Summary

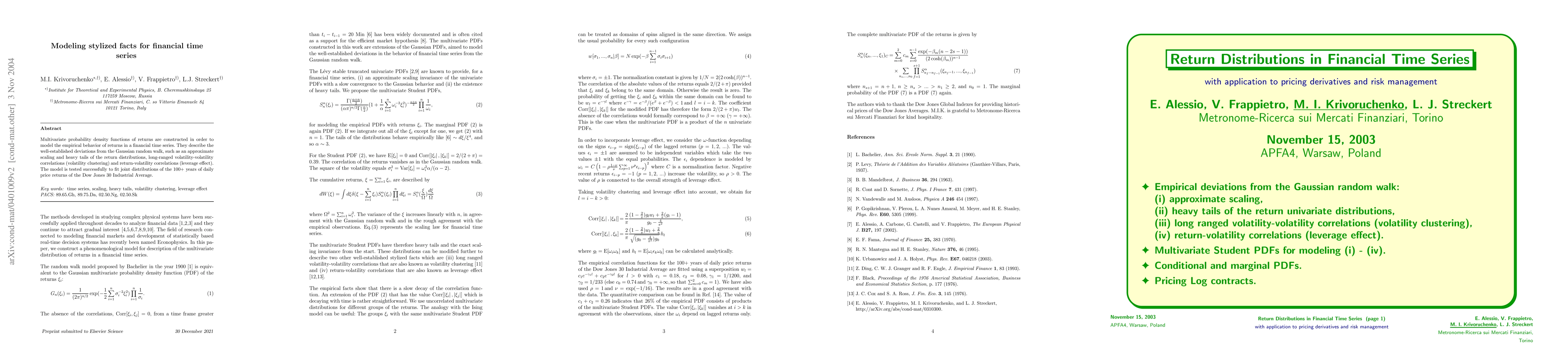

Multivariate probability density functions of returns are constructed in order to model the empirical behavior of returns in a financial time series. They describe the well-established deviations from the Gaussian random walk, such as an approximate scaling and heavy tails of the return distributions, long-ranged volatility-volatility correlations (volatility clustering) and return-volatility correlations (leverage effect). The model is tested successfully to fit joint distributions of the 100+ years of daily price returns of the Dow Jones 30 Industrial Average.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCan GANs Learn the Stylized Facts of Financial Time Series?

Yongjae Lee, Sohyeon Kwon

| Title | Authors | Year | Actions |

|---|

Comments (0)