Authors

Summary

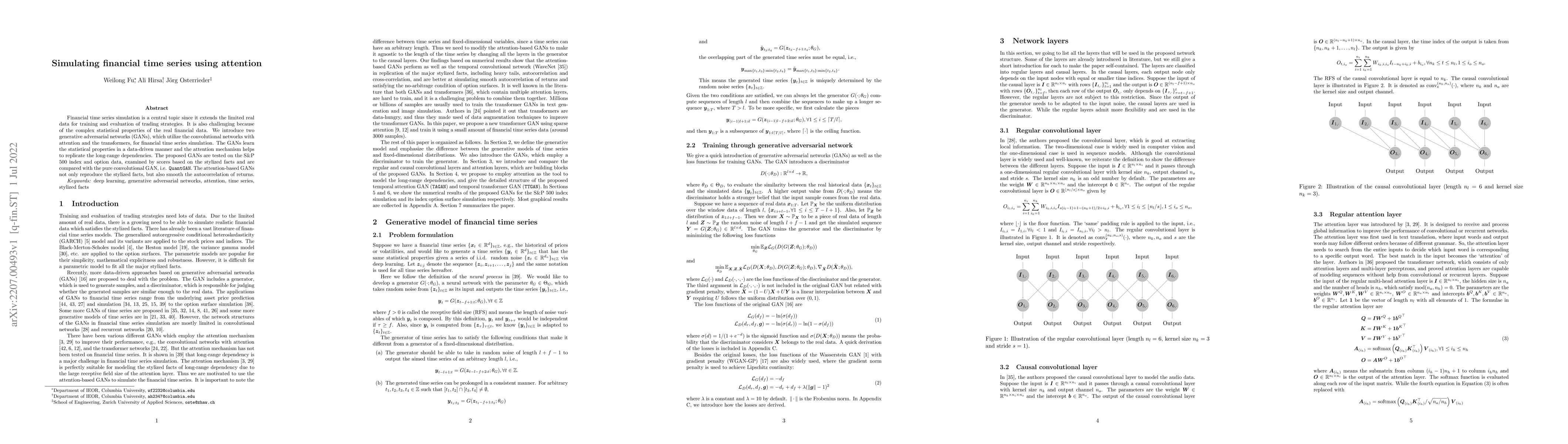

Financial time series simulation is a central topic since it extends the limited real data for training and evaluation of trading strategies. It is also challenging because of the complex statistical properties of the real financial data. We introduce two generative adversarial networks (GANs), which utilize the convolutional networks with attention and the transformers, for financial time series simulation. The GANs learn the statistical properties in a data-driven manner and the attention mechanism helps to replicate the long-range dependencies. The proposed GANs are tested on the S&P 500 index and option data, examined by scores based on the stylized facts and are compared with the pure convolutional GAN, i.e. QuantGAN. The attention-based GANs not only reproduce the stylized facts, but also smooth the autocorrelation of returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-head Temporal Attention-Augmented Bilinear Network for Financial time series prediction

Martin Magris, Mostafa Shabani, Alexandros Iosifidis et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)