Summary

Portfolio optimization is one of the essential fields of focus in finance. There has been an increasing demand for novel computational methods in this area to compute portfolios with better returns and lower risks in recent years. We present a novel computational method called Representation Portfolio Selection (RPS) by redefining the distance matrix of financial assets using Representation Learning and Clustering algorithms for portfolio selection to increase diversification. RPS proposes a heuristic for getting closer to the optimal subset of assets. Using empirical results in this paper, we demonstrate that widely used portfolio optimization algorithms, such as MVO, CLA, and HRP, can benefit from our asset subset selection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

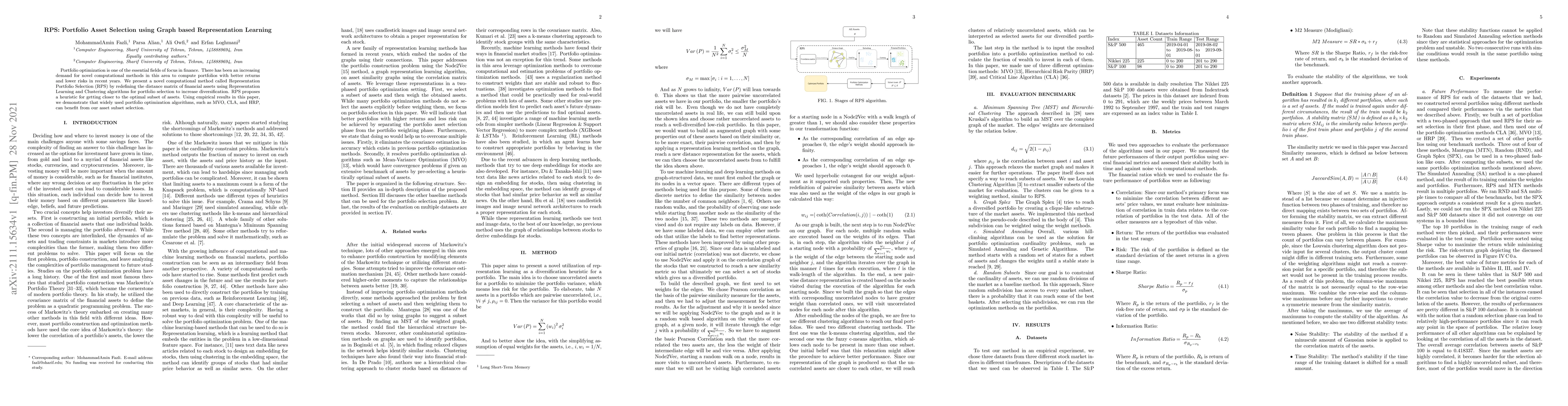

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Exploratory Multi-Asset Mean-Variance Portfolio Selection using Reinforcement Learning

Yu Li, Yuhan Wu, Shuhua Zhang

Big portfolio selection by graph-based conditional moments method

Ke Zhu, Ningning Zhang, Zhoufan Zhu

A Cholesky decomposition-based asset selection heuristic for sparse tangent portfolio optimization

Yongjae Lee, Woo Chang Kim, Minsu Park et al.

The mean-variance portfolio selection based on the average and current profitability of the risky asset

Yu Li, Yuhan Wu, Shuhua Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)