Summary

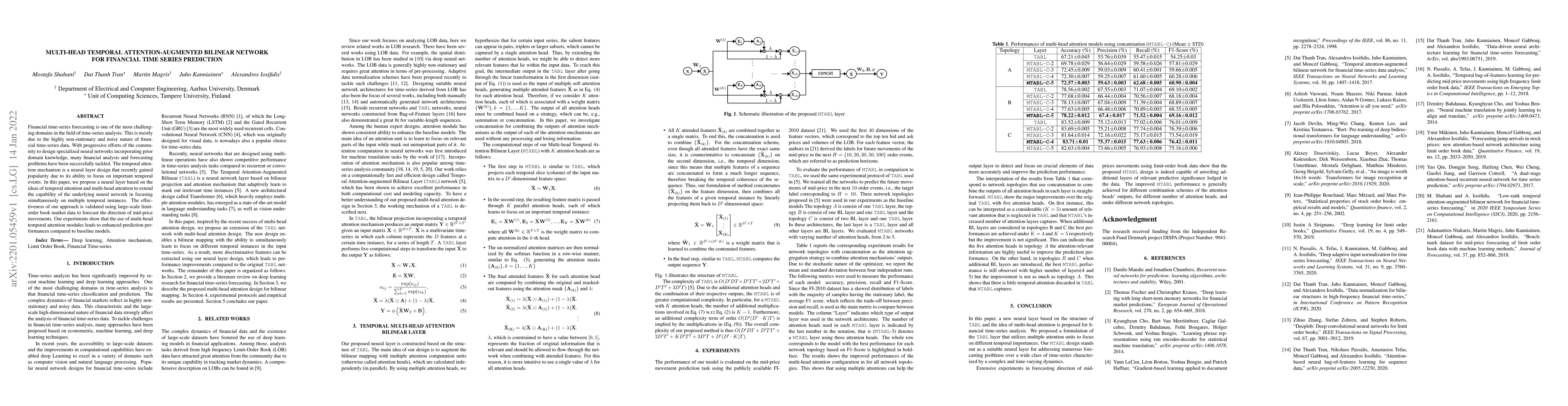

Financial time-series forecasting is one of the most challenging domains in the field of time-series analysis. This is mostly due to the highly non-stationary and noisy nature of financial time-series data. With progressive efforts of the community to design specialized neural networks incorporating prior domain knowledge, many financial analysis and forecasting problems have been successfully tackled. The temporal attention mechanism is a neural layer design that recently gained popularity due to its ability to focus on important temporal events. In this paper, we propose a neural layer based on the ideas of temporal attention and multi-head attention to extend the capability of the underlying neural network in focusing simultaneously on multiple temporal instances. The effectiveness of our approach is validated using large-scale limit-order book market data to forecast the direction of mid-price movements. Our experiments show that the use of multi-head temporal attention modules leads to enhanced prediction performances compared to baseline models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTemporal and Heterogeneous Graph Neural Network for Financial Time Series Prediction

Ying Zhang, Dawei Cheng, Sheng Xiang et al.

Augmented Bilinear Network for Incremental Multi-Stock Time-Series Classification

Mostafa Shabani, Alexandros Iosifidis, Juho Kanniainen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)