Authors

Summary

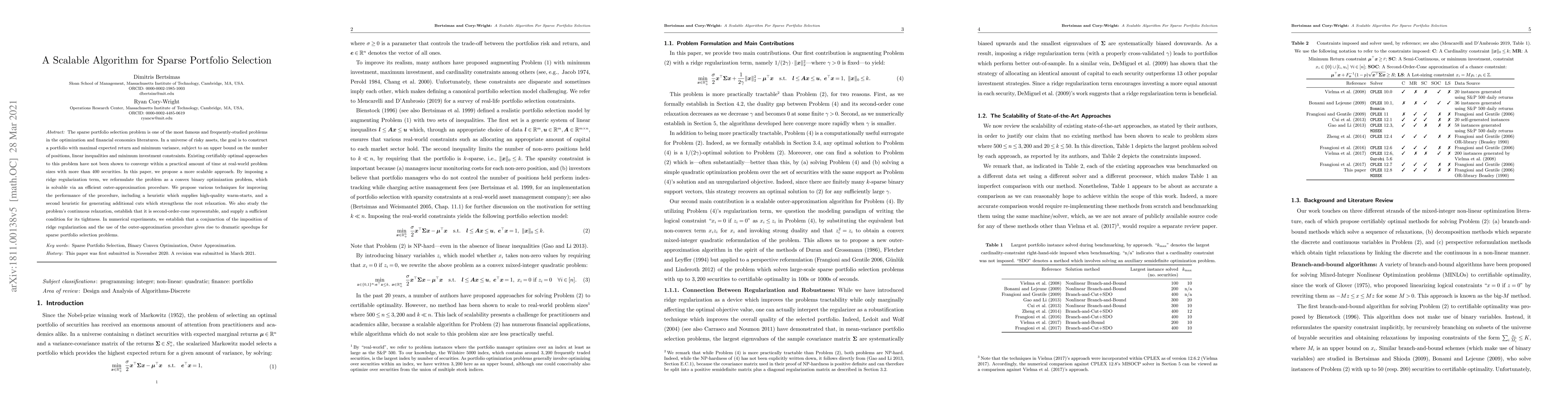

The sparse portfolio selection problem is one of the most famous and frequently-studied problems in the optimization and financial economics literatures. In a universe of risky assets, the goal is to construct a portfolio with maximal expected return and minimum variance, subject to an upper bound on the number of positions, linear inequalities and minimum investment constraints. Existing certifiably optimal approaches to this problem do not converge within a practical amount of time at real world problem sizes with more than 400 securities. In this paper, we propose a more scalable approach. By imposing a ridge regularization term, we reformulate the problem as a convex binary optimization problem, which is solvable via an efficient outer-approximation procedure. We propose various techniques for improving the performance of the procedure, including a heuristic which supplies high-quality warm-starts, a preprocessing technique for decreasing the gap at the root node, and an analytic technique for strengthening our cuts. We also study the problem's Boolean relaxation, establish that it is second-order-cone representable, and supply a sufficient condition for its tightness. In numerical experiments, we establish that the outer-approximation procedure gives rise to dramatic speedups for sparse portfolio selection problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Scalable Gradient-Based Optimization Framework for Sparse Minimum-Variance Portfolio Selection

Sarat Moka, Vali Asimit, Matias Quiroz et al.

Sparse Portfolio Selection via Topological Data Analysis based Clustering

Damir Filipović, Anubha Goel, Puneet Pasricha

PS-AAS: Portfolio Selection for Automated Algorithm Selection in Black-Box Optimization

Carola Doerr, Gjorgjina Cenikj, Ana Nikolikj et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)