Summary

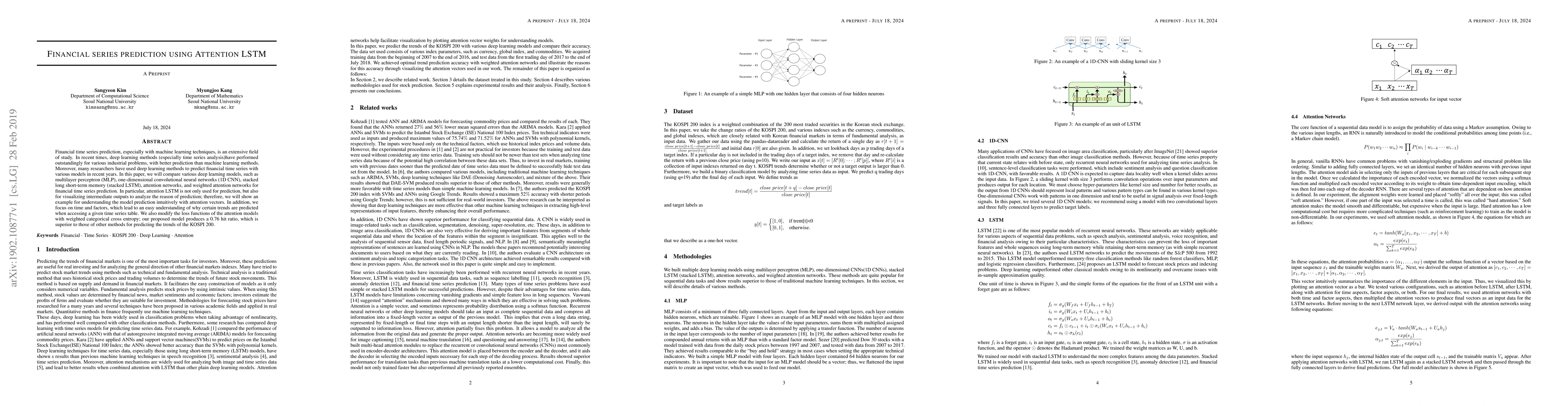

Financial time series prediction, especially with machine learning techniques, is an extensive field of study. In recent times, deep learning methods (especially time series analysis) have performed outstandingly for various industrial problems, with better prediction than machine learning methods. Moreover, many researchers have used deep learning methods to predict financial time series with various models in recent years. In this paper, we will compare various deep learning models, such as multilayer perceptron (MLP), one-dimensional convolutional neural networks (1D CNN), stacked long short-term memory (stacked LSTM), attention networks, and weighted attention networks for financial time series prediction. In particular, attention LSTM is not only used for prediction, but also for visualizing intermediate outputs to analyze the reason of prediction; therefore, we will show an example for understanding the model prediction intuitively with attention vectors. In addition, we focus on time and factors, which lead to an easy understanding of why certain trends are predicted when accessing a given time series table. We also modify the loss functions of the attention models with weighted categorical cross entropy; our proposed model produces a 0.76 hit ratio, which is superior to those of other methods for predicting the trends of the KOSPI 200.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)