Summary

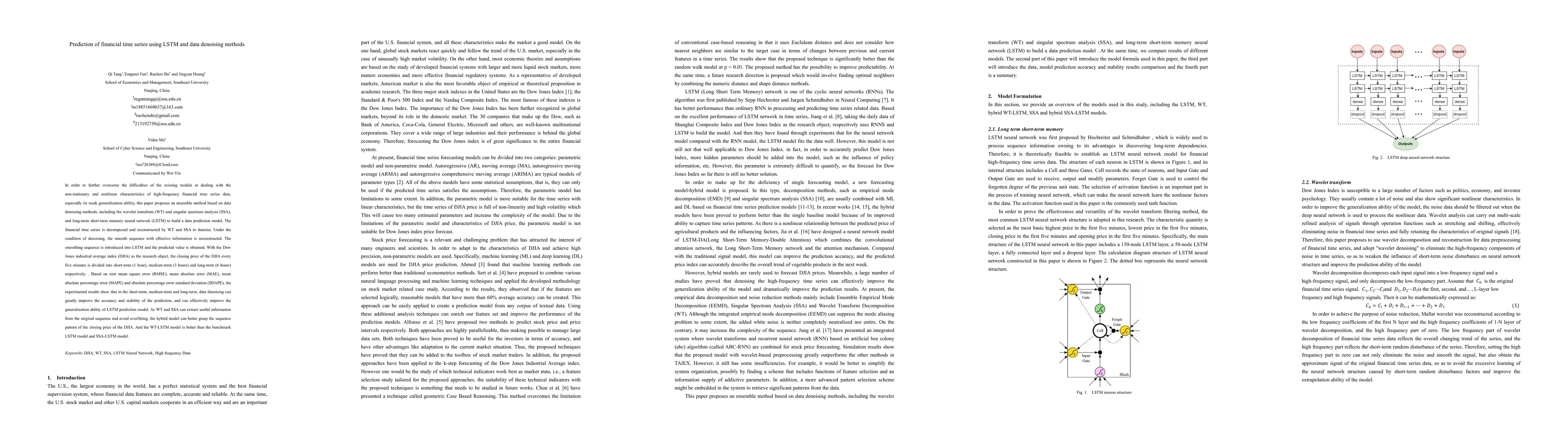

In order to further overcome the difficulties of the existing models in dealing with the non-stationary and nonlinear characteristics of high-frequency financial time series data, especially its weak generalization ability, this paper proposes an ensemble method based on data denoising methods, including the wavelet transform (WT) and singular spectrum analysis (SSA), and long-term short-term memory neural network (LSTM) to build a data prediction model, The financial time series is decomposed and reconstructed by WT and SSA to denoise. Under the condition of denoising, the smooth sequence with effective information is reconstructed. The smoothing sequence is introduced into LSTM and the predicted value is obtained. With the Dow Jones industrial average index (DJIA) as the research object, the closing price of the DJIA every five minutes is divided into short-term (1 hour), medium-term (3 hours) and long-term (6 hours) respectively. . Based on root mean square error (RMSE), mean absolute error (MAE), mean absolute percentage error (MAPE) and absolute percentage error standard deviation (SDAPE), the experimental results show that in the short-term, medium-term and long-term, data denoising can greatly improve the accuracy and stability of the prediction, and can effectively improve the generalization ability of LSTM prediction model. As WT and SSA can extract useful information from the original sequence and avoid overfitting, the hybrid model can better grasp the sequence pattern of the closing price of the DJIA. And the WT-LSTM model is better than the benchmark LSTM model and SSA-LSTM model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)