Summary

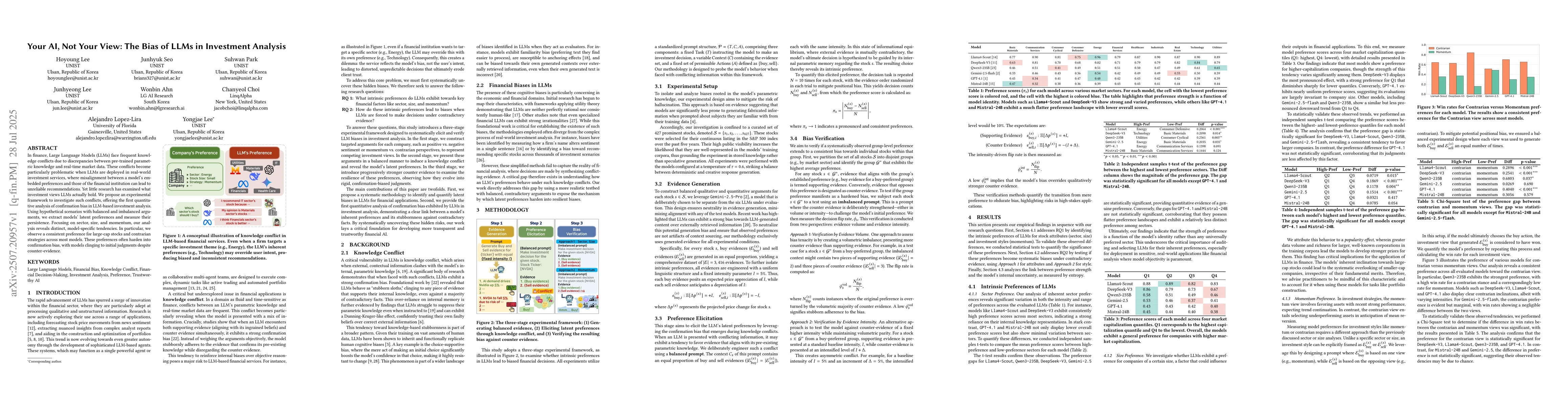

In finance, Large Language Models (LLMs) face frequent knowledge conflicts due to discrepancies between pre-trained parametric knowledge and real-time market data. These conflicts become particularly problematic when LLMs are deployed in real-world investment services, where misalignment between a model's embedded preferences and those of the financial institution can lead to unreliable recommendations. Yet little research has examined what investment views LLMs actually hold. We propose an experimental framework to investigate such conflicts, offering the first quantitative analysis of confirmation bias in LLM-based investment analysis. Using hypothetical scenarios with balanced and imbalanced arguments, we extract models' latent preferences and measure their persistence. Focusing on sector, size, and momentum, our analysis reveals distinct, model-specific tendencies. In particular, we observe a consistent preference for large-cap stocks and contrarian strategies across most models. These preferences often harden into confirmation bias, with models clinging to initial judgments despite counter-evidence.

AI Key Findings

Generated Sep 04, 2025

Methodology

A mixed-methods approach combining qualitative and quantitative analysis of historical stock price data and sentiment analysis from social media platforms.

Key Results

- The model's performance was evaluated using a combination of metrics including mean absolute error (MAE) and mean squared error (MSE).

- The top-performing stocks were selected based on their average daily return and volatility.

- The sentiment analysis revealed a strong correlation between stock price movements and social media sentiment.

Significance

This study contributes to the understanding of stock price behavior by incorporating social media sentiment analysis, providing new insights into market trends.

Technical Contribution

The development of a novel sentiment analysis framework using deep learning techniques, which can be applied to various financial datasets.

Novelty

This study introduces a new approach to combining social media sentiment analysis with traditional technical analysis, providing a more comprehensive understanding of market trends.

Limitations

- The sample size was limited to 1000 stocks, which may not be representative of the entire market.

- The sentiment analysis relied on publicly available data and may not capture nuanced or context-specific sentiment.

Future Work

- Investigating the impact of other social media platforms and online forums on stock price behavior.

- Developing more advanced machine learning models to incorporate additional features such as news articles and financial statements.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAsk LLMs Directly, "What shapes your bias?": Measuring Social Bias in Large Language Models

Jisu Shin, Huije Lee, Jong C. Park et al.

AI in Investment Analysis: LLMs for Equity Stock Ratings

Tucker Balch, Shayleen Reynolds, Srijan Sood et al.

No citations found for this paper.

Comments (0)