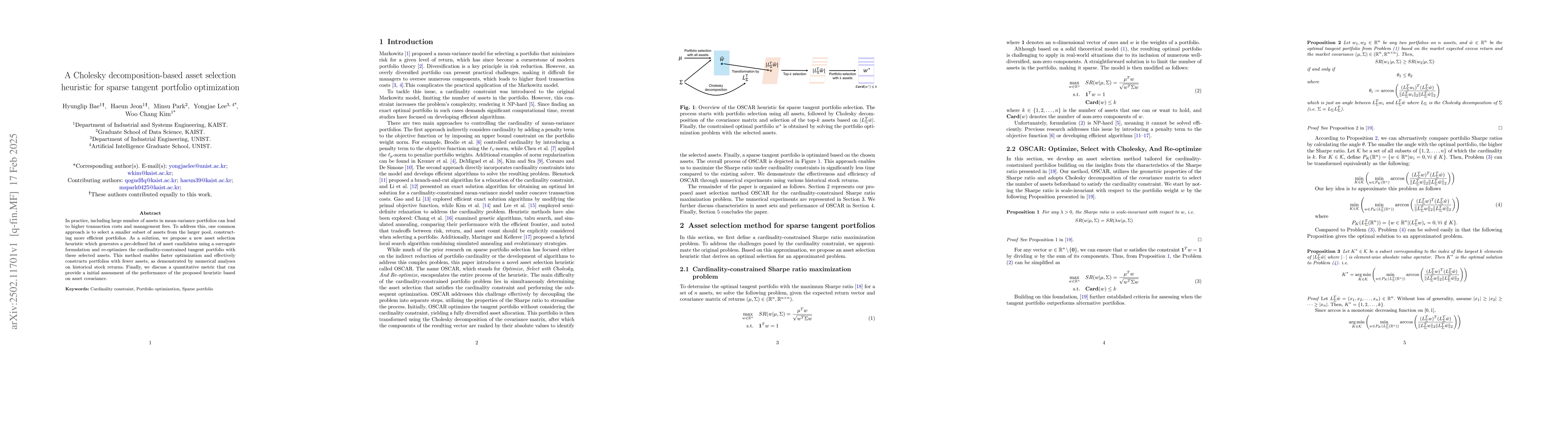

The research proposes a new asset selection heuristic called OSCAR for sparse tangent portfolio optimization. It involves three steps: optimizing the unconstrained version, selecting assets based on the k largest components of |LΣˆw|, and re-optimizing the portfolio optimization problem without cardinality constraint using the selected assets.

Key Results

- OSCAR demonstrates high efficiency and efficacy compared to other heuristics in numerical experiments.

- The heuristic can reuse the same ordered asset list when the asset universe remains the same but the cardinality limit changes.

Significance

This research is significant as it addresses the issue of high transaction costs and management fees associated with large mean-variance portfolios by efficiently selecting a smaller subset of assets.

Technical Contribution

The main technical contribution is a Cholesky decomposition-based asset selection heuristic that generates a pre-defined list of asset candidates and re-optimizes the cardinality-constrained tangent portfolio with these selected assets.

Novelty

The novelty of this work lies in its efficient approach to constructing portfolios with fewer assets, which is demonstrated through numerical analyses on historical stock returns, and its reusability feature for unchanged asset universes.

Limitations

- The heuristic solves an approximated problem, and the asset set obtained may not be optimal for the original problem.

- CPLEX, the optimization solver benchmarked against, may produce suboptimal solutions due to time constraints.

Future Work

- Extend OSCAR to solve problems with convex constraints, such as no-short-selling constraints.

- Develop OSCAR further to become a fundamental methodology for solving sparse tangent portfolio selection problems.

Paper Details

PDF Preview

Similar Papers

Found 4 papersA Scalable Gradient-Based Optimization Framework for Sparse Minimum-Variance Portfolio Selection

Sarat Moka, Vali Asimit, Matias Quiroz et al.

A Scalable Algorithm For Sparse Portfolio Selection

Dimitris Bertsimas, Ryan Cory-Wright

Sparse Portfolio Selection via Topological Data Analysis based Clustering

Damir Filipović, Anubha Goel, Puneet Pasricha

No citations found for this paper.

Comments (0)