Authors

Summary

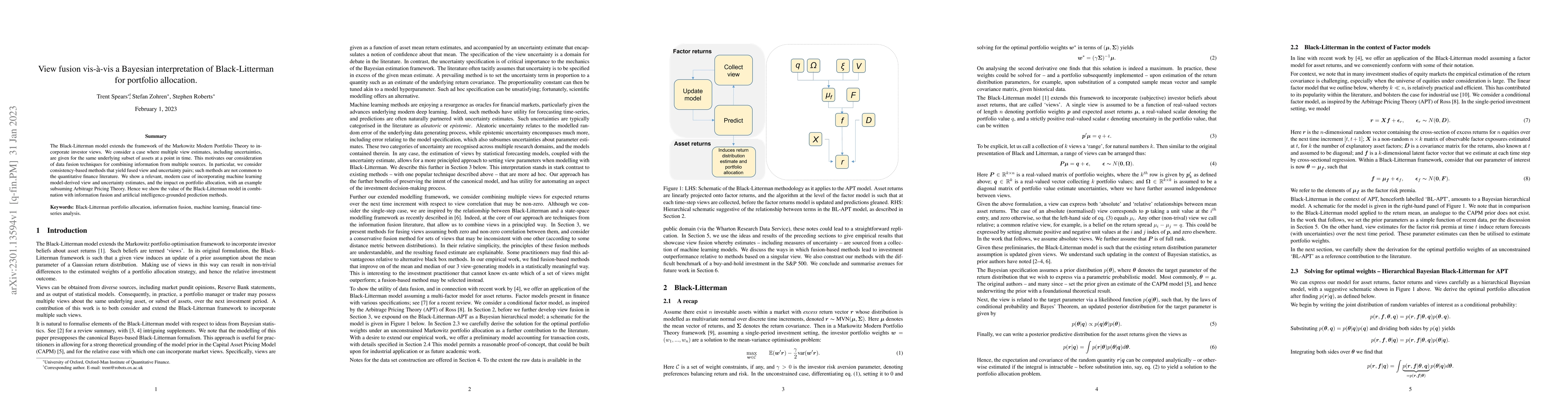

The Black-Litterman model extends the framework of the Markowitz Modern Portfolio Theory to incorporate investor views. We consider a case where multiple view estimates, including uncertainties, are given for the same underlying subset of assets at a point in time. This motivates our consideration of data fusion techniques for combining information from multiple sources. In particular, we consider consistency-based methods that yield fused view and uncertainty pairs; such methods are not common to the quantitative finance literature. We show a relevant, modern case of incorporating machine learning model-derived view and uncertainty estimates, and the impact on portfolio allocation, with an example subsuming Arbitrage Pricing Theory. Hence we show the value of the Black-Litterman model in combination with information fusion and artificial intelligence-grounded prediction methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBlack-Litterman Asset Allocation under Hidden Truncation Distribution

Jungjun Park, Andrew L. Nguyen

Joint Feature Distribution Alignment Learning for NIR-VIS and VIS-VIS Face Recognition

Hitoshi Imaoka, Akinori F. Ebihara, Takaya Miyamoto et al.

Latent Variable Estimation in Bayesian Black-Litterman Models

Jerry Yao-Chieh Hu, Peter Lin, Thomas Y. L. Lin et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)